7th August 2024 (8 Topics)

Context

Insurance companies have jacked up premiums on health and life insurance policies this year which, together with the 18% Goods and Services Tax (GST), has made insurance less affordable for many sections of the country’s population.

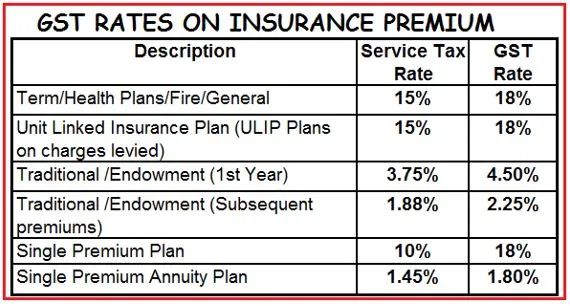

GST Structure on Healthcare:

- Currently, GST on health and life insurance policies is fixed at 18%. Since GST encapsulates service tax, which applies to the insurance industry, its introduction has increased premium amounts.

- Before GST, life insurance premiums were subject to 15% service taxes, comprising Basic Service Tax, Swachh Bharat cess, and Krishi Kalyan cess.

- The increase from 15% to 18% impacted the end consumer — that is, policyholders — by raising their premiums amounts.

- This, along with the runaway cost of treatment — medical inflation was estimated to be 14% towards the end of last year — has made buying medical insurance difficult for many people.

More Articles