3rd February 2025 (12 Topics)

Mains Issues

Context

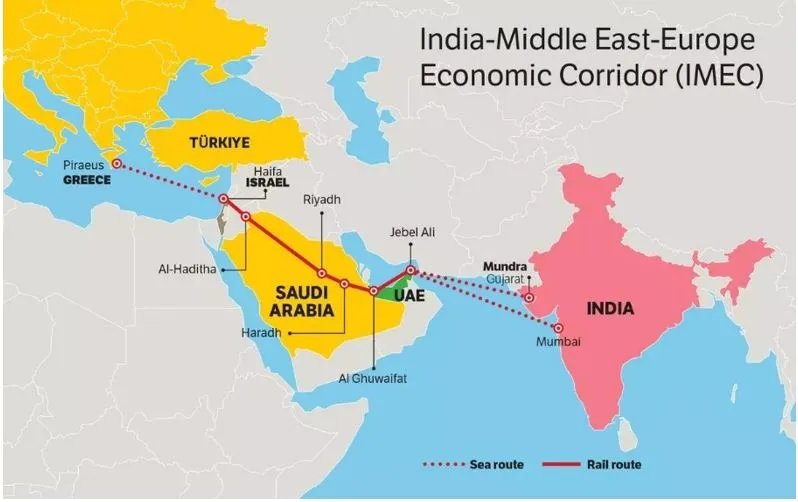

While the India-Middle East-Europe Economic Corridor has faced challenges due to regional instability, especially the Israel-Gaza conflict, diplomatic efforts are underway to revive the project.

What is the IMEC Project?

- The IMEC is a major infrastructure and trade project designed to create a trade route that spans multiple continents. Key features include:

- Route: The corridor will connect western India, the UAE’s Ras Al Khaimah, Saudi Arabia, Jordan, Israel, and then continue to Europe across the Mediterranean Sea.

- Mode of Transport: It will include shipping, rail, and road

- Objective: The goal is to increase trade between these regions, foster economic integration, and strengthen geopolitical ties.

- The initiative was launched during the G-20 Summit in September 2023 by countries such as India, France, Germany, Italy, Saudi Arabia, UAE, the S., and the EU.

Current Status

- While IMEC has the potential to transform trade and connectivity between three major regions, its progress has been slow due to regional conflicts and diplomatic hurdles.

- The Gaza Conflict: The Israel-Gaza conflict (particularly the October 7, 2023 attacks) has created significant uncertainties for the IMEC project:

- The Israel-Gaza war and the broader conflicts in the Middle East have led to delays in the diplomatic meetings crucial for advancing IMEC.

- Despite this, the Gaza ceasefire (since November 2023) has raised hopes that the situation may stabilize enough to resume discussions.

- Diplomatic sources indicate that while the project is still a priority, it is unlikely to move forward without some progress on peace talks between Israel and Palestinian representatives.

Concerns Over IMEC’s Viability

Despite the optimism, some concerns over IMEC’s viability remain:

- Regional Instability: Ongoing conflicts, such as the Israel-Gaza conflict, and broader instability in Iran, Syria, and Yemen have delayed progress. The ceasefire in Gaza has opened a window of opportunity, but lasting peace is uncertain.

- Slow Diplomatic Momentum: Initial momentum on the IMEC project was lost after the Gaza war, and despite efforts from India and other stakeholders, the first meeting of stakeholders has not yet taken place as initially scheduled.

- Infrastructure Development: Countries like Saudi Arabia, UAE, and India are working on the required infrastructure for the project, but the absence of a definitive peace agreement in the region complicates the development process.

Mains Issues

Context

In a recent development, U.S. President Donald Trump signed an executive order that drastically alters how U.S. citizenship is granted. The new order limits citizenship to children born in the U.S. to parents who are either U.S. citizens or permanent residents (Green Card holders).

Legal Principles of Citizenship: Jus Soli vs. Jus Sanguinis

There are two main legal systems used worldwide to determine citizenship:

- Jus Soli (Right of the Soil): Under this principle, a child's citizenship is determined by their place of birth.

- Countries such as the S., Canada, Mexico, and many countries in Latin America follow jus soli. If a child is born in one of these countries, they are automatically granted citizenship, regardless of their parents' citizenship.

- Jus Sanguinis (Right of Blood): Here, a child’s citizenship is determined by the citizenship of their parents.

- This principle is followed in countries such as Germany, India, and Egypt. Citizenship is passed from parent to child, irrespective of where the child is born.

Current Issue in the U.S.: Trump’s Executive Order

- Historically, the United States has followed the jus soli principle, granting automatic citizenship to anyone born on U.S. soil.

- However, President Trump’s executive order, titled "Protecting the Meaning and Value of American Citizenship", proposes a change.

- According to this order, U.S. citizenship will be granted only to children born in the U.S. whose parents are U.S. citizens or permanent residents (Green Card holders).

- The motivation behind this change stems from concerns about illegal immigration and the flow of migrants from countries like Mexico. Trump believes that restricting birthright citizenship will reduce birth tourism and illegal immigration.

- However, this executive order has been met with legal opposition. A federal court in Washington temporarily blocked the order, calling it “blatantly unconstitutional.”

Citizenship in India

This shift was primarily aimed at addressing the issue of illegal immigration from countries like Bangladesh. |

Mains Issues

Context

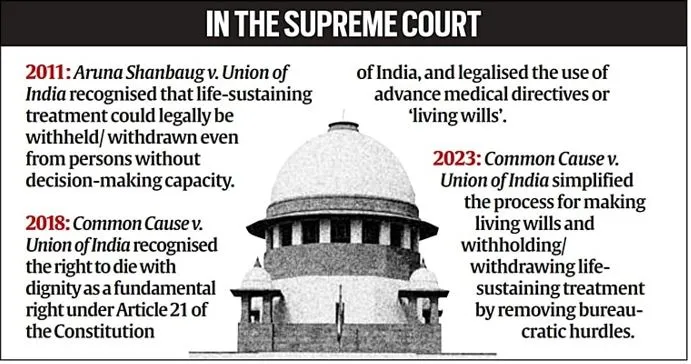

Karnataka has taken a landmark step in facilitating the right to die with dignity to implement the Supreme Court’s 2023 directive, becoming the first state to do so.

Background

- This move is in line with the Supreme Court’s 2023 ruling, which affirmed that the Right to Life under Article 21 of the Constitution also includes the right to die with dignity (Withdrawal of Life-Sustaining Therapy (WLST)).

- Supreme Court has held that if a patient is terminally ill and is undergoing prolonged medical treatment with no hope of recovery and cure of the ailment, and does not have decision-making capacity, then WLST may be appropriate, in accordance with the prescribed procedure.

- In response to this, the Karnataka government has taken proactive steps to implement a system that formalizes the process of passive euthanasia through Advance Medical Directives (AMD), also known as living wills.

What is Withdrawing Life-Sustaining Treatment?

- Withholding or withdrawing life-sustaining treatment refers to stopping medical interventions such as ventilators, feeding tubes, and other artificial means that help maintain vital bodily functions.

- This decision is made when these treatments no longer improve the patient's condition or when they only serve to prolong suffering.

- Difference Between Withdrawing Life Support and Euthanasia

- Withdrawing Life-Sustaining Treatment (Passive Euthanasia): This involves stopping treatment when it is no longer beneficial, and the patient is in a terminal state. The patient is allowed to die naturally, with pain relief and comfort care provided.

- Euthanasia: This is the intentional act of ending a patient's life to relieve suffering, typically administered by a doctor. It is not legal in India unless passive euthanasia is followed as per the defined guidelines.

What is an Advance Medical Directive (AMD)?

- An Advance Medical Directive (AMD), or living will, is a legal document in which a person outlines their wishes regarding medical treatment in case they become terminally ill or are unable to communicate.

- This allows individuals to express their desires about life-sustaining treatments, such as whether or not they wish to be kept alive through artificial means in the event of severe illness or injury.

- The Karnataka order enables individuals to execute an AMD and register it with the local government or the healthcare establishment to ensure that their medical wishes are known and respected when the time comes.

- While living wills are legal in India, their adoption has been slow.

- The Supreme Court had allowed passive euthanasia in 2018, but with strict guidelines.

Implications of the Karnataka Order

- Dignified End-of-Life Care: The decision allows terminally ill patients to choose a dignified death by having their life-sustaining treatments withdrawn if there is no hope of recovery. This will provide much-needed relief for patients who may be suffering from debilitating conditions.

- Legal and Humane Framework: The Karnataka order establishes a humane, legally sanctioned process for passive euthanasia, which balances medical ethics and the patient's autonomy. It also ensures legal oversight to prevent misuse and to safeguard the rights of the patient.

- Progressive Step for Healthcare: By becoming the first state to implement such a framework, Karnataka is leading the way in upholding human rights and healthcare values, offering individuals greater control over their healthcare decisions.

|

Reasons for favouring passive euthanasia |

Arguments against euthanasia |

|

|

Mains Issues

Context

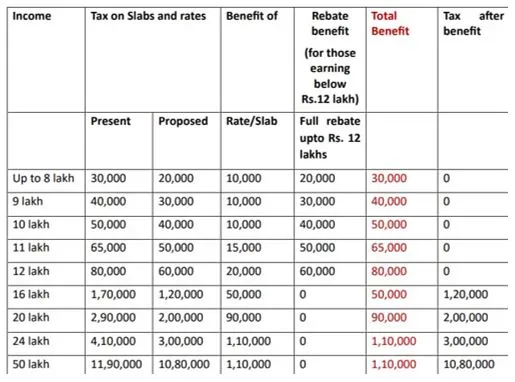

The Budget introduces a massive income tax cut to spur consumer consumption and economic activity. The government estimates that Rs 1 lakh crore will be foregone in tax revenues, and this money is expected to flow back into the economy through higher consumption.

Key-highlights of the Tax Reform:

- The budget has proposed to exempt individuals with income (excluding incomes taxable at special rates like capital gains) up to Rs 12 lakhs from paying income tax from FY 2025-26 onwards.

- The annual limit for TDS on rent has been raised from Rs 2.40 lakh to Rs 6 lakh, benefiting small taxpayers receiving smaller payments.

- This Rs 1 lakh crore largesse has been given in the hope of driving consumption and GDP growth, thereof.

What are the potential impact of Tax Cut?

- The tax cut aims to increase disposable income for citizens, allowing them to spend more on goods and services.

- This is seen as a way to address the demand-side problem of the economy, as businesses are unlikely to invest without adequate consumer demand.

- Economic Theory Behind the Tax Cut:

- Multiplier Effect: Economists suggest that the multiplier effect of an income tax cut is 1.01. This means that for every rupee cut in income tax, the GDP could grow by Rs 1.01 due to increased consumption.

- Increased Savings and Lower Interest Rates: The additional income can also increase savings, which could lower interest rates and stimulate more borrowing and economic activity.

- However, experts caution that the Rs 1 lakh crore tax cut may not be sufficient to trigger a full economic recovery, as India's GDP is much larger, and the total private final consumption expenditure (PFCE) is around Rs 200 lakh crore.

Key Challenges and Potential Pitfalls

While the tax cut may have positive short-term effects, experts argue that a comprehensive strategy for sustained economic growth is still lacking.

- Limited Impact of Tax Cuts: Critics point out that a tax cut, while helpful in the short term, will not solve the fundamental issue of low income growth across the population.

- Income Inequality: Tax cuts benefit a small portion of the population (those who pay income taxes). Since only a small segment of the population pays income taxes, the broader effect of tax cuts on consumption might be limited.

- External Dependencies: If increased consumer spending focuses on imported goods or services, it could lead to higher imports and inflation, rather than boosting domestic industries.

- Increased Domestic Inflation: More money in circulation may lead to higher demand, which could push up prices, especially if supply doesn’t keep pace with demand.

Mains Issues

Context

In a significant escalation of trade tensions, US President Donald Trump signed an executive order imposing new tariffs on imports from Canada, Mexico, and China. President Trump’s executive order imposes:

- 25% tariff on all goods imported from Mexico and Canada (except for energy products from Canada, which are taxed at 10%).

- 10% tariff on all goods imported from China.

Why Did Trump Impose These Tariffs?

The US government has provided several reasons for this decision, focusing on national security and public health concerns:

- Fentanyl Crisis: The administration argues that these tariffs are aimed at curbing the flow of fentanyl, a deadly drug primarily trafficked through Mexico and China. The White House claims that fentanyl is the leading cause of death for Americans aged 18-45.

- Illegal Immigration: The tariffs are also seen as a way to force Mexico to take stronger actions to curb illegal immigration into the United States.

- Holding Countries Accountable: According to the White House, the tariffs are a tool to hold Mexico, Canada, and China accountable for their failure to meet promises regarding illegal drugs and immigration.

What are tariffs?

|

Prelims Articles

Context

Sree Gowreeswara Temple, Cherai, has recently decided to end a nearly century-old practice that required men to remove their upper garments to worship at the temple.

About the Tradition

- The tradition at Sree Gowreeswara Temple, Cherai, required men to remove their upper garments, such as shirts, before entering the temple to worship.

- The practice is not scriptural but rather a social construct rooted in the caste system.

- It was deeply tied to the marginalization of lower-caste communities.

- Between the 10th and 19th centuries, Kerala’s scriptures have explicitly detailed barring entry to people from marginalised communities such as the Ezhavas and Adivasis.

- This practice (removing the upper garment) was started to ensure that the punool(sacred thread worn by Brahmins) could be seen. That custom still continues in temples.

- Not all temples in the state ask men to remove their shirts before entering the sanctum sanctorum.

- However, the practice is strictly enforced in some major temples such as the Sree Padmanabhaswamy Temple in Thiruvananthapuram, the Guruvayur Sri Krishna Temple in Thrissur, and the Ettumanoor Mahadeva Temple in Kottayam.

|

Shree Gowreeswara Temple

|

Prelims Articles

Context

In recent developments, the Ministry of Tribal Affairs has streamlined the process for approving homes for Particularly Vulnerable Tribal Groups (PVTGs) across India. This move follows the identification of delays caused by the data requirements in the PM-GatiShakti portal, which led to slower project approvals.

What is the PM-JANMAN Package?

- Launched in: 2023

- Nodal Ministry: Ministry of Tribal Affairs

- The scheme delivers essential amenities, including safe housing, clean drinking water, sanitation, healthcare, education, road and telecom connectivity, and sustainable livelihoods.

- It seeks to bridge development gaps in remote tribal areas through initiatives such as constructing pucca houses, deploying mobile medical units, establishing health and wellness centres, and setting up Van Dhan Vikas Kendrasalongside skill development programs.

- Under the housing component of the package, the goal is to sanction and build 4.90 lakh homes for these communities under the PM-AWAS (Pradhan Mantri Awas Yojana)

- Issue with Data on the PM-GatiShakti Portal: One of the central features of the PM-JANMAN package was the use of the PM-GatiShakti portal, which was meant to maintain data sanctity by tracking the details of each village, including village codes, beneficiaries, and housing requirements.

- This portal is monitored by the respective line ministries and supervised by the Ministry of Tribal Affairs.

Fact Box:Particularly Vulnerable Tribal Groups (PVTGs)

|

PYQQ. Consider the following statements about Particularly Vulnerable Tribal Groups (PVTGs) in India: (2019)

Which of the statements given above are correct?

Solution: (c) |

Prelims Articles

Context

Cardamom, often called the "Queen of Spices," has long been a symbol of aromatic and flavorful spices. For years, it was believed that only one species of cardamom existed in the genus Elettaria—Elettaria cardamomum (green cardamom). However, recent research reveals that this spice has a number of wild relatives, leading to the reclassification of cardamom species.

Key-highlights of the Research

- An international research team has discovered that green cardamom (Elettaria cardamomum) is not alone in its genus, as previously thought.

- The team has now identified six closely related species of cardamom, expanding the genus Elettaria from one to seven species. This breakthrough changes the understanding of cardamom’s diversity and potential uses.

- Previous Classification: Earlier, four species (previously classified under the genus Alpinia) were reclassified under Elettaria. These species are:

- ensal

- floribunda

- involucrata

- rufescens

- Newly Identified Species: Two entirely new species of cardamom were identified and described from the Western Ghats in Kerala:

- Elettaria facifera: Found in Periyar Tiger Reserve, Idukki district.

- Elettaria tulipifera: Found in the Agasthyamalai Hills (Thiruvananthapuram and Munnar).

Newly Identified Species

|

Green cardamom

|

Prelims Articles

Context

Tamil Nadu has added two more Ramsar sites: Sakkarakottai and Therthangal bird sanctuaries. This brings the state’s total number of Ramsar sites to 20, the highest in India. Uttar Pradesh follows with 10 Ramsar sites.

What is a Ramsar Site?

- The Ramsar Convention, signed in 1971, aims to protect wetlands worldwide through local conservation efforts, national policies, and international cooperation.

- Wetlands included under the treaty encompass a wide range of ecosystems, from marshes, lakes, rivers, and peatlands, to coastal habitats such as mangroves, saltmarshes, mudflats, seagrass beds, and even coral reefs.

- Importance of Ramsar Status: The Ramsar status provides enhanced conservation efforts and global recognition for these crucial ecosystems. It opens the door for increased funding and ensures better protection for these fragile areas.

- Tamil Nadu’s Wetland Conservation Efforts

- The newly designated Sakkarakottai and Therthangal bird sanctuaries are located in Ramanathapuram district, which already hosts two other Ramsar sites: Chitrangudi and Kanjirankulam.

- Tamil Nadu has been at the forefront of wetland conservation in India, with its first Ramsar designation granted in 2002 for the Point Calimere Wildlife and Bird Sanctuary.

- Other sanctuaries in Tamil Nadu that have received Ramsar recognition include Kazhuveli and Nanjarayan Bird Sanctuaries, which were added in 2024.

- Alongside the Tamil Nadu sites, India has recently added four new Ramsar sites in total, bringing the country’s total Ramsar sites to 89:

- Khecheopalri Wetland (Sikkim)

- Udhwa Lake (Jharkhand)

Editorials

Context

US President Donald Trump has imposed steep tariffs on imports from Canada, Mexico, and China, escalating trade tensions. This move is part of his broader agenda to address issues like illegal immigration and the flow of drugs into the US, while also attempting to boost domestic manufacturing and reduce the trade deficit. However, this action has led to retaliatory measures from the affected countries and raised concerns about global economic consequences, including higher inflation and potential disruptions to US monetary policy.

Implications of Tariffs on Trade and Economic Growth:

- Retaliation from Affected Countries: Following Trump's tariff imposition, Canada and Mexico have announced retaliatory tariffs on US goods, while China is considering filing a case at the WTO. This escalation could lead to a global trade war.

- Impact on US Households: The tariffs are expected to impose a significant burden on US households, with estimates suggesting a tax of more than USD 830 per household in 2025. Additionally, long-term economic output could be reduced by 0.4%.

- Global Economic Uncertainty: The decision introduces uncertainty in global markets, with implications for trade and economic growth, potentially leading to a 0.7% rise in core inflation and a 0.4% dip in GDP in the US.

US Monetary Policy and Inflation Concerns:

- Impact on US Inflation: Higher tariffs will likely result in increased inflation in the US. Economists estimate that tariffs on imports from Canada and Mexico could push inflation up by 0.7%, which could undermine efforts to keep inflation under control.

- Monetary Policy Complications: The rise in inflation could make it difficult for the Federal Reserve to reduce interest rates as previously planned. This may result in tighter monetary policy, compounding challenges in the broader economy.

- Conflict with the Federal Reserve: Trump's criticisms of the Federal Reserve's monetary policy add another layer of complexity, as the administration's stance on tariffs could complicate the Fed's ability to navigate inflation and economic growth.

Opportunities for India in the Current Global Scenario:

- Leveraging Strong India-US Ties: India should capitalize on the growing bipartisan consensus in the US for strengthening bilateral relations. Prime Minister Narendra Modi’s visit to the US could be a strategic opportunity to foster deeper ties, especially in the context of increasing trade tensions between the US and other countries.

- Navigating Uncertainty: In an uncertain global environment, India can play a cautious yet proactive role by focusing on diplomatic engagements and positioning itself as a stable partner for trade and investment.

- Seizing Emerging Opportunities: The global economic uncertainty created by the US tariffs may present India with opportunities to attract foreign investment and enhance its role in global supply chains, particularly if it can position itself as a more reliable and competitive market for trade.

Practice Question:

Q. Analyze the economic and geopolitical implications of the US imposing tariffs on its major trading partners. How can India strategically navigate this period of global uncertainty to strengthen its position in the international trade landscape?

Editorials

Context

The Union Budget for FY26 has outlined several initiatives aimed at addressing the challenges faced by Indian agriculture, including climate resilience, farm productivity, and income growth for farmers and farm laborers. However, while the budget includes some positive measures, questions remain about their effectiveness in tackling structural issues like labor absorption, agricultural diversification, and marketing inefficiencies.

Budget Allocation and Structural Challenges in Agriculture:

- Agriculture and Allied Sectors Funding: The total allocation for agriculture, including allied sectors, is Rs 1.49 trillion, marking a 4% increase from the previous year. However, inflation might reduce its real value, making it insufficient to address underlying structural challenges like stagnant agricultural wages and labor inefficiencies.

- PM-Kisan and Income Support: The PM-Kisan scheme continues with a Rs 60,000 crore allocation, but its real value has been declining. The absence of a more integrated approach that includes fertilizer subsidy transfers limits its potential to drive significant change in farmers’ incomes.

- Labor-Intensive Sectors and Employment: With agriculture's share in GDP shrinking, but its labor share increasing, India faces a challenge in absorbing surplus agricultural labor. The lack of sufficient growth in non-agricultural sectors adds to this, necessitating greater focus on labor-intensive industries and skill upgradation to improve farmer livelihoods.

Climate Resilience and Productivity Enhancements:

- Climate-Resilient Crops and R&D Investment: The budget proposes releasing 109 high-yielding, climate-resilient crop varieties. However, the marginal increase in R&D funding is insufficient to meet the one per cent of agri-GDP benchmark needed to sustain agricultural growth in the face of climate change.

- Market Access and Value Chain Improvements: The Mission for Vegetables and Fruits is an encouraging step to enhance production and market access. However, the Rs 500 crore allocation is limited, and logistical bottlenecks persist, which can impede the successful implementation of these initiatives.

- Pulses and Oilseeds Production: The Pulses Mission aims to reduce dependence on imports, but the budget does not address the structural issues like MSP-centric policies that favor rice and wheat over more diversified crops such as pulses and oilseeds.

Post-Harvest Losses and Infrastructure Gaps:

- Post-Harvest Losses: India suffers significant post-harvest losses, particularly in fruits and vegetables, due to inadequate cold storage and processing infrastructure. While the government is encouraging private investment in this area, the existing budget allocation under the Agriculture Infrastructure Fund (Rs 900 crore) is insufficient to address the vast needs of the post-harvest value chain.

- Cold Storage and Processing Facilities: The budget provides a marginal increase in funding for cold storage infrastructure, but it remains far from addressing the systemic inefficiencies and logistical challenges in the agricultural supply chain.

- Missed Opportunities for Reform: The incremental approach of the budget, without addressing fundamental issues such as subsidy rationalization and private sector participation, limits the potential for transforming Indian agriculture into a globally competitive and climate-resilient sector.

Practice Question:

Q. Evaluate the effectiveness of the Union Budget 2025-26 in addressing the structural challenges faced by Indian agriculture. How can the government improve its approach to make Indian agriculture more resilient, competitive, and inclusive?

Editorials

Context

The Union Budget 2025, aims to address macroeconomic challenges like high taxes, unemployment, subdued private investment, and fiscal vulnerabilities. It outlines key policy measures in agriculture, manufacturing, MSMEs, social welfare, and infrastructure to achieve the vision of Viksit Bharat. However, there are concerns regarding the feasibility of fiscal consolidation, the impact of tax cuts, and the effectiveness of long-term economic goals.

Fiscal Consolidation and Revenue Projections:

- Ambitious Fiscal Targets: The Budget sets a fiscal deficit target of 4.4% of GDP for FY26. Achieving this depends on optimistic revenue projections, such as an 11.2% growth in total tax revenues and a 14.4% increase in income tax collections.

- Risks in Borrowing: The Budget plans Rs 11.54 lakh crore in net market borrowings, which could crowd out private capital and pose risks in the current low-credit demand environment.

- Asset Monetisation Challenges: The success of the second asset monetisation plan is critical, but concerns about the underperformance of the previous plan raise doubts on its effectiveness.

Tax Revisions and Middle-Class Relief:

- Tax Cuts Impact: The reduction in income tax liabilities and raising the exemption limit up to Rs 12 lakh will provide relief to the middle class but result in a Rs 1 lakh crore shortfall in direct tax revenue.

- Concerns on Tax Base Erosion: The decline in household savings and the reduced tax base raise questions about the long-term sustainability of these tax cuts and their impact on funding developmental initiatives.

- Limited Public Investment Capacity: While tax cuts may boost disposable income, the strain on fiscal capacity could hinder the government’s ability to fund essential infrastructure and social welfare programs.

Focus on Manufacturing and Agriculture:

- Manufacturing Growth Goals: The Budget emphasizes improving the manufacturing sector’s contribution to GDP (currently 17%) through enhanced credit for MSMEs and a National Manufacturing Mission. However, structural issues like regulatory inefficiencies and low innovation remain unaddressed.

- Agriculture Challenges: The Budget introduces measures such as Kisan Credit Card (KCC) loan limits and climate-resilient initiatives, but these fall short of addressing deeper market inefficiencies and price volatility in agriculture.

- Lack of Export Strategy: While there are efforts to diversify exports, the Budget's focus on trade facilitation and export credit support for MSMEs lacks scale, especially given challenges like a depreciating rupee and declining forex reserves.

Practice Question:

Q. Evaluate the fiscal measures announced in the Union Budget 2025. How do the proposed tax revisions, asset monetisation strategies, and manufacturing sector reforms address India’s macroeconomic challenges?