9th February 2024 (11 Topics)

Context

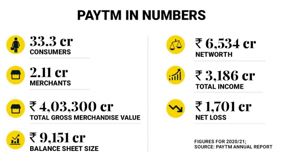

In a shocking move, the Reserve Bank of India (RBI) has barred Paytm’s subsidiary Paytm Payments Bank from taking further deposits in it’s prepaid wallets and accounts.

Overview

- Paytm (Pay through Mobile) started as a wallet business to cater for one tap easy financial services for mobile and dth recharges.

- It was founded in 2010 by vijay shekhar sharma with initial investment of $2 million in Noida.

What is Payment Bank?

- Origin: Based on the recommendations of the Nachiket Mor Committee (2013), Payments Bank was set up to operate on a smaller scale with minimal credit risk.

- Legislation: They are registered under the Companies Act 2013 but are governed by a host of legislations such as Banking Regulation Act, 1949; RBI Act, 1934; Foreign Exchange Management Act, 1999, Payment and Settlement Systems Act, 2007 and the like.

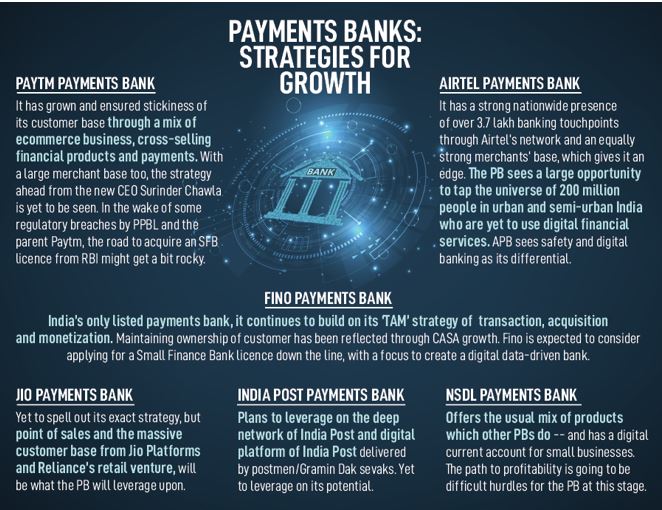

- India currently has 6 Payment Banks namely, Airtel Payment Bank, India Post Payment Bank, Fino, Paytm Payment Bank, NSDL Payment Bank and Jio Payment Bank.

- Important Features:

- Payment banks can take deposits up to Rs. 2,00,000. It can accept demand deposits in the form of savingsand current accounts.

- The money received as deposits can be invested in secure government securities only in the form of Statutory Liquidity Ratio (SLR).

- This must amount to 75% of the demand deposit balance. The remaining 25% is to be placed as time deposits with other scheduled commercial banks.

- Payments banks will be permitted to make personal payments and receive crossborder remittances on the current accounts.

- It can issuedebit

- Minimum capital requirement: Rs 100 crore

RBI move:

In January 2024, the RBI issued an order against PPBL under Section 35A of the Banking Regulation Act, 1949:

- Deposits and Transactions: No further deposits, credit transactions, or top-ups allowed after February 29, 2024, except for interest, cashbacks, or refunds.

- Banking Services: No fund transfers, Bharath Bill Pay, or UPI facility after February 29, 2024.

- Nodal Accounts: Termination of One97 Communications Ltd and Paytm Payments Services Ltd nodal accounts by February 29, 2024.

- Pipeline Transactions: Settlement of initiated pipeline transactions by March 15, 2024.

Why did Paytm Payments Bank come under RBI lens?

- Non-KYC accounts: Hundreds of accounts created on Paytm Payments Bank without proper identification were one of the major reasons for the Reserve Bank of India to impose stringent curbs on the company.

- Potential money laundering: These accounts with inadequate Know-Your-Customer (KYC) conducted transactions worth crores of rupees on the platform, leading to fears of potential money laundering.

- Same PAN: More than 1,000 users were found to have linked the same Permanent Account Number (PAN) to their accounts.

- China connection: In 2015, Paytm secured a significant stake from the Chinese e-commerce giant Alibaba Group. Mediatek, the Taiwanese chip major had also invested in Paytm in 2016.

Potential impact of the Move

- Impact on users: It might lead to widespread disruption and chaos in retail payment space.

- Competition: It might have positive effect on other players such as Phonepe and Gpay.

More Articles