23th September 2025 (13 Topics)

Context:

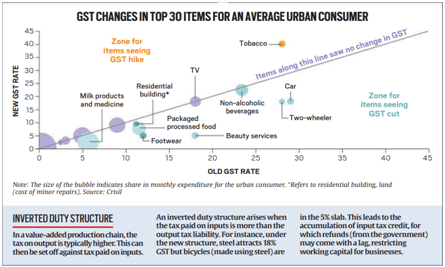

The Government has undertaken a major GST rate rejig to simplify classification, rationalise slabs, and reduce the inverted duty structure (IDS), with the aim of boosting consumption and investments.

Background of GST Rationalisation

- Introduction of GST (2017): GST subsumed 17 indirect taxes and 13 cesses into a unified framework, initially with four slabs – 5%, 12%, 18%, and 28%.

- Problem of Complexity: Multiple slabs and exceptions created confusion for taxpayers and businesses.

- Objective of GST 2.0: To streamline rates, reduce disputes, and spur consumption by placing items in a simplified two-slab structure.

Key Changes in Rate Structure

- Standardisation of Rates:

- Four main slabs (5%, 12%, 18%, 28%) further rationalised; exemptions removed for items like bread, food additives, and health insurance.

- Precious stones taxed at 1.5%; diamonds at 0.25%; gold and silver at 3%.

- Medical devices, bio-fuel, and hydrogen vehicles rationalised under lower slabs.

- Consumer Impact:

- Household expenditure expected to decline due to reduction in rates of essential goods like milk products, footwear, and packaged food.

- Some items such as tobacco continue to be taxed at higher rates for revenue and health concerns.

Inverted Duty Structure (IDS): A Persistent Issue

- Definition: IDS arises when input tax is higher than output tax, leading to accumulation of Input Tax Credit (ITC).

- Examples: Steel taxed at 18% but bicycles made using steel at 12%.

- Concerns: Refunds are often delayed, locking working capital for businesses, especially SMEs.

Expected Benefits

- For Consumers:

- Increased disposable income, enhancing demand for goods and services.

- Reduced litigation due to simplified classification.

- For Businesses:

- Lower compliance burden, promoting ease of doing business.

- Potential rise in investment due to predictable tax environment.

- For Government:

- Streamlined revenue inflow through reduced evasion.

- Enhanced efficiency in tax collection via harmonised slabs.

Challenges and Concerns

- Incomplete IDS Resolution: Certain sectors (fertilisers, textiles, bicycles) continue to suffer from blocked credit.

- Revenue Concerns: Excessive rate cuts could limit fiscal capacity of the government.

- Frequent Changes: Continuous modifications in slab rates may cause uncertainty for businesses.

More Articles