19th December 2024 (15 Topics)

Mains Issues

Context

The newly elected Sri Lankan President, Anura Kumara Dissanayake (AKD), made his first official overseas visit to India. This visit aimed to discuss various topics such as Indian projects in Sri Lanka, the proposed Comprehensive Economic Partnership Agreement (CEPA), the Tamil issue, and regional security cooperation. It is important because India had been a crucial partner to Sri Lanka during its economic crisis and post-pandemic recovery.

Key-takeaways of the Meeting

- Economic Cooperation:

- Sri Lanka’s Economic Recovery: Dissanayake expressed deep gratitude for India’s support during Sri Lanka's economic crisis in 2022. India provided USD 4 billion in credit lines and grants, which helped stabilize Sri Lanka’s economy.

- Continued Support from India: India would continue supporting Sri Lanka’s recovery, focusing on long-term economic cooperation. The leaders agreed to explore new avenues for trade and investment, particularly in sectors like agriculture, dairy, and textiles.

- Free Trade Agreement (ISFTA): Both countries discussed expanding the India-Sri Lanka Free Trade Agreement (ISFTA) to enhance trade relations. Sri Lanka sees India’s large market as a vital opportunity for its exports.

- Defence and Regional Security:

- Security Concerns in the Indian Ocean: The leaders discussed the growing security challenges in the Indian Ocean, especially with China’s increasing presence in the region. President Dissanayake assured that Sri Lanka would not allow its territory to be used against India’s security.

- Maritime Cooperation: Both leaders highlighted the importance of strengthening defence and maritime security cooperation. India has provided Sri Lanka with Offshore Patrol Vessels and helped set up a Maritime Rescue and Coordination Centre to enhance Sri Lanka’s maritime capabilities. Joint efforts between both countries' navies are also tackling narcotics trafficking in the region.

- Joint Exercises: Both countries agreed to conduct joint military exercises, share intelligence, and collaborate on maritime security.

- Strategic and Economic Cooperation:

- Infrastructure and Renewable Energy: The leaders agreed to focus on infrastructure development, renewable energy, and digital connectivity between the two countries.

- Agricultural Modernization: A Joint Working Group will be set up to explore collaboration in modernizing Sri Lanka’s agriculture and promoting sustainable farming practices, including in the dairy sector.

- Cyber Security and Climate Change: They also discussed cooperation on countering cyber threats and addressing climate change in the region.

- Fishermen’s Issue: The India-Sri Lanka fisherman is a long-standing dispute between the two over fishing rights in the Palk Strait and the Gulf of Mannar. The Palk Strait is a narrow strip of water that separates the state of Tamil Nadu in India from the northern regions of Sri Lanka.

Challenges in Relations:

- Economic Cooperation: India and Sri Lanka have had complex discussions over economic agreements, such as the Free Trade Agreement (FTA) and Comprehensive Economic Cooperation Agreement (CECA). Political resistance in Sri Lanka has slowed progress in these areas.

- China’s Influence: China’s Belt and Road Initiative (BRI) projects, like the Hambantota Port, have become a major competitor to India’s infrastructure efforts in Sri Lanka. Sri Lanka handed over control of Hambantota port to China for 99 years after struggling with debt repayment.

- Tamil Political Issue: The unresolved Tamil political question has been a longstanding issue in Sri Lanka’s domestic politics. President Dissanayake promised to return Tamil lands occupied by state agencies. However, his party, JVP, does not support political devolution for Tamils, which remains a point of contention in the relationship between India and Sri Lanka.

India-Sri Lanka Relations

|

PYQUPSC Prelims Question

Which of the statements given above is/are correct?

UPSC Mains Question Q1: India is an age-old friend of Sri Lanka.’ Discuss India’s role in the recent crisis in Sri Lanka in the light of the preceding statement. (UPSC 2022) Q2: In respect of India — Sri Lanka relations, discuss how domestic factors influence foreign policy. (UPSC 2013) |

Mains Issues

Context

A Parliamentary Committee on Agriculture, Animal Husbandry, and Food Processing presented its first report on the demands for grants for the Ministry of Agriculture and Farmers Welfare for the fiscal year 2024-25. The report, chaired by Charanjit Singh Channi (former Chief Minister of Punjab), contains several key recommendations aimed at improving farmers’ welfare and addressing issues in the agricultural sector.

Key Recommendations from the Report:

- Legal Guarantee for Minimum Support Price (MSP): The committee has recommended that the government introduce a legal guarantee for MSP. This means farmers will be assured of a minimum price for their produce, which will reduce market volatility, prevent farmer suicides, and ensure a stable income. It would also promote food security and encourage farmers to invest in farming, thereby boosting rural economic growth.

- The committee has stressed the need to declare a roadmap for implementing this legal guarantee, and regularly inform Parliament about the number of farmers selling produce at MSP.

- Compensation for Paddy Waste Management: To address the environmental issue of burning paddy stubble (parali), the committee recommends that farmers should be compensated for disposing of crop residue

- The Punjab government has proposed a compensation of Rs 2,000 per acre, with the central government covering half of this amount.

- Increase in PM-KISAN Support: The committee has suggested that the PM-KISAN scheme should be enhanced by doubling the monetary support from Rs 6,000 per year to Rs 12,000 per year.

- The committee also recommends extending seasonal incentives to tenant farmers and farm labourers.

- Debt Waiver for Farmers:

- To address the growing farmer distress and rural indebtedness, the committee recommends a debt waiver scheme for farmers and farm labourers.

- Loan dependency among rural families has risen sharply, with more families borrowing money to cover rising expenses. This has contributed to a rise in farmer suicides due to financial stress.

- Increase in Budget Allocation for Agriculture: The committee pointed out that despite absolute increases in budget allocation for agriculture, its share as a percentage of the total central plan has been decreasing. It recommended that the central government increase its budget allocation to boost agricultural growth.

- The growth rate of agriculture has slowed down significantly, falling to 4% in 2023-24, the lowest in seven years, down from the average of 4.18% over the past four years.

- Compulsory Crop Insurance for Small Farmers: The committee recommended implementing compulsory crop insurance for small farmers, especially those with land holdings of up to 2 acres, similar to the PM-JAY health insurance scheme.

- National Commission for Minimum Living Wages for Farm Labourers: A new National Commission should be set up to ensure minimum living wages for farm labourers and address their long-pending rights.

- Renaming the Department of Agriculture: The committee suggested renaming the Department of Agriculture and Farmers Welfare to the Department of Agriculture, Farmers, and Farm Labourers Welfare to reflect a broader focus on the welfare of farm labourers.

Significance:

- These recommendations come in the context of farmers' protests in Punjab and Haryana, where farmers have been demanding a legal guarantee for MSP.

- The committee’s recommendations aim to reduce the financial burden on farmers, ensure stable incomes, and improve the agricultural sector's performance.

- The report also emphasizes environmental protection and addressing farmer suicides due to rising debts and financial stress.

Prelims Articles

Context

Every year on 16 December, both India and Bangladesh celebrate Vijay Diwas (Victory Day) to mark India’s decisive victory over Pakistan in the 1971 war, which also led to the birth of Bangladesh.

About Vijay Diwas

- Vijay Diwas commemorates India’s significant victory against Pakistan during the Liberation War in 1971.

- The day signifies the end of an intense 13-day battle that resulted in Pakistan’s submission through a surrender agreement in Dhaka.

- This pivotal moment led to the ultimate liberation of Bangladesh, once recognized as East Pakistan.

- Factors responsible for 1971 India-Pakistan war

- Ethnic and Linguistic Differences: The division between East Pakistan (now Bangladesh) and West Pakistan (now Pakistan) was primarily rooted in cultural and linguistic differences.

- East Pakistanis were predominantly Bengali-speaking and felt marginalized by the Urdu imposition from the West Pakistani government, which led to a growing sense of alienation and resentment.

- East Pakistanis were also discriminated against in terms of economic development and political power.

- Political Tensions and the Demand for Autonomy: In the mid-1960s, Sheikh Mujibur Rahman, a leader from East Pakistan, began advocating for greater autonomy for East Pakistan through his Six-Point Programme. However, the Pakistani refused to grant these demands, leading to political tension and conflict between the two regions.

- Operation Searchlight and the Genocide: In March 1971, Pakistan's military launched Operation Searchlight to suppress the growing separatist movement in East Pakistan. This operation involved mass atrocities, including widespread killings, rapes, and the targeting of Hindu minorities, which has been referred to as a genocide. The brutal repression triggered a mass exodus of refugees, leading to millions fleeing to neighboring India.

- India's Role in the Liberation of Bangladesh: India provided military and logistical support to the Mukti Bahini, a guerrilla force made up of Bangladeshi soldiers and civilians trained by India. The Mukti Bahini played a crucial role in gathering intelligence, launching sabotage operations, and creating instability for Pakistani forces in East Pakistan.

Prelims Articles

Context

India and China have taken steps to improve their strained bilateral relations, which were affected by the 2020 military standoff in eastern Ladakh. The two countries reached an agreement on a set of six consensus measures aimed at restoring cooperation and easing tensions.

Key Agreements and Steps Taken:

- Resumption of Kailash Mansarovar Yatra: The Kailash Mansarovar Yatra, a pilgrimage that Indian citizens make to a sacred site in Tibet, had been disrupted due to the tensions along the India-China border. The two countries agreed to resume the Yatra, which is an important cultural and religious link between India and China.

- Enhancement of Trans-Border River Cooperation: India and China also agreed to improve cooperation related to the sharing of data and information on trans-border rivers. This includes sharing crucial water data to manage the flow of rivers that cross both countries, which is vital for water security in both regions.

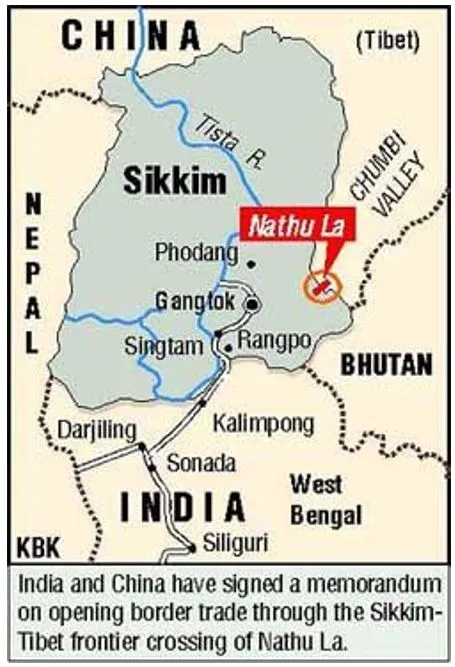

- Reopening Nathula Border Trade: Nathula, a mountain pass in the eastern Himalayas, had been closed for border trade after the standoff. The two countries have now agreed to reopen this trade route, which will help restore economic exchanges and improve connectivity between the two nations.

Fact Box:

Kailash Mansarovar Yatra

Nathula Pass (Indo - China Border)

Major trans-border rivers between India and China are:

|

Prelims Articles

Context

OPEC+ are now worried about the United States, which has become the world's largest oil producer.

The Situation:

- US Oil Production Growth: The United States has dramatically increased its oil production in recent years, mainly through shale oil Since 2022, US production has grown by 11%, and it now produces about 21.6 million barrels per day (bpd), up from about 10 million bpd just 11 years ago.

- Opec+ Output: Opec+ currently holds back 85 million bpd from production to manage prices. Opec+ now controls only about 48% of the world's oil supply, which is its lowest share since 2016, when it was over 55%.

- Why Opec+ is Concerned?

- US Influence on Oil Prices: With rising US oil production, Opec+ has lost some of its influence over global oil prices. If the US continues to increase its output, it could lead to lower oil prices, which would hurt Opec+ countries that rely heavily on oil revenue.

- Trump’s Potential Impact: If Donald Trump returns to the White House, Opec+ fears that his pro-business and deregulatory policies could encourage even more oil production in the US. Trump's administration would likely ease environmental regulations, allowing more oil drilling, which would increase supply and potentially reduce global oil prices.

- Trump's Election Campaign: During his campaign, Trump focused on lowering energy prices and inflation, which he believes could be achieved by increasing oil production in the US.

OPEC+

|

Prelims Articles

Context

The Centre has re-imposed the Protected Area Permit (PAP) in the Manipur, Mizoram and Nagaland, due to growing security concerns linked to the influx of people from neighboring countries. This measure requires foreign nationals visiting these states to obtain Protected Area Permits (PAP) under the Foreigners (Protected Areas) Order, 1958.

What is Protected Area Permit (PAP)?

- A Protected Area Permit (PAP) is issued under the Foreigners (Protected Areas) Order, 1958.

- It is a regulatory mechanism for controlling the entry of non-Indian citizens into designated areas in India, primarily in the Northeastern regions, which include states like Manipur, Nagaland, Mizoram, and others.

- These areas are considered sensitive due to geopolitical concerns, security issues, and the need for controlled tourism and migration.

- The Ministry of Home Affairs is the central authority responsible for issuing the PAP.

- In addition, the state authorities of the concerned regions, such as the state governments of Northeastern states, can also issue PAPs.

- Duration: The PAP is generally issued for a 10-day However, it can be extended for an additional 7 days, depending on the specific situation or requirement.

Prelims Articles

Context

The National Testing Agency (NTA) is set to undergo significant changes starting in the coming year, focusing exclusively on conducting higher education entrance exams. This decision follows recommendations from a high-level committee chaired by former ISRO chief K Radhakrishnan, which was tasked with addressing issues like exam leaks, technical glitches, and a lack of transparency in the examination process.

Key Recommendations and Changes:

The restructuring will allow NTA to focus on enhancing the quality and reliability of exams such as NEET-UG 2025, CUET-UG 2025, and UGC NET 2025, while relinquishing its role in recruitment exams.

- Focus on Higher Education Entrance Exams: The NTA will no longer conduct recruitment exams, streamlining its operations to improve the conduct of exams for admission into higher education institutions.

- Multi-Level Exam Format: A multi-stage examination system has been proposed, particularly for NEET UG, to ensure comprehensive and fair testing.

- The committee suggested introducing a Digi-exam system, incorporating multi-session testing, and expanding testing centers to enhance accessibility and efficiency.

- Expansion of Testing Centres: The panel proposed leveraging institutions like Kendriya Vidyalayas, Navodaya Vidyalayas, and reputable universities to create a network of about 400-500 testing centers within a year. This network would significantly increase the testing capacity, enabling the conduct of Computer-Based Tests (CBT) with a capacity of 2-2.5 lakh candidates in one session nationwide.

- Permanent Staffing Recommendations: Rather than making the staff permanent, the committee recommended longer tenure for executives and domain experts, with attractive service conditions. This change aims to improve the continuity and efficiency of the agency's operations.

- Restructuring NTA’s Governing Body: The committee emphasized the need for an empowered and accountable governing body for the NTA. The body would consist of three sub-committees focused on test audits, ethics and transparency, and stakeholder relationships, ensuring that the exam processes are robust and trustworthy.

- Oversight of Coaching Centres: A system for the oversight of coaching centers has been proposed to mitigate any unfair advantages and maintain the integrity of the exam process.

- Security and Transparency Enhancements: The committee also suggested strengthening security protocols related to the paper-setting process and other critical aspects of the exams to prevent irregularities and leaks.

Fact Box: National Testing Agency

|

Prelims Articles

Context

Nearly 15 years after its launch, the Crime and Criminal Tracking Network and Systems (CCTNS) has successfully linked all 17,130 police stations across India. This centralized online platform facilitates the filing of First Information Reports (FIRs), chargesheets, and investigation reports, and provides a nationwide database accessible to law enforcement authorities.

What is Crime and Criminal Tracking Network and Systems (CCTNS) project?

- Crime and Criminal Tracking Network and Systems (CCTNS) project, started in the year 2009.

- It aimed to inter-link all police stations under a common application software for the purpose of investigation, data analytics, research, policy making and providing Citizen Services such as reporting & tracking of complaints, request for antecedent verifications by Police etc.

- The project is being implemented with close collaboration between States and Union Government.

- CCTNS allows law enforcement to generate analytical reports on criminal cases, property crimes, and crime statistics at the police station level.

- Support for New Criminal Laws: The system has been upgraded to accommodate the implementation of three new criminal laws introduced on July 1:

- Bharatiya Nyaya Sanhita (replacing the Indian Penal Code of 1860)

- Bharatiya Sakshya Adhiniyam (replacing the Indian Evidence Act of 1872)

- Bharatiya Nagarik Suraksha Sanhita (replacing the Code of Criminal Procedure of 1898)

- These laws have prompted 23 functional modifications in the CCTNS application, including:

- Senior officer approval for arrests in specific cases,

- Mandatory informant notifications about arrests and summons,

- Daily diary reports to the magistrate,

- Forensic investigations and videography at crime scenes,

- Timely updates on investigation progress to victims.

- Expansion to Integrated Criminal Justice System (ICJS): Over the years, the scope of CCTNS has expanded to connect with other components of the criminal justice system, such as courts, prisons, prosecution, forensics, and fingerprints.

- This integration has led to the development of the Integrated Criminal Justice System (ICJS), which streamlines the flow of data across these sectors.

- Implementing Agency: The National Crime Records Bureau (NCRB)is the central nodal agency that implements the Crime and Criminal Tracking Network and Systems (CCTNS).

Prelims Articles

Context

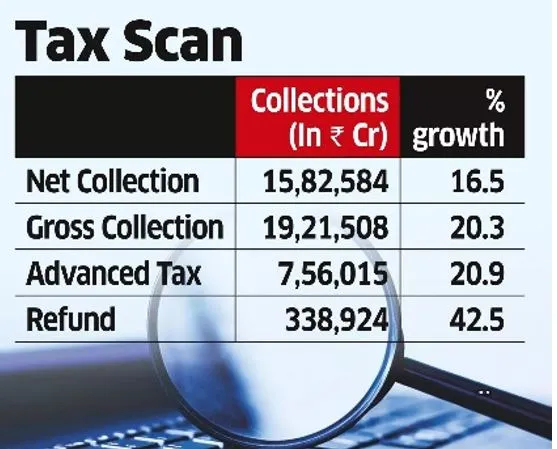

The net direct tax collections for the current fiscal year have shown robust growth, rising by 16.45% year-on-year to exceed Rs 15.82 lakh crore, according to the latest government data.

Key Insights:

- Corporate Tax (CT) Performance: Gross collections from corporate tax reached Rs 9.24 lakh crore, up from Rs 7.90 lakh crore in the same period last year.

- After refunds, the net corporate tax collections stood at Rs 7.42 lakh crore, compared to Rs 6.83 lakh crore in the previous fiscal year.

- Non-Corporate Tax (NCT) Growth:

- Non-corporate tax, which mainly includes personal income tax, showed strong growth.

- Gross collections for this segment climbed to Rs 9.53 lakh crore, compared to Rs 7.81 lakh crore last year.

- Net collections grew significantly to Rs 7.97 lakh crore, up from Rs 6.50 lakh crore in the same period of the previous fiscal year.

- Direct Taxes Overview:

- Direct taxes in India encompass a wide range of taxes including corporate tax, personal income tax, securities transaction tax, equalization levy, and others.

- These taxes are an essential source of revenue for the government and include wealth tax, fringe benefits tax, banking cash transaction tax, hotel receipt tax, interest tax, and gift tax, among others.

Prelims Articles

Context

Today marks a significant milestone in wildlife conservation with the first-ever tagging of a Ganges River Dolphin (Platanista gangetica) in Assam. This initiative, which is part of the Project Dolphin, was conducted by the Wildlife Institute of India (WII).

Key Points:

- This is the first tagging of a Ganges River Dolphin, not just in India, but for the species globally.

- The tagging of a healthy male river dolphin took place in Assam under strict veterinary care.

- Purpose of Tagging: The primary goal of this tagging exercise is to gather data on the dolphin’s seasonal movements, migratory patterns, and habitat utilization, especially in fragmented or disturbed river systems.

- Significance of the Project:

- The tagging will help fill the knowledge gaps about the species, which is essential for its long-term conservation.

- As apex predators in their ecosystem, Ganges River Dolphins play a crucial role in maintaining the balance of the river systems they inhabit. Ensuring their survival supports the entire ecosystem, which includes the communities that depend on these waters.

Ganges river dolphins (Platanista gangetica)

|

Prelims Articles

Context

ISRO (Indian Space Research Organisation) has begun assembling the Human-rated Launch Vehicle Mark 3 (HLVM3) rocket, which is designed to carry Indian astronauts to space as part of India’s Gaganyaan human spaceflight programme.

About Human-rated Launch Vehicle Mark 3 (HLVM3) Rocket

- The assembly of HLVM3 is taking place at Sriharikota, India’s spaceport. This rocket will first fly a humanoid robot, Vyommitra, instead of astronauts on three test missions.

- These uncrewed missions will collect data vital for the success of future crewed missions.

- Rocket Specifications:

- The HLVM3 is a three-stage rocket capable of carrying 10 tonnes to Low Earth Orbit (LEO).

- It stands 53 meters tall and weighs 640 tonnes.

- The rocket uses S200 solid motors in the first stage, L110 liquid stage, and C32 cryogenic stage for the second and final stages.

- Crew Escape System: The Crew Escape System (CES), which is critical for astronaut safety during an emergency, has been integrated into the rocket. It is designed to eject the Crew Module (the capsule for astronauts) safely if an anomaly is detected during flight.

- Project Milestones:

- The LVM3-X/CARE mission in 2014 validated crucial technologies like the aerothermal performance of the Crew Module, its thermal protection systems, parachute deceleration mechanisms, and recovery logistics.

- These successful tests laid the foundation for human spaceflight and the development of a human-rated rocket.

Prelims Articles

Context

The INS Nirdeshak, the second ship of the Survey Vessel (Large) project, was officially commissioned into the Indian Navy at a ceremony held at Naval Dockyard, Visakhapatnam.

Key Details:

- INS Nirdeshak is the second of four ships being built under the Survey Vessel (Large) project, which is a part of the Indian Navy's ongoing efforts to modernize its fleet.

- The ship was constructed at Garden Reach Shipbuilders & Engineers (GRSE) in Kolkata.

- Role and Function:

- INS Nirdeshak is designed for hydrographic surveys, which involve the study and mapping of oceanic and seafloor data.

- The ship will also assist in navigation and support maritime operations, which are critical for the safety and security of maritime activities in the region.

- Significance of Survey Vessels:

- These highly specialized ships are vital for producing accurate oceanic charts, which are essential for navigation and maritime safety.

- Survey ships also enhance maritime operations by providing detailed, reliable data for planning and executing naval and commercial operations.

- The vessels act as a powerful tool for maritime diplomacy, strengthening India’s bilateral ties with friendly countries by conducting hydrographic surveys in international waters and assisting other nations in charting their own waters.

- Technological Features: Built with over 80% indigenous content, the INS Nirdeshak is equipped with advanced hydrographic systems such as:

- Multi Beam Echo Sounders

- Side Scan Sonars

- Autonomous Underwater Vehicles (AUVs)

- Remotely Operated Vehicles (ROVs)

- These systems enable precise mapping of deep-sea areas, facilitating operations like wreck identification and environmental studies, especially in hazardous or restricted zones.

- Strategic Importance: The ship will enhance India’s capabilities in the Indian Ocean Region (IOR), contributing to regional security, scientific exploration, and environmental health.

- It will support India’s SAGAR (Security and Growth for All in the Region) initiative, which aims to foster shared maritime data with friendly countries and contribute to the region’s peacekeeping efforts.

Editorials

Context

In October 2024, the Supreme Court of India upheld the constitutional validity of Section 6A of the Citizenship Act, 1955, by a 4:1 majority. This provision provides a special framework for migrants from East Pakistan (now Bangladesh) who settled in Assam before March 25, 1971, to acquire Indian citizenship. The judgment, however, raises concerns regarding constitutional violations and the potential negative implications of the ruling.

Constitutional Issues with Section 6A

- Violation of Article 29 – Cultural Rights: Section 6A’s provision for granting citizenship to migrants has been critiqued for violating Article 29 of the Constitution, which guarantees the protection of distinct cultural and linguistic identities. The Court's reasoning that the influx of migrants does not affect Assamese culture overlooks the reality of demographic and linguistic changes, which have led to the erosion of Assamese cultural identity.

- Temporal Unreasonableness: Section 6A suffers from temporal unreasonableness, a concept under the doctrine of manifest arbitrariness. The law allows the indefinite processing of citizenship applications without any time limit, despite the fact that the original migration issue was meant to be addressed by the 1985 Assam Accord. This perpetuates an outdated policy that no longer reflects current circumstances.

- Flawed Mechanism of Identifying Migrants: The mechanism for identifying migrants under Section 6A is flawed because it places the burden of initiating proceedings on the state without providing a process for self-identification by migrants. This has led to confusion and a backlog of cases, with foreigners' tribunals overwhelmed by the volume, further delaying the determination of citizenship status.

Impact on Assam’s Demographic and Cultural Identity

- Demographic Shifts in Assam: The judgment fails to consider the demographic shifts caused by the influx of migrants, which has led to a significant increase in the Bengali-speaking population in Assam. From 1951 to 2011, the proportion of Assamese-speaking people in Assam declined by 30.18%, while the percentage of Bengali-speaking people rose by 36.36%, highlighting the cultural displacement of the indigenous Assamese population.

- Contradictory Reasoning in the Judgment: The judgment displays contradictory reasoning by acknowledging the impact of migrant influx on the political and cultural rights of the Assamese people but simultaneously ruling that this influx does not infringe upon their ability to conserve their language and culture. This inconsistency weakens the judgment’s constitutional foundation.

- Failure to Address Cultural Erosion: The Court emphasized the abstract right of citizens to conserve culture but ignored the practical reality that the presence of large numbers of migrants undermines the cultural identity of the indigenous population. The erosion of Assamese culture, language, and social structures is a direct consequence of unchecked migration, which the Court failed to acknowledge.

Broader Implications of the Judgment

- Legal and Constitutional Gaps in Section 6A: Section 6A’s indefinite nature, combined with its flawed implementation mechanism, leads to legal and constitutional gaps. The law continues to be operational despite the absence of a clear cut-off date, resulting in unresolved migration issues that further strain the state’s resources and undermine the intent of the Assam Accord.

- Increased Political Tensions: The judgment could exacerbate political tensions in Assam, as local groups and political parties have already raised concerns over the dilution of Assamese identity due to unchecked migration. The Court’s decision might intensify these tensions by allowing the continued settlement of migrants without adequate safeguards.

- Need for Legal Reforms and Clarifications: The ruling underscores the need for reforms in both the legal framework surrounding migration and the mechanisms for granting citizenship. Legal clarity, a time-bound framework, and effective monitoring of migration flows are crucial to resolving the issues raised by Section 6A and its implications for Assam’s cultural and demographic future.

Practice Question:

Q. Critically examine the constitutional and socio-political implications of the Supreme Court's ruling on Section 6A of the Citizenship Act, 1955, which allows migrants from Bangladesh to acquire Indian citizenship in Assam. Discuss its impact on Assamese cultural and linguistic identity.

Editorials

Context

A recent writing ("Piketty’s rights, wrongs") discusses issues related to inequality, demand, and taxation in India, particularly questioning the effectiveness of wealth taxation. While agreeing with the concern over low tax revenue and its impact on social sectors, the editorial argues that wealth taxation could be disruptive and ineffective. However, it is suggested that broadening the tax base through reforms has the potential to generate more revenue.

Taxation and Economic Challenges

- Low Tax-to-GDP Ratio: India's tax-to-GDP ratio is low at 17%, with direct taxes contributing only 7%, far below global standards. This leads to inadequate public spending on essential sectors like education and healthcare, resulting in low productivity, weak demand, and sluggish growth.

- Impact of Black Income on Taxation: The top 1% of earners in India account for 22% of national income, and the top 5% likely earn 40%. If black income generation by the wealthiest could be reduced, more tax revenue could be collected, contributing significantly to GDP. This would help in broadening the tax base and tackling inequality.

- Limited Taxpayer Base: Despite recent reforms, only 6.5% of India's population are taxpayers, and a large portion of these pay negligible tax. This narrow tax base contributes to a skewed income distribution, highlighting the need for better tax collection mechanisms, especially in the service sector.

The Case for Wealth Tax

- Wealth Tax as a Viable Solution: Wealth tax is seen as a viable option for raising revenue because wealth is tangible and often recorded in financial assets and real estate. With digital records and proper political will, taxing wealth can be more efficiently implemented compared to past failures due to loopholes.

- Impact of Wealth Tax on Stock Market Valuations: A wealth tax could reduce inflated asset prices, such as in the stock market, leading to a more realistic return on investments. For example, wealth tax on large corporations like Reliance Industries could lead to lower share prices, prompting capital to shift towards more productive investments, thus boosting growth.

- Challenges and Potential Consequences: While wealth tax is feasible, there are potential challenges such as capital flight, currency depreciation, and balance of payments issues. These concerns would require temporary capital controls. However, the long-term benefits of wealth tax include higher tax collections, which could fund greater investments in public goods and social sectors.

Political Will and the Future of Wealth Tax

- Political Will as a Key Factor: The successful implementation of wealth tax hinges on political will. Despite its feasibility, there are political and economic roadblocks that have historically hindered its introduction. Overcoming these barriers would be critical to ensure wealth tax can be a tool for improving social sector investment and reducing inequality.

- Wealth Tax and Inequality: If structured effectively, wealth tax could contribute to reducing economic inequality, as it would generate more funds for public investment in education, healthcare, and infrastructure. This, in turn, would foster a more productive workforce, leading to sustained economic growth and development.

- Impact on the Black Economy: A well-implemented wealth tax would also reduce the black economy by addressing illegal wealth generation, which would further increase direct tax collections. This could create a virtuous cycle where the tax system becomes more effective, and inequality is addressed over time.

Practice Question

Q. Evaluate the feasibility and potential economic implications of implementing a wealth tax in India. Discuss how it could address issues of inequality, economic growth, and the informal economy.

Editorials

Context

Carbon markets are emerging as a potential solution to both mitigate climate change and promote sustainable agricultural practices in India. The Indian government has launched initiatives for carbon credit projects, with some projects listed under international platforms like Verra, aiming to generate revenue for farmers adopting sustainable practices. However, several challenges have hindered the success of these projects, including issues with inclusivity, training, and timely payment.

Carbon Market Mechanism

- Compliance vs Voluntary Markets: Carbon markets operate through compliance and voluntary mechanisms. Compliance markets, regulated by governments or international bodies, require companies to either purchase carbon credits or pay taxes for exceeding emissions caps. In contrast, voluntary markets, operating without regulation, allow entities to trade carbon credits through platforms like Verra and Gold Standard.

- Key Principles - Additionality and Permanence: For carbon credits to be valid, projects must meet two key conditions: additionality and permanence. Additionality ensures emission reductions are achieved due to the adoption of new farming practices, while permanence guarantees the durability of these benefits over time, preventing the reversal of carbon sequestration practices.

- India's Carbon Market Status: India has recently announced the launch of its own carbon markets. The National Bank for Agriculture and Rural Development (NABARD), in collaboration with the Indian Council of Agricultural Research, has listed agriculture carbon projects under the Verra platform, aiming to generate millions of carbon credits from sustainable farming practices.

Challenges in Indian Carbon Farming Projects

- Inclusivity Issues: Carbon farming projects in India have been critiqued for their lack of inclusivity. Marginalized communities and small farmers are often excluded, with women comprising only 4% of participants. Larger landowners tend to dominate the projects, with farmers from non-marginalized communities holding a disproportionate share of land.

- Training and Incentives Deficiencies: Over 60% of farmers involved in carbon farming projects lack proper training in new techniques. Furthermore, 28% of farmers abandon sustainable practices due to insufficient financial incentives, highlighting the gap in providing adequate support for long-term participation.

- Payment Delays and Communication Issues: A significant issue is that 99% of farmers have not received payments for carbon credits, with over 45% of farmers reporting poor communication regarding the projects. This has created distrust and discouraged wider participation in carbon credit programs.

Improving the Effectiveness of Carbon Markets

- Incentivizing Smallholders and Marginalized Communities: To enhance the effectiveness of India's carbon market, there is a need to incentivize projects that include smallholders and marginalized communities by offering higher prices for carbon credits from these projects, ensuring social inclusivity and equity.

- Use of Digital Technologies for Monitoring: Recent advancements in digital technologies, such as remote sensing, satellite imagery, and drones, can help improve monitoring and verification of carbon credits, ensuring more reliable and transparent assessments of carbon sequestration practices.

- Collaboration for Improved Implementation: The success of carbon markets in India requires collaboration among policymakers, researchers, and private entities to ensure the development of inclusive, transparent, and scientifically robust systems. This collaboration will help overcome implementation challenges and ensure timely rewards for farmers.

Practice Question:

Q. India's carbon farming initiatives have significant potential to transform agriculture and mitigate climate change. However, challenges such as inclusivity, inadequate training, and delayed payments need to be addressed. Discuss the key issues in the implementation of carbon farming projects in India and suggest measures to improve their effectiveness.