4th September 2024 (11 Topics)

Context

In recent years, two major economies—the United States and India—decided to cut corporate tax rates with hopes of boosting their economies.

The U.S. Tax Cuts

In 2017, the U.S. government passed the Tax Cuts and Jobs Act. One of its biggest changes was lowering the corporate tax rate from 35% to 21%. This meant companies would pay less in taxes, with the goal of encouraging them to invest more in their businesses, create jobs, and improve worker wages.

What Were the Results?

- More Investment: Studies show that the tax cuts led to an increase in investment by around 8-14%. This is a positive outcome because investing more in businesses can lead to new technology and higher productivity.

- Wage Increase: However, wages only went up by less than $1,000 per worker. This is much lower than the $4,000 to $9,000 increase that was initially promised.

- Lower Tax Revenue: The U.S. government’s tax revenue dropped by nearly 41% because of these cuts. This made it harder for the government to fund various services and programs.

The Indian Tax Cuts

In 2019, India reduced corporate tax rates as well. For existing companies, the rate went from 30% to 22%, and for new companies, it dropped from 25% to 15%. The aim was to boost investment and create jobs.

What Were the Results?

- Limited Impact on Jobs: Although unemployment has decreased, much of the new employment has been in less secure jobs. The corporate sector hasn’t significantly contributed to this improvement, and wages have not increased substantially.

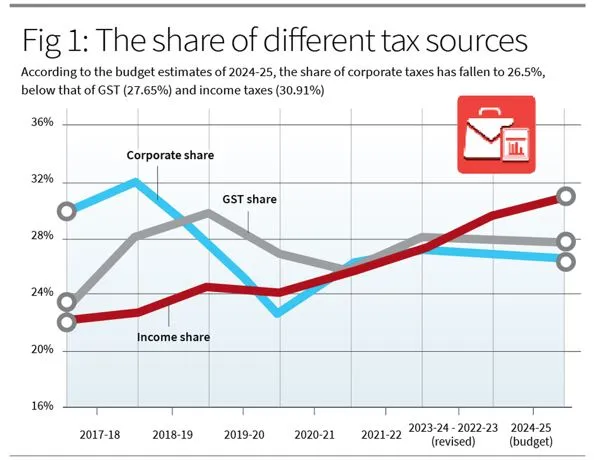

- Shift in Tax Burden: With the reduction in corporate taxes, the share of revenue collected from corporate taxes has decreased. The government now relies more on income taxes and Goods and Services Tax (GST) to make up for this loss.

- Increased Revenue: Despite these challenges, corporate tax collections have grown since the pandemic. However, this hasn’t translated into significant benefits for workers or an increase in job security.

What’s the Takeaway?

Both the U.S. and India aimed to stimulate their economies through corporate tax cuts, but the results have been mixed:

- In the U.S., while investment increased, wages didn’t rise as much as expected, and the government saw a big drop in tax revenue.

- In India, the tax cuts didn’t significantly boost job security or wages, and the burden of tax revenue has shifted from corporations to individuals.

Tax cuts alone may not be enough to solve broader economic issues. They need to be part of a larger strategy that includes investments in job creation, wage growth, and sustainable fiscal policies.

Fact Box: TaxationIndian taxes are broadly divided into two categories:

|

More Articles