8th September 2025 (12 Topics)

Mains Issues

Context:

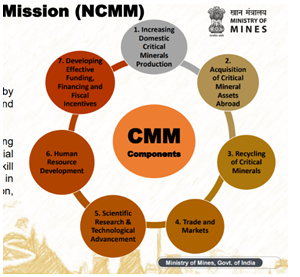

The Government of India launched the National Critical Minerals Mission (NCMM) in 2025 to secure long-term domestic and global supply chains of strategic minerals essential for clean energy, advanced technologies, and national security.

Critical Minerals: The Strategic Foundation of India’s Energy and Economic Future

Introduction

- Critical minerals are essential for clean energy, advanced electronics, defence, and digital infrastructure.

- India released a list of 30 critical minerals in 2023, including lithium, cobalt, nickel, rare earths, tungsten, vanadium, etc.

- With the launch of NCMM (2024–25 to 2030–31), India aims to strengthen exploration, extraction, processing, recycling, and global partnerships.

Key Features of National Critical Mineral Mission (NCMM)

- Scope and Expenditure

- Duration:7 years (2024–25 to 2030–31)

- Outlay:?16,300 crore (government) + ?18,000 crore PSU/stakeholder investment

- Targets

- 1,000 patents by 2030 in mineral R&D

- 7 Centres of Excellence (CoEs) in IITs & research institutions

- 270 kilo ton annual recycling capacity by 2030

- 40 kilo ton production of minerals from recycling

- Job creation:~70,000 direct jobs

- Institutional Mechanism

- Amendment of MMDR Act: Centre empowered to auction 24 of 30 minerals.

- Pilot projects: ?100 crore for recovery from fly ash, mine tailings, red mud.

- Incentive scheme: ?1,500 crore for recycling e-waste, battery scrap, end-of-life vehicles.

Critical Minerals in India’s Clean Energy Transition

- Solar Energy

- Reliance on silicon, gallium, tellurium, indium for photovoltaic cells.

- India’s solar capacity: 64 GW (2025), target 280 GW+ by 2030.

- Wind Energy

- Neodymium, dysprosium crucial for permanent magnets in turbines.

- India’s target: 140 GW wind capacity by 2030.

- Electric Mobility

- Lithium, cobalt, nickel for EV batteries.

- Target: 30% EV penetration by 2030.

- Energy Storage

- Lithium-ion systems critical for renewable grid integration.

- Strategic stockpiles planned for ensuring energy security.

Innovation and R&D Push

- Patent Ecosystem: 62 patents filed in May–June 2025, 10 granted.

- Focus on battery materials, advanced alloys, nanotechnology.

- Centres of Excellence: IIT Bombay, IIT Hyderabad, IIT Roorkee, IIT-ISM Dhanbad, CSIR labs (IMMT, NML), NFTDC Hyderabad.

Strategic and Geopolitical Dimension

- Global race for critical minerals: dominated by China, U.S., EU, Australia.

- India’s strategy: domestic exploration + overseas asset acquisition.

- Enhances supply chain resilience, reduces import dependency.

- Aligns with Atmanirbhar Bharat and India’s net-zero target by 2070.

Global Partnerships

- Mineral Security Partnership (MSP): 14 countries + EU, chaired by South Korea; India exploring 32 global projects.

- iCET (India–US Initiative on Critical & Emerging Technologies): joint projects in exploration and R&D.

- Indo-Pacific Economic Framework (IPEF): India presented CM initiatives in 2024.

- India–UK Technology and Security Initiative (TSI): collaborative R&D.

- Quad Clean Energy Principles (2023): focus on resilient supply chains.

- Bilateral MoUs: with Australia, Argentina, Chile.

Challenges

- Limited domestic reserves of minerals like lithium and cobalt.

- High dependence on imports from geopolitically sensitive regions.

- Environmental and social risks from intensive mining.

- Need for advanced refining and processing technologies.

Way Forward

- Strategic Partnerships: Deepen collaborations with resource-rich countries (Australia, Chile, Argentina, Africa).

- Technology Development: Invest in indigenous refining, advanced metallurgy, and battery recycling.

- Environmental Safeguards: Balance extraction with sustainability through circular economy models.

- Skill Development: Establish academic–industry partnerships for human capital in mining and processing.

- Global Role: Position India as a critical minerals hub by leveraging International Solar Alliance (ISA) and new supply chain coalitions.

Mains Issues

Context:

India’s bioeconomy expanded from USD 10 billion (2014) to USD 165.7 billion (2024), with a target of USD 300 billion by 2030, marking it as one of the fastest-growing in the world.

Biotechnology as a Driver of Sustainable and Inclusive Growth

Introduction

- Bioeconomy is the sustainable use of renewable resources (plants, animals, microorganisms) to produce food, energy, medicines, and industrial products.

- India contributes 25% of GDP through bioeconomy, supported by biotechnology, agriculture, healthcare, and industrial innovations.

- With the BioE³ Policy (2024) and youth-focused initiatives like the BioE³ Challenge, India aims to integrate biotechnology into its economic and environmental strategy.

Key Drivers of India’s Bioeconomy

- BioIndustrial (47% share, USD 78.2 bn)

- Growth led by biofuels, bioplastics, enzymatic applications, biosynthetic chemicals.

- Enabled 20% ethanol blending by 2025 (5 years ahead of target).

- Contributes to circular economy and sustainability.

- BioPharma and BioMedical (35.2% share, USD 58.4 bn)

- India is a global vaccine hub; Serum Institute holds 24% global share (2024).

- Innovation in gene editing, cancer immunotherapy, CAR T-cell therapies, AI-driven diagnostics.

- Expanding MedTech and affordable biologics strengthens healthcare access.

- BioAgri (8.1% share, USD 13.5 bn)

- Driven by GM crops, precision farming, bio-fertilizers, bio-based pesticides.

- Bt cotton success improved productivity and farmer incomes.

- Supports sustainable agriculture and food security.

- BioResearch&BioIT (9.4% share, USD 15.6 bn)

- Includes contract research, bioinformatics, biotech software, clinical trials.

- India emerging as global hub for cost-effective R&D services.

- Enhances drug discovery and data-driven healthcare.

Policy Framework and Institutional Support

- BioE³ Policy (2024): promotes economy, environment, and employment through biomanufacturing.

- 21 BioEnabler facilities set up for startups and SMEs in areas like smart proteins, carbon capture, marine biotechnology.

- Biofoundry Network (2025): first national initiative to support biomanufacturing ecosystem.

- Biotech startup growth: 5,365 (2021) ? 13,000 (2025), developing 800+ products with $600 million in funding.

Climate Change Mitigation and Sustainability

- Bioeconomy reduces GHG emissions, supports bioenergy use, recycling, forest restoration, and sustainable agriculture.

- Achieving 20% ethanol blending saved ?1.44 lakh crore in foreign exchange and substituted 245 LMT crude oil.

- Promotes energy independence, food security, and green growth.

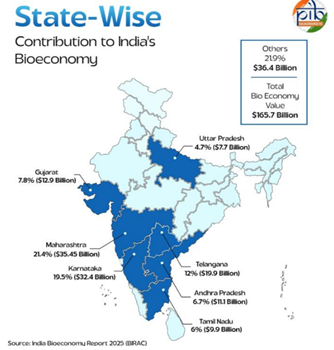

Regional Contribution

- Maharashtra (21.4%), Karnataka (19.5%), Telangana (12%) are top contributors.

- Southern region dominates with 4% share, followed by Western (30.3%), Northern (18.5%), and Eastern (5.8%).

- Regional clusters reflect strong innovation ecosystems in South and West India.

Global Context and Future Outlook

- Global bioeconomy projected to grow from $4 trillion (2020) to $30 trillion (2050) (~12% of world GDP).

- India’s bioeconomy could reach $1.4–2.7 trillion by 2050 (6.5–12% of projected GDP $22 trillion).

- India’s leadership in vaccines, ethanol blending, and bio-manufacturing positions it as a global powerhouse.

Challenges

- Need for stronger regulatory frameworks for biotech and bio-safety.

- Dependence on global collaborations for advanced technologies.

- Skilled workforce gap in synthetic biology, gene editing, and bioinformatics.

- Ensuring equitable farmer benefits from biofuel and agri-bio initiatives.

Way Forward

- Strengthen R&D: Expand Centres of Excellence, promote indigenous biotech innovation.

- Promote Biomanufacturing: Scale up Biofoundry Network to reduce dependence on imports.

- Invest in Human Capital: Biotechnology-focused education, fellowships, and youth engagement.

- Expand Global Partnerships: Collaborate with EU, U.S., and Asia-Pacific on biotech standards and markets.

- Sustainability Integration: Ensure bio-based industries align with climate goals and environmental safeguards.

Mains Issues

Context:

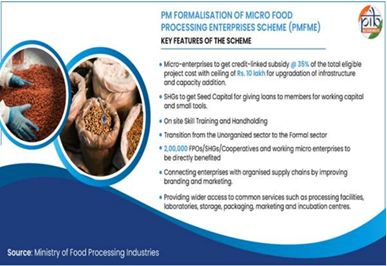

As of June 2025, ?3,791.1 crore has been released to States/UTs, with over 1.44 lakh loans sanctioned under the PMFME scheme, reflecting progress in formalising India’s micro food processing sector.

“Vocal for Local”: Building Competitiveness in Food Processing

Introduction

- Launched on 29 June 2020, PMFME is a Centrally Sponsored Scheme under the Atmanirbhar Bharat Abhiyaan.

- Total outlay: ?10,000 crore (2020–21 to 2025–26) with cost-sharing (Centre–State 60:40; 90:10 for NE/Himalayan States; 100% for UTs without legislature).

- Aims: formalisation of 2 lakh micro food units, adoption of ODOP (One District One Product) approach, and strengthening infrastructure.

Key Components of the Scheme

- Support for Individual Units

- Credit-linked subsidy: 35% of project cost (ceiling ?10 lakh).

- Beneficiary contribution: 10%; balance via bank loan.

- Support for Groups (FPOs/Cooperatives/SHGs)

- Seed capital: ?40,000 per SHG member for working capital and tools.

- Grant support at 35% for FPOs and cooperatives.

- Branding & marketing assistance for ODOP products at state/regional level.

- Common Infrastructure

- Facilities for grading, warehousing, cold storage, processing units, incubation centres.

- Promotes shared facilities for clusters under ODOP.

- Capacity Building

- Training and R&D support by NIFTEM, IIFPT, ICAR institutes, CSIR labs.

- Focus on technology adoption, entrepreneurship, and product-specific improvements.

Achievements (As of June 2025)

- ?11,501.79 crore loans sanctioned under credit-linked subsidy (1.44 lakh units).

- Seed capital support for 1.03 lakh SHG members worth ?376.98 crore.

- 93 common infrastructure projects sanctioned (?187.20 crore).

- 27 branding and marketing projects approved (?82.82 crore).

- 16 lakh beneficiaries trained in modern practices.

- Food processing exports:USD 49.4 billion (2024–25), with processed foods forming 4% of the share.

Analysis

- Economic Impact

- Strengthens linkages between agriculture and industry, creating rural jobs and reducing post-harvest losses.

- Expands India’s processed food exports, contributing to forex earnings.

- Social Impact

- Promotes women empowerment through SHGs.

- Supports traditional foods under ODOP, preserving cultural identity while improving market access.

- Institutional Impact

- Brings informal enterprises into the formal regulatory and credit system.

- Enhances skills and innovation via training institutes and incubation centres.

Challenges

- Low awareness among rural entrepreneurs and SHGs.

- Credit access difficulties despite subsidies, especially for first-generation entrepreneurs.

- Logistical gaps in cold chains and last-mile connectivity.

- Quality certification and standardisation remain weak for small producers.

Way Forward

- Awareness Campaigns: Strengthen outreach in rural areas with digital platforms and grassroots mobilisation.

- Ease of Credit: Simplify bank procedures, expand microfinance and fintech involvement.

- Market Linkages: Tie-ups with e-commerce, retail chains, and export councils to boost ODOP visibility.

- Quality Assurance: Provide standardisation and certification facilities at district level.

- Sustainability Integration: Encourage eco-friendly packaging, renewable energy use in processing units.

Prelims Articles

Context:

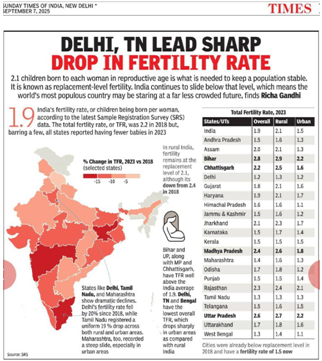

The Sample Registration System (SRS) Statistical Report 2023 shows India’s Total Fertility Rate (TFR) has declined to 1.9 in 2023 from 2.0 in 2022, with rural TFR reaching the replacement level of 2.1 for the first time.

Total Fertility Rate (TFR)

- TFR measures the average number of children born to a woman during her reproductive span (15–49 years).

- India reached the replacement level fertility of 1 in 2019, and since 2020, TFR has remained at or below 2.0.

- Rural–urban difference persists: Rural TFR at 2.1 (2023) Urban TFR at 1.5 (2023).

- Highest TFR states: Bihar (2.8), Uttar Pradesh (2.6), Madhya Pradesh (2.4).

- Lowest TFR states/UTs: Delhi (1.2), Tamil Nadu and West Bengal (1.3 each).

Gross Reproduction Rate (GRR)

- GRR is the average number of daughters a woman would give birth to during her lifetime if she experiences current age-specific fertility rates (ASFRs) and no mortality.

- India’s GRR (2023) is 0.9, with rural GRR at 1.0 and urban GRR at 0.7.

- State-wise variation: Delhi, West Bengal, Tamil Nadu (0.6) vs. Bihar (1.3).

Infant Mortality Rate (IMR)

- IMR declined from 32 (2018) to 25 (2023), showing a fall of seven points in five years.

- Rural IMR fell by 8 points (36 to 28), urban IMR fell by 5 points (23 to 18).

- Highest IMR: Chhattisgarh, Madhya Pradesh, Uttar Pradesh (37 each).

- Lowest IMR: Manipur (3) and Kerala (5).

- Despite decline, 1 in 40 infants die before completing one year of age.

Prelims Articles

Context:

External Affairs Minister S. Jaishankar will represent India at a leaders’ virtual BRICS summit convened by Brazil’s President Luiz Inácio Lula da Silva to discuss U.S. tariff hikes and multilateral responses.

Evolution and Membership

- Origin: The acronym BRIC was coined in 2001 by Jim O’Neill (Goldman Sachs) to highlight emerging economies.

- Summits: First formal BRIC Summit held in 2009 (Russia); South Africa joined in 2010, making it BRICS.

- Members (11): Brazil, Russia, India, China, South Africa plus Egypt, Ethiopia, Indonesia, Iran, Saudi Arabia, UAE.

Institutional Framework of BRICS

- New Development Bank (NDB):

- HQ: Shanghai; Authorised capital: USD 100 billion.

- Supports infrastructure and sustainable development projects.

- All members are shareholders; India’s KV Kamath was the first President.

- Contingent Reserve Arrangement (CRA):

- Size: USD 100 billion.

- Provides liquidity support during balance of payments crises.

- Other Mechanisms:

- BRICS Business Council (private sector linkages).

- BRICS Think Tank Council (policy research).

- BRICS Payment System (under discussion) to reduce dependency on SWIFT.

Significance for India & Global Economy

- Economic Clout:

- Collectively represented 35% of global GDP and 46% of world population prior to Indonesia’s entry discussion.

- Aims to enhance intra-BRICS trade and South-South cooperation.

- Counterbalance to G7/Western blocs:

- Provides an alternative pole in global governance.

- Promotes multipolarity and reform of international institutions (IMF, World Bank, UN Security Council).

- Strategic Value:

- Collaboration in energy (oil & gas), critical minerals, and technology.

- Increasing importance amid geopolitical realignments and sanctions regimes.

Tariffs—Key Facts in this context

- 50% tariffs reportedly imposed by the U.S. on India and Brazil (highest rung).

- 30% on China and South Africa; 19% on Indonesia (waivers for key agri items like palm oil, cocoa, rubber).

- 10% on Russia and Iran and other BRICS members at the lowest rung.

- Core discussion themes expected: impact on global trade, responses to unilateral measures, and strengthening multilateralism.

Why it matters to India:

- India’s export exposure to the U.S. in sectors like textiles, gems &jewellery, leather, engineering goods; tariff shocks hurt margins, jobs, MSME supply chains.

- Policy levers: duty drawback/RoDTEP calibration, export credit support, market diversification (EU, West Asia, Africa, Latin America), and leveraging upcoming BRICS Chairmanship for consensus-building.

Prelims Articles

Context:

The U.S. government under President Donald Trump imposed 50% tariffs on Indian imports, severely impacting India’s textile export hubs, especially Tiruppur and Karur in Tamil Nadu, leading to production cuts, stockpiling, and wage uncertainties.

Background of the Issue

- Scale of Exports: India exports $11 billion worth of textiles and apparel to the U.S. annually, with Tamil Nadu contributing nearly $4 billion.

- Concentration Risk: Districts like Tiruppur, Karur, and Coimbatore are heavily dependent on U.S. buyers such as Walmart, Costco, Target, and GAP.

- Tariff Shock: The tariff escalation from 25% to 50% in September 2025 has halted shipments, created stockpiles, and disrupted payments.

Impact on Industry and Workers

- Exporters’ Challenges

- Orders held back; ?65 crore worth of stockpiles at single firms.

- Factories forced to close; 2 of 5 units shut down at RRK Cottons.

- Profit margins eroded (average 5–10%), buyers seeking heavy discounts.

- MSME Supply Chain

- Thousands of MSMEs in yarn, dyeing, embroidery, printing, packing face reduced workload.

- Embroidery units alone contribute ?1,000 crore annually, now at 50% capacity.

- Labour and Wages

- 2–4 lakh workers (direct and indirect) employed in Tiruppur’s ecosystem face job insecurity.

- Wages, overtime, and bonuses reduced; absenteeism has dropped as workers fear job losses.

Responses and Way Forward

- Immediate Relief Needs

- Relief package to compensate at least 25% of tariff losses.

- Moratorium on loans and revival of Focus Market Scheme for exporters.

- Enhanced duty drawback rates to restore competitiveness.

- Long-Term Strategy

- Market Diversification: Expand exports to EU, Africa, Middle East, and Latin America.

- FTA Leverage: India–EU Free Trade Agreement and Indo-Pacific trade pacts are critical.

- Value-Addition and Innovation: Shift towards technical textiles, smart fabrics, and e-commerce channels.

- Global Partnerships: Explore joint ventures in Africa or Sri Lanka for final processing to bypass tariffs.

Prelims Articles

Context:

The combined assets under management (AUM) of REITs and InvITs in India have crossed ?9 lakh crore, projected to reach ?25 lakh crore by 2030.

REITs (Real Estate Investment Trusts):

- Collective investment vehicles that pool capital from investors to invest in income-generating real estate such as office parks, malls, and commercial properties.

- Provide regular income to investors in the form of dividends.

- First REIT in India listed in 2019 (Embassy Office Parks REIT).

InvITs (Infrastructure Investment Trusts):

- Investment vehicles that allow pooling of funds for infrastructure projects such as roads, highways, power transmission lines, and renewable energy assets.

- First InvIT was registered in 2016.

- Help monetise operational infrastructure projects and recycle capital for developers.

Present Status (2025):

- 5 listed REITs (including Embassy Office Parks, Brookfield India REIT, Mindspace Business Parks, Nexus Select Trust).

- 27 InvITs registered with SEBI, out of which 5 publicly listed and 23 privately listed.

- Current AUM:?7 lakh crore (InvITs) and ?2.25 lakh crore (REITs).

- Expected AUM by 2030: ?25 lakh crore.

Significance:

- Channelises long-term finance into real estate and infrastructure sectors.

- Encourages participation of retail investors in capital markets.

- Supports India’s infrastructure pipeline and real estate formalisation.

Prelims Articles

Context:

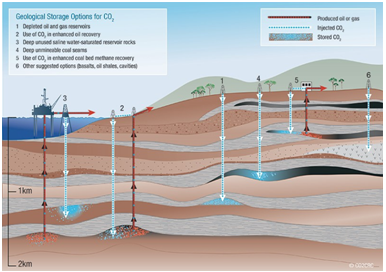

A new Nature study has found that the Earth can only safely hold about 1,460 billion tonnes of CO? underground, far less than earlier estimates.

Concept

- Carbon Capture and Storage/Carbon Capture, Utilisation and Storageinvolves capturing CO? from large emission sources (power plants, cement, steel, refineries) and storing it deep underground in geological formations (~2 km depth).

- Aim: Prevent release of anthropogenic CO? into the atmosphere, mitigate climate change, and enable low-carbon industrial transitions.

Process Stages

- Capture:

- From stationary sources (power stations, hydrogen production, cement, steel, natural gas processing).

- Direct Air Capture and Storage (DACS) under research.

- Transport:

- Via pipelines, ships, trucks, or rail, similar to natural gas transport.

- Injection & Storage:

- Stored in saline aquifers, depleted oil/gas fields, deep coal seams, or basalts.

- CO? trapped in pore spaces ? dissolves in brine ? reacts to form stable minerals.

- Utilisation (CCUS):

-

- Enhanced Oil Recovery (EOR): injecting CO? into mature oil fields.

- Production of fertilisers, fuels, plastics, and food products.

- Currently, industry mostly uses naturally accumulated CO?, but anthropogenic CO? could replace this.

-

Geological Carbon Storage (GCS):

- Involves capturing CO? from sources like power plants or the atmosphere and injecting it into deep rock formations.

- Expected to help achieve Paris Agreement targets of limiting warming below 2°C.

Revised Capacity Estimates:

- Previous estimates: ~11,800 billion tonnes of storage.

- New safe limit:1,460 billion tonnes (just 10% of earlier figure).

- High storage potential in Russia, USA, Saudi Arabia; low in India and Europe.

Implications:

- Maximum possible reversal of warming through storage is only 7°C.

- Storage alone cannot solve climate change ? emission cuts remain the primary solution.

- Raises policy dilemma: whether to use storage to extend fossil fuel use or prioritize carbon removal for future generations.

Prelims Articles

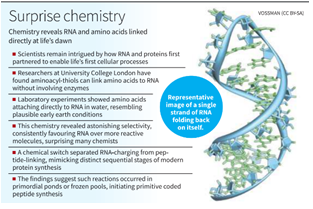

Context:

A new study in Nature has demonstrated that aminoacyl-thiols can link amino acids to RNA without enzymes, providing insights into the origins of protein synthesis on early Earth.

RNA–Protein Puzzle:

- Modern cells use ribosomes and enzymes (proteins) to link amino acids to RNA, creating a chicken-and-egg problem in explaining the origins of life.

New Finding:

- Researchers discovered that aminoacyl-thiols can attach amino acids to RNA in plain water, without enzymes, under conditions that may have existed on early Earth.

Selectivity:

- Despite other reactive molecules being present, aminoacyl-thiols showed strong selectivity for RNA, mirroring processes seen in life today.

Chemical Switch:

- Thioesters help amino acids attach to RNA, while their conversion to thioacidsfavours peptide bond formation — separating the two modern steps of protein synthesis.

Prebiotic Chemistry:

- Aminoacyl-thiols could have been formed from simple precursors like nitriles and thiols in frozen pools, making this pathway plausible under natural early-Earth conditions.

Significance:

- This finding provides a realistic model for how RNA and amino acids may have directly interacted, bridging the gap between the RNA world hypothesis and the origin of protein translation.

|

RNA Structure of RNA

Types of RNA and Functions

|

Editorials

Context:

The Delhi High Court’s refusal to grant bail to Umar Khalid in the 2020 Delhi riots case has reignited debate on the judiciary’s role in politically sensitive matters.

Judiciary’s Constitutional Role

- Guardian of Liberty: The judiciary has consistently struck down unconstitutional laws such as Section 66A of the IT Act (2015) and affirmed fundamental rights in cases like Puttaswamy (privacy) and decriminalisation of Section 377.

- Impartial Duty: Courts protect liberty even under special laws dealing with terrorism, money laundering, and narcotics, demonstrating adherence to constitutional balance.

- Public Trust: Citizens must repose faith in judicial institutions, as constitutional morality requires judgments to be accepted even when verdicts appear inconvenient.

Ambedkar’s Guidance and Judicial Philosophy

- Constitutional Morality: B. R. Ambedkar, in his final speech to the Constituent Assembly, stressed that democracy rests not only on rights but also on constitutional discipline and respect for institutions.

- Judicial Principles: The judiciary cannot act to please political sentiments; it must remain principled and uphold constitutional morality even when verdicts are unpopular.

- Examples of Scrutiny: Controversial cases, including the Citizenship Amendment Act (CAA), highlight the need to judge laws on constitutional grounds rather than political popularity.

Judiciary as Conscience Keeper

- Resilience Amid Criticism: In high-profile cases like Zakia Jafri and Sohrabuddin, appellate courts upheld due process, proving that judicial pronouncements must outlast public outrage.

- Constitutional Balance: The judiciary ensures that extraordinary laws such as UAPA are scrutinised rigorously, preventing misuse while protecting national security.

- Strength of Institutions: From the Ayodhya dispute to minority rights cases, the judiciary has acted as a stabilising force, reflecting Ambedkar’s vision of institutions guiding India’s collective life.

Practice Question:

“Judiciary’s role is not to be popular, but to be principled. Discuss this statement in light of B. R. Ambedkar’s concept of constitutional morality and recent judicial interventions in India.” (250 words)

Editorials

Context:

India’s evolving foreign policy highlights the centrality of strategic autonomy in navigating multipolar global challenges.

Historical Roots and Evolution

- Colonial Legacy: India’s emphasis on strategic autonomy is rooted in its historical experience of colonial subjugation, shaping its resolve to preserve independent decision-making.

- Nehruvian Non-Alignment: During the Cold War, India pursued non-alignment under Nehru, resisting bloc politics while safeguarding national sovereignty.

- Multi-Alignment Era: In contemporary times, India practices “multi-alignment,” engaging flexibly with multiple powers while ensuring policy independence.

Contemporary Practice and Challenges

- United States Engagement: India has deepened ties with the U.S. through defence cooperation, technology transfers, and platforms like Quad and IMEC, while resisting pressure on Russia and trade frictions.

- China Challenge: Strategic autonomy manifests in cautious engagement with China, combining deterrence, border strengthening, and multilateral participation without surrendering sovereignty.

- Russia Continuity: India maintains historical defence and energy ties with Russia despite Western pressure, showcasing an independent stance in global conflicts.

Redefinition in a New Global Order

- Beyond Traditional Domains: Autonomy today extends to data sovereignty, supply chain security, and technological ecosystems like AI and space.

- Global South Leadership: India positions itself as the voice of the Global South, advocating agency, pluralism, and pragmatic diplomacy.

- Resilience and Adaptability: Strategic autonomy is not isolation but the ability to balance great-power rivalries while investing in economic and technological strength.

Practice Question:

“Strategic autonomy remains the cornerstone of India’s foreign policy, but its meaning has evolved from non-alignment to multi-alignment in a multipolar world. Critically examine with reference to India’s relations with the United States, China, and Russia.” (250 words)

Editorials

Context:

At the 56th GST Council meeting major reforms were announced to simplify rates, ease compliance, and strengthen dispute resolution, marking the launch of GST 2.0.

Relief to Consumers and Key Sectors

- Essential Goods Rationalisation: Daily-use products such as soap, toothpaste, hair oil, packaged foods, and kitchenware have been moved into lower tax brackets, easing household expenditure and stimulating demand.

- Housing and Infrastructure Boost: Reduction in GST on cement and construction inputs supports the “Housing for All” mission, lowers project costs, and benefits allied industries like steel, paints, and sanitaryware.

- Healthcare Access Expansion: Life-saving drugs and critical medical devices are placed under nil or 5% GST, reducing treatment costs and strengthening India’s role as a global hub for affordable medicines.

Support for Exporters and MSMEs

- Correction of Inverted Duty Structures: Long-pending anomalies in textiles, fertilizers, and renewables have been resolved, enhancing global competitiveness and reducing import dependence.

- MSME Empowerment: The Simplified GST Registration Scheme with automated approvals within three days reduces compliance costs, encourages formalisation, and facilitates market expansion for small businesses.

- Trade Facilitation: Removal of refund thresholds on low-value consignments aids exporters, while clarifications on intermediary services and post-sale discounts reduce litigation and align tax rules with business practices.

Institutional and Global Significance

- GSTAT Operationalisation: The Goods and Services Tax Appellate Tribunal ensures timely and fair resolution of disputes, strengthening confidence in India’s indirect tax regime.

- Streamlined Two-Rate Structure: Adoption of a merit rate (5%), standard rate (18%), and limited de-merit rate (40%) aligns India’s GST with global best practices and enhances ease of doing business.

- Signal to Global Investors: Policy predictability and simplified structures position India as a competitive investment destination, reinforcing its role in reconfigured global supply chains.

Practice Question:

“Critically examine the significance of GST 2.0 reforms in strengthening India’s tax framework, with special reference to their impact on consumers, MSMEs, and global competitiveness.” (250 words)