21st June 2024 (11 Topics)

Mains Issues

Context

The Supreme Court of India has announced a special Lok Adalat scheduled for the upcoming months, marking the 75th year of its establishment.

Reason behind SC’s Decision

- The Supreme Court is committed to enhancing accessible and efficient justice delivery for all segments of society. The special Lok Adalat is part of efforts to expedite the resolution of pending cases.

- This initiative aims to resolve pending cases through amicable settlements.

- At the end of 2023, the Supreme Court was saddled with 80,439pending cases. The government is a litigant in more than 70% of all admitted matters before the Supreme Court.

About Lok Adalat and Its Role

- Lok-Adalat is a system of alternative dispute resolution developed in India. It is an integral part of India’s judicial system, focusing on alternative dispute resolution outside formal court proceedings.

- Aim: to facilitate quick settlements while saving time, costs, and energy for both litigants and judges. The process emphasizes negotiation and compromise in an informal setting.

- Lok Adalats derive their authority from Article 39A of the Constitution of India, which mandates the state to ensure that the legal system promotes justice on the basis of equal opportunity.

- These adalats operate under the Legal Services Authorities Act, 1987, providing a statutory status.

- National Legal Services Authority (NALSA) and other legal service institutions conduct Lok Adalat.

- Lok Adalat can make awards/decisions, which are deemed to be a decree of a civil court and is final and binding on all the parties concerned.

- All Lok Adalats function under the aegis of NALSA, which is headed by its executive chairman, the second senior-most judge of the Supreme Court. The chief justice of India is a Patron-in-Chief of the NALSA.

Mains Issues

Context

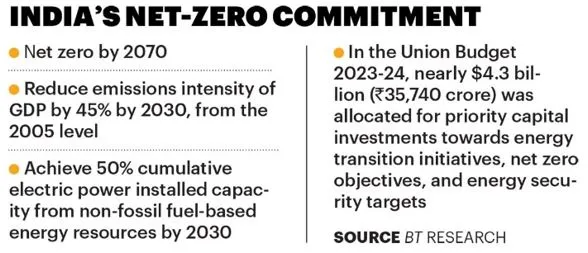

The recently released Energy Institute’s Statistical Review of World Energy shows that energy emissions rose by 2% in 2023, surpassing 40 gigatonnes of CO? equivalent for the first time.

Global Energy Consumption and Emissions

- Overall Increase: Global primary energy demand reached a record 620 Exajoules (EJ), marking a 2% increase from 2022 despite efforts to reduce fossil fuel dependency. Emissions intensified within the fossil fuels category, driven by rising oil and coal use alongside stable gas emissions.

- 1EJ is equivalent to about 170mn barrels of oil.

- Fossil Fuel Dominance: Fossil fuels constituted 5% of the global energy mix, despite a slight decrease from the previous year.

- Regional Shifts: In Europe, fossil fuel use dropped below 70% for the first time since the industrial revolution.

- Renewable Energy Growth

- Record High: Renewable energy generation (excluding hydro) surged by 13% to a new high of 4,748 terawatt-hours (TWh).

- Increased Share: Renewables now account for 8% of the global energy mix excluding hydro, up from 7.5% in 2022.

- Oil Consumption and Production

- Historic Milestone: Global oil consumption exceeded 100 million barrels per day (bpd) for the first time.

- Supply Dynamics: Non-OPEC+ producers, notably the U.S., drove oil supply growth with a 9% increase in output.

- Natural Gas and LNG

- Stability in Production: Global gas production and consumption remained stable, with LNG supply rising by nearly 2%.

- Leadership Shift: The U.S. surpassed Qatar as the leading global LNG supplier.

- Coal Consumption

- Continued Growth: Coal consumption hit a new high of 164 EJ, driven by increases in China and India.

- Regional Comparison: India’s use of fossil fuels climbed 8 per cent, with its coal consumption overtaking the combined use in North America and Europe for the first time.

Fact Box: India’s Energy Demand and Infrastructure:

|

Related PYQQ1: The question of India’s Energy Security constitutes the most important part of India’s economic progress. Analyze India’s energy policy cooperation with West Asian Countries. [2016] Q2: Give an account of the current status and the targets to be achieved pertaining to renewable energy sources in the country. Discuss in brief the importance of the National Programme on Light Emitting Diodes (LEDs). (2016) Q3: Clean energy is the order of the day.’ Describe briefly India’s changing policy towards climate change in various international for in the context of geopolitics. [2022] |

Mains Issues

Context

Deep-sea mining has emerged as a contentious issue garnering global attention due to its potential impact on marine ecosystems and its role in meeting the growing demand for critical minerals essential for modern technology.

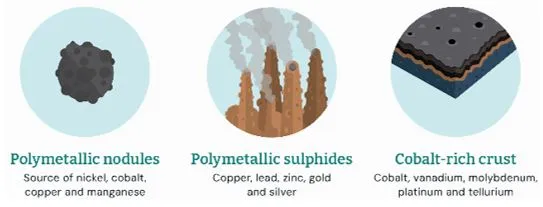

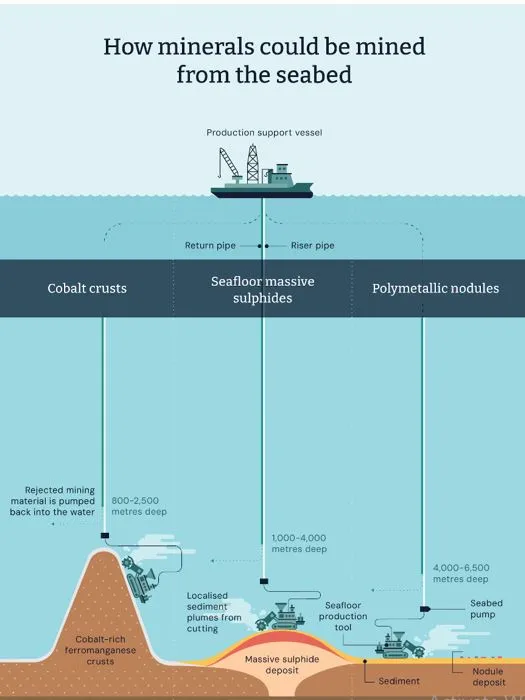

What exactly is deep-sea mining?

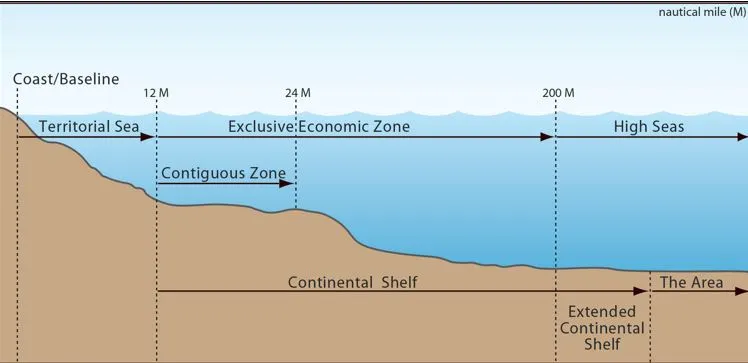

- Deep-sea mining involves extracting mineral deposits from seabeds deeper than 200 meters below the ocean surface.

- These areas cover about 65% of the Earth’s surface and host diverse ecosystems and geological features, including mountains, canyons, and hydrothermal vents like those in the Mariana Trench.

- Targeted Commodity: Miners target critical minerals such as nickel, copper, cobalt, and manganese.

- These minerals are essential for modern technologies like smartphones, solar panels, and electric vehicles.

- They are found in polymetallic nodules, seafloor massive sulphide deposits, and cobalt-rich ferromanganese crusts.

- Coastal state rights: Countries have the rights to explore and exploit the natural resources of the seabed and subsoil within their territorial sea and exclusive economic zone (EEZ), which normally extends 200 nautical miles beyond a nation’s territorial sea.

- Nations can claim rights over even more seabed on the continental shelf under certain circumstances.

- Norway and the Cook Islands are among the nations actively pursuing mining in the waters under their control.

How might deep-sea mining affect the ocean?

- Mining could harm deep-sea habitats and species like octopuses and sponges by destroying their homes.

- Removing hydrothermal vents and crusts on seamounts would disrupt thriving animal communities.

- Sediment plumes from mining might be toxic and could smother downstream ecosystems, while noise and light pollution could disturb deep-sea creatures adapted to extreme conditions.

What is the International Seabed Authority?

- The International Seabed Authority (ISA), based in Jamaica, regulates mineral exploitation in international waters under the UN Convention on the Law of the Sea.

- It has issued exploration contracts for areas like the Clarion-Clipperton Zone in the Pacific Ocean but is still developing regulations for deep-sea mining.

- Pressure is mounting to finalize these rules amid debates over environmental impacts and the equitable use of ocean resources.

Fact BoxTerritorial Sea:

Exclusive Economic Zone (EEZ):

|

Prelims Articles

Context

Following the cancellation of the UGC-NET examination by the Centre, the National Testing Agency (NTA) is under scrutiny with calls for its abolition.

About the National Testing Agency (NTA)

- Established by the Centre in 2017, the NTA is an autonomous body responsible for conducting entrance examinations for higher educational institutions.

- Role: The NTA manages the entire process of exam preparation, delivery, and evaluation in a rigorous and scientific manner. It collaborates closely with subject matter experts and psychometricians.

- The NTA is governed by a board comprising 14 members, including the chairman.

- Key Examinations Conducted: The NTA administers various prominent exams, including:

- NEET (National Eligibility cum Entrance Test) for medical admissions.

- UGC-NET (National Eligibility Test) for determining eligibility for lectureship and Junior Research Fellowship.

- JEE Main (Joint Entrance Examination) for admission to IITs and NITs.

- CMAT (Common Management Admission Test) for management programs.

- GPAT (Graduate Pharmacy Aptitude Test) for pharmacy programs.

Fact Box: Public Examinations (Prevention of Unfair Means) Act, 2024

|

Prelims Articles

Context

A team of herpetologists conducting a rapid survey in Kaziranga National Park and Tiger Reserve has made a notable discovery. For the first time, they recorded the presence of a striped caecilian (Ichthyophis spp), a limbless amphibian.

What are Caecilians?

- Caecilians are a group of limbless, burrowing amphibians that resemble earthworms or limbless lizards like snakes and amphisbaenians.

- Order Gymnophiona: They belong to the order Gymnophiona, one of the three extant amphibian orders alongside Anura (frogs and toads) and Caudata (newts and salamanders).

- Habitat and Distribution: Caecilians are mostly found in moist tropical and subtropical regions of South and Central America, South and Southeast Asia, and Sub-Saharan Africa.

- Terrestrial and Elusive: They are primarily terrestrial and spend the majority of their lives underground. Caecilians burrow in various habitats such as forests, grasslands, savannas, shrublands, and wetlands.

- Anatomy: Caecilians lack limbs and have no appendicular skeleton or shoulder girdle. Their spine shows a kink where the pelvic girdle once was, reflecting their adapted burrowing lifestyle.

- Caecilians play a vital role as indicator species, reflecting environmental conditions and contributing to pest control.

Fact Box: About Kaziranga National Park

|

Prelims Articles

Context

Recent years have seen notable advancements in SCD treatment, including multiple approved medications and breakthroughs in gene therapy. However, there still exists the need for scalable solutions and collaborative efforts among healthcare stakeholders, government bodies, and pharmaceutical companies.

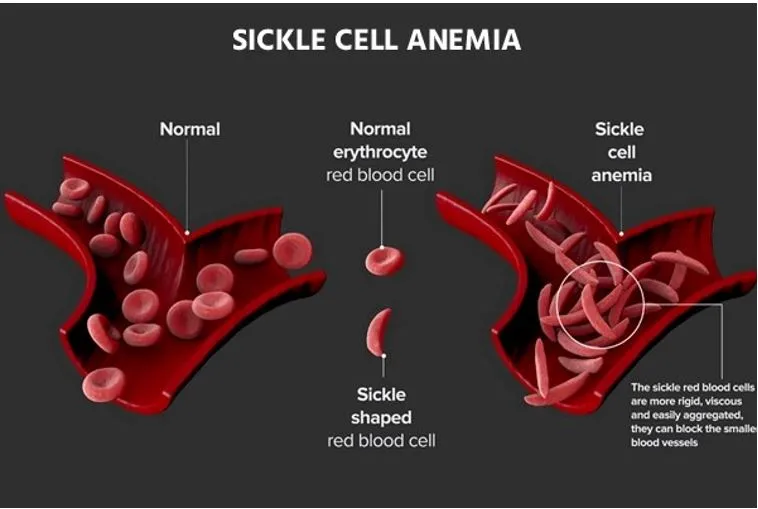

What is SCD?

- Sickle Cell Disease (SCD) is a genetic condition affecting hemoglobin, the protein that carries oxygen in red blood cells.

- Genetic mutations cause red blood cells to adopt a crescent shape, disrupting blood flow and leading to severe complications.

- Normally, these cells are round and flexible, but in SCD, they become rigid and crescent-shaped due to a genetic mutation.

- This abnormal shape causes them to stick together and block blood flow, leading to pain, infections, and other serious health problems.

- Global and Indian Burden: SCD affects 20 million people worldwide, with India facing a significant challenge, especially among tribal populations.

- The country has the second-highest prevalence globally, with 1 in 86 births affected.

- Complications and Challenges:

- Patients with SCD suffer from a range of complications, including organ damage, increased infection susceptibility, stroke, and pulmonary issues. Geographic and socioeconomic disparities exacerbate these challenges.

- Despite progress, accessibility to medications like hydroxyurea remains a barrier.

- National Initiatives: The Indian government's National Sickle Cell Anaemia Elimination Mission aims to eradicate SCD by 2047 through awareness enhancement, universal screening, and collaborative interventions.

- World Sickle Cell Day is observed on June 19 every year.

Prelims Articles

Context

In recent months, the Reserve Bank of India (RBI) has implemented and subsequently adjusted regulations concerning Alternate Investment Funds (AIFs). The Indian government has asked the central bank to exempt sovereign funds (including a fund called Special Window for Affordable and Mid-Income Housing (SWAMIH)) from a recent set of tightened rules concerning investments in alternate investment funds (AIFs)

What is AIF?

- Alternate Investment Funds (AIFs) are pooled investment vehicles that invest in assets other than traditional stocks and bonds.

- They include various categories like private equity, venture capital, real estate funds, etc.

|

Fact Box: About SWAMIH

|

Prelims Articles

|

S.No. |

Term |

About |

|

1. |

Derivatives |

Derivatives are financial contracts that derive their value from an underlying asset such as stocks, commodities, currencies etc., and are set between two or more parties, where the value of the derivative is derived from price or value fluctuations of the underlying assets. |

|

2. |

Exclusive economic zone (EEZ) |

The exclusive economic zone (EEZ) is an area where sovereign states have jurisdiction over resources. This maritime zone is defined by UNCLOS. It extends up to 200 nautical miles from a coastal state's baseline. |

|

3. |

Lok Adalat |

It is a forum where disputes/cases pending in the court of law or at pre-litigation stage are settled/compromised amicably. |

|

4. |

Sovereign Wealth Fund |

Sovereign Wealth Fund is an investment fund which is primarily owned by the National Government. These funds generally invest in financial instruments such as bonds, stocks, gold, and real estate. |

Editorials

Context

The evolving dynamics of the U.S.-Saudi relations is marked by a historical "oil-for-security" arrangement and the current negotiations for a Strategic Alliance Agreement (SAA), which aims to address mutual domestic and regional ambitions.

The Layers to the Agreement

- Bilateral Relations: The proposed SAA would formalize the U.S.-Saudi alliance into a strategic defense pact similar to the U.S.-Japan treaty, potentially including the provision of F-35 stealth fighters and nuclear technology for peaceful use.

- Regional Impact: Saudi Arabia seeks a ceasefire in Gaza and progress towards a two-state solution for Israel-Palestine. In return, the U.S. expects Saudi Arabia to recognize Israel and limit its foreign policy ties with China and Russia.

- Economic Implications: The SAA could ensure that a significant portion of projects under Saudi Arabia’s Vision 2030 benefits American companies, maintaining economic coordination despite the U.S. no longer depending on Saudi oil.

The Hurdles

- Bilateral Trust Deficit: Historical events like the 2019 attack on Saudi oil facilities and U.S. actions during the Yemeni war have eroded trust. Saudi Arabia’s increasing ties with China and Russia and its reconciliation with Iran also pose challenges.

- Gaza Conflict: The ongoing conflict makes it politically difficult for Saudi Arabia to reconcile with Israel. U.S. Senate approval for the SAA requires significant progress towards peace in Gaza and a two-state solution.

- Geopolitical Tensions: Regional stability is crucial for the SAA. Events such as Hamas’ attack on Israel and shifting alliances indicate the complex geopolitical landscape that the U.S. and Saudi Arabia must navigate.

India’s Stakes

- Regional Stability: An SAA could enhance stability in the Gulf and West Asia, which is beneficial for India’s economic and strategic interests.

- Economic Opportunities: The agreement might create new opportunities within the India-Middle East-Europe Economic Corridor.

- Strategic Policy: India should continue its “Act West” policy independently, while monitoring developments between the U.S. and Saudi Arabia.

UPSC Mains Questions

Q. Discuss the implications of the proposed U.S.-Saudi Strategic Alliance Agreement on the geopolitical landscape of West Asia.

Editorials

Context

As AI technology rapidly advances, India is exploring how to regulate and foster AI, balancing potential economic and social benefits with concerns about copyright, human rights, privacy, and fairness. Japan’s approach to AI regulation offers valuable lessons for India.

Balancing Innovation and Regulation

- Government as Facilitator: Japan's government acts as a facilitator rather than the primary innovator, encouraging the private sector to drive AI development while government institutions support through governance and coordination. This approach ensures a balanced ecosystem where innovation thrives.

- Focused Funding and Investment: Japan has established significant funding for generative AI, domestic data centers, and local chip production, with incentives and subsidies in collaboration with cloud computing providers and tech companies. In contrast, India's funding often centralizes procurement rather than decentralizing innovation.

- Government-Academia-Industry Collaboration: The AI Japan R&D Network exemplifies effective collaboration across universities, research institutes, private sector, and global tech companies to recommend AI policies. India has the infrastructure for similar collaboration but needs to strengthen these partnerships.

Building Domestic Competence

- Large Language Models (LLM): Japan is developing its own LLMs, while India is also building various LLMs that would benefit from government support. Leveraging India's expertise in citizen-centric technology, similar initiatives can promote AI as a public good.

- Philosophical Differences: Western and Eastern societies have different approaches to privacy and data usage. India's perspective aligns more with the Eastern notion of collective or societal privacy, making Japan's approach more culturally compatible.

- Strategic AI Adoption: AI's transformative potential necessitates urgent action from Indian policymakers. Observing Japan’s balanced approach can help India foster innovation while ensuring robust regulation.

India's Strategy

- Policy Implementation: India should adopt a framework similar to Japan’s, placing the private sector at the center of AI efforts, supported by relevant government ministries.

- Investment in Technology: Decentralized innovation and focused funding, akin to Japan’s model, can drive India’s AI advancements.

- Cultural Compatibility: Recognizing cultural similarities with Japan, India can adopt an AI regulatory framework that balances innovation and regulation, addressing unique societal needs.

UPSC Mains Questions

Q. Analyze the differences in privacy and data usage perspectives between Western and Eastern societies. How can India leverage its cultural alignment with Japan to develop an effective AI regulation framework?

Editorials

Context

India’s economy has demonstrated consistent strength post-pandemic, with an optimistic outlook for future growth. Despite a coalition government at the Centre, policy continuity is expected, supporting India's trajectory towards becoming the world's third-largest economy by 2027.

Current Economic Growth Cycle

- Positive GDP Growth: India's GDP growth has consistently surpassed expectations over the past five quarters. High-frequency data reflects this robustness with manufacturing and services PMI readings near 14-year highs, credit growth at or above 15% for the past nine months, and GST collections above ?1.5 trillion for the past 15 months.

- Early-Stage Expansion: Despite concerns about sluggish consumption in low-income segments and slow private capex pick-up, indicators suggest this is symptomatic of an early-stage expansion. Data points to improving rural demand and an uptick in private investment.

- Broader-Based Growth: As the economic expansion continues, growth is expected to become more broad-based, with rural demand and private investment showing signs of recovery.

Transformation Through Policy Reforms

- Supply-Side Responsiveness: Policy reforms in the past decade have enhanced the economy’s supply-side responsiveness, contributing to a higher investment rate, systematically lower inflation, and a stronger external balance sheet. Capex has risen to around 34% of GDP in 2023-24 from a trough of 28% in 2020-21.

- Macro Stability: Inflation has been below 6% in seven of the past nine years, and the current account deficit has remained around or below 2% of GDP since 2013-14. India’s export market share has increased by 40 basis points to 2.5% since 2019.

- Global Integration: Improved integration with the global economy through policy measures has fortified India’s economic position, making the growth cycle more self-sustaining and less vulnerable to global shocks.

Future Policy Directions

- Job Creation: Focus on expanding infrastructure investment and boosting the manufacturing base is crucial for leveraging India’s demographic dividend. Since 2014, significant expansion in physical infrastructure, including a 1.5x increase in roads, doubling of airports, and electrification of railway routes, is expected to enhance domestic competitiveness and create non-farm jobs.

- Macro Stability: Policymakers are expected to maintain a framework favoring fiscal prudence, an efficient expenditure mix, and improvements in targeting welfare spending. The upcoming budget is likely to emphasize fiscal consolidation, job creation, and sustaining capex growth.

- Growth Strategy: To achieve 8-10% growth, decisive steps are needed to address factor markets (land and labor) and improve agricultural productivity. Maintaining a balanced policy mix is essential to ensure continued economic expansion.

Risks and Bottom-Line

- Global Factors: Risks include a sharp deterioration in global growth, increased risk aversion impacting capital flows, and a sustained rise in commodity prices, particularly oil. While India is less vulnerable to these shocks, it is not completely immune.

- Policy Risks: Structural risks involve potential changes in policy focus towards aggressive redistribution, which could undermine macro stability and the growth outlook.

- Outlook: India's expansion cycle is expected to continue, with GDP growth averaging 6.5% until 2030. The economy is projected to grow to $8 trillion by 2032 from $3.8 trillion in 2024, contributing significantly to global growth.

UPSC Mains Questions

Q. Examine the impact of recent policy reforms on India's economic growth cycle. How have these reforms contributed to macro stability and global integration?