7th October 2022 (7 Topics)

Context

- The OPEC+ alliance of oil-exporting countries has decided to sharply cut production to support sagging oil prices.

About

Why oil prices are experiencing a downward trend?

- The oil prices are sagging because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates, and uncertainty over the war in Ukraine.

- The present decision of OPEC+ has been based on the “uncertainty that surrounds the global economy and oil market outlooks.

What is the OPEC plus?

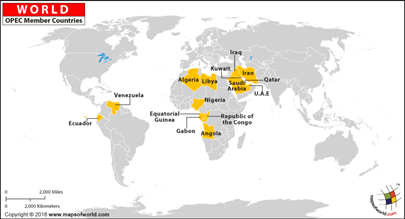

- OPEC+ is a group of 23 oil-exporting countries that meets regularly to decide how much crude oil to sell on the world market.

- At the core of this group are the 13 members of OPEC (the Organization of Oil Exporting Countries), which are mainly Middle Eastern and African countries.

- The core members are mainly Middle Eastern and African countries.

Opec+ cutting oil output:

- At a meeting in Vienna in March 2020, OPEC+ members agreed to cut production from August 2022 levels by two million barrels per day to less than 42 million barrels.

- The cut, which will take effect in November, represents around 2% percent of the global oil supply.

- It is the biggest reduction by OPEC+ since 2020 when it cut production by more than nine million barrels per day in response to the pandemic.

- The move is designed to boost the cost of oil, which has fallen as low as $84 in recent days after spending most of the summer months over $100 per barrel.

- S. crude rose to $87.64, and international benchmark Brent went up to $93.21 after the decision.

Trends in oil pricing:

- Previously due to COVID, the price of crude oil crashed because of a lack of buyers.

- Producers were paying people to take the oil off their hands because they didn't have enough space to store it all.

- After this, OPEC+ members agreed to slash production by ten million barrels a day, to help drive the price back up.

- Since then, the group has slowly increased production as demand has also grown.

- But when Russia invaded Ukraine, the price of crude soared to well over $100 a barrel. This is because the markets were worried, that the global sanctions could lead to a shortage of Russian oil.

What's happening with Russian oil?

- After Russia invaded Ukraine, many countries bought less Russian oil and its price started to fall.

- India and China - who did not join the Western sanctions against Russia - now account for over half of the country's seaborne oil exports.

- Russia is now China's biggest supplier of oil, taking over from Saudi Arabia.

- The OPEC+ decision on oil cuts could help alliance member Russia facing the European ban on oil imports.

- Russia “will need to find new buyers for its oil when the EU embargo comes into force in early December and will have to make further price concessions.