10th November 2023 (8 Topics)

Context:

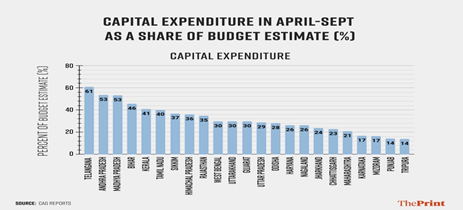

Capital expenditure of 23 states grew by 52% in April-September 2023 over same period last year.

Key Highlights-

- Capital Expenditure Growth:

- Substantial Improvement in Expenditure Quality.

- States Prioritize Development with 52% Growth.

- Varied Spending Patterns Across Indian States.

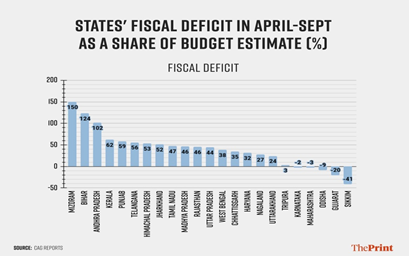

- Fiscal Performance Variations:

- Fiscal Deficit Budgeted at Rs 9.6 Lakh Crore.

- States Like Gujarat and Maharashtra Achieve Fiscal Surplus.

- Concerns in States Exceeding Budgeted Fiscal Deficit Targets.

- Revenue Receipts and Tax Growth:

- 14 States Surpass 40% of Budgeted Revenue Receipts.

- Gujarat Leads in Revenue Performance.

- Double-Digit Tax Growth, but Contractions in Some States.

- Comparative Positioning of States:

- States Balancing Fiscal Deficit and Capital Spending.

- Importance of Capital Expenditure for Fiscal Health.

- Analysis Indicates Varied Fiscal Landscapes Across States.

Effects of Increased Capital Expenditure and Decreasing Fiscal Deficit –

- Stimulates Economic Growth:

- Higher capital expenditure often involves investments in infrastructure, industries, and developmental projects.

- This spending can stimulate overall economic activity, leading to higher GDP growth.

- Job Creation:

- Capital projects, such as infrastructure development, require labor, leading to job creation.

- Increased employment can boost consumer spending, further contributing to economic growth.

- Improved Productivity:

- Capital expenditure in technology, machinery, and innovation can enhance productivity.

- Improved productivity can result in higher output and efficiency across various sectors.

- Enhanced Competitiveness:

- Investments in technology and innovation can make industries more competitive globally.

- Increased competitiveness can lead to higher exports and a favorable trade balance.

- Positive Investor Sentiment:

- Decreased fiscal deficit signals responsible fiscal management.

- Positive investor sentiment can attract both domestic and foreign investments.

- Infrastructure Development:

- Capital expenditure often involves investments in critical infrastructure like roads, bridges, and energy.

- Improved infrastructure can reduce logistics costs, enhance connectivity, and attract business investments.

More Articles