03rd January 2025 (12 Topics)

Context

India's economic landscape is facing new challenges, particularly in the form of rising household debt and growing retail loan defaults. The latest Financial Stability Report (FSR) from the Reserve Bank of India (RBI), released in December 2024, sheds light on these developments, signaling both risks and opportunities for the economy.

Key Findings from the RBI Report

- Rising Household Debt: Household debt in India has risen to 43% of GDP in 2024, up from 35% in 2020. This growth is primarily driven by consumption loans (like personal loans), while loans for asset creation are shrinking.

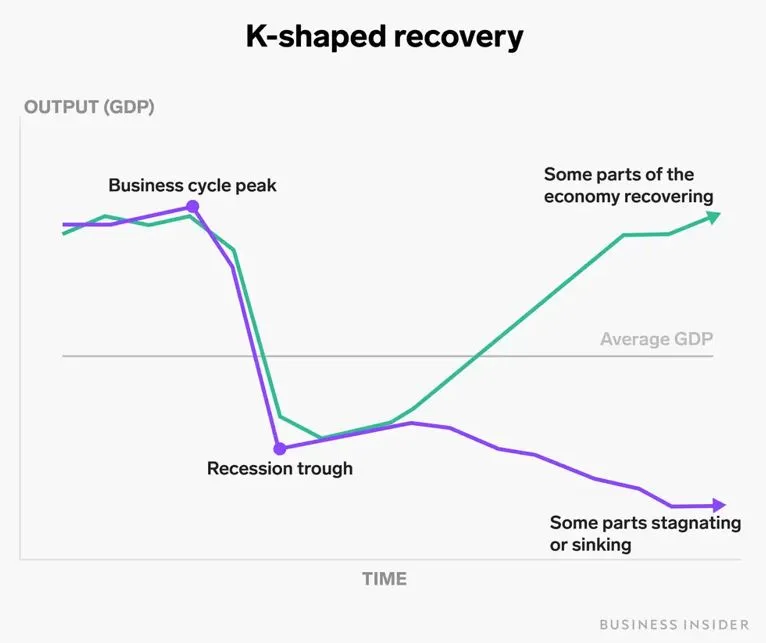

- Economists describe this as a K-shaped recovery, where wealthier individuals borrow for assets, while lower-income segments face increasing debt for daily expenses.

- Retail Loan Stress: There is growing stress in retail loans, especially unsecured loans, which are seeing higher defaults and write-offs. Microfinance loans have also seen rising delinquency rates.

- While overall bank NPAs (non-performing assets) are low at 6%, the RBI’s stress tests suggest this could rise to 3% by 2025-26.

- Economic Growth and Slowdown: The economy is experiencing a cyclical slowdown, with GDP growth forecasted at 6% in 2024-25 and 9% in 2025-26. This is tied to weak income levels and uneven consumption, reflecting broader household financial stress.

- Global and Domestic Risks: Global uncertainties (e.g., geopolitical tensions, trade disruptions) pose risks to India’s economy. However, the RBI remains confident about the strength of India’s financial system, with healthy banking sector fundamentals.

- Equity Market and Inflation: While the Indian stock market performed well in 2024, concerns about high valuations and slowing corporate earnings signal potential risks of a market correction.

- Food inflation and a weak rupee against the US dollar are additional risks that could affect consumer prices and overall economic stability.

Reserve Bank of India’s (RBI) Financial Stability Report (FSR)

What is K-shaped recovery?

|