19th December 2024 (15 Topics)

Context

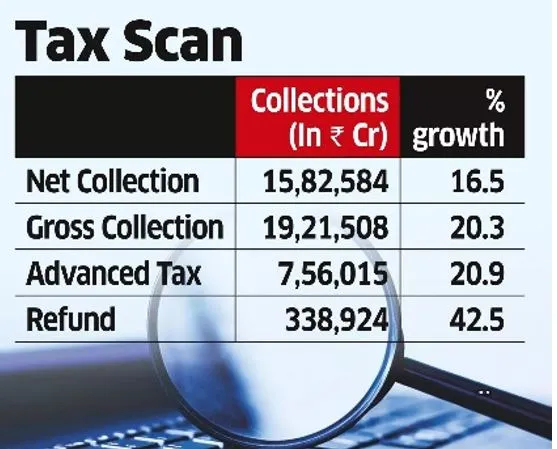

The net direct tax collections for the current fiscal year have shown robust growth, rising by 16.45% year-on-year to exceed Rs 15.82 lakh crore, according to the latest government data.

Key Insights:

- Corporate Tax (CT) Performance: Gross collections from corporate tax reached Rs 9.24 lakh crore, up from Rs 7.90 lakh crore in the same period last year.

- After refunds, the net corporate tax collections stood at Rs 7.42 lakh crore, compared to Rs 6.83 lakh crore in the previous fiscal year.

- Non-Corporate Tax (NCT) Growth:

- Non-corporate tax, which mainly includes personal income tax, showed strong growth.

- Gross collections for this segment climbed to Rs 9.53 lakh crore, compared to Rs 7.81 lakh crore last year.

- Net collections grew significantly to Rs 7.97 lakh crore, up from Rs 6.50 lakh crore in the same period of the previous fiscal year.

- Direct Taxes Overview:

- Direct taxes in India encompass a wide range of taxes including corporate tax, personal income tax, securities transaction tax, equalization levy, and others.

- These taxes are an essential source of revenue for the government and include wealth tax, fringe benefits tax, banking cash transaction tax, hotel receipt tax, interest tax, and gift tax, among others.