03rd January 2025 (12 Topics)

Mains Issues

Context

The Central Industrial Security Force (CISF) has successfully reduced suicides among its personnel by 40% in 2024. According to the National Crime Records Bureau (NCRB), the suicide rate for CISF personnel dropped to 9.87 per lakh in 2024, compared to the national rate of 12.4 per lakh in 2022. This marks the first time in five years that the CISF’s suicide rate has fallen below the national average.

Reasons for Suicides in CAPFs

Suicides in the Central Armed Police Forces (CAPFs), including the CISF, are driven by multiple factors:

- Stress from work-related pressures.

- Prolonged separation from family due to postings in remote areas.

- Personal issues such as family disputes, financial problems, and health issues.

- Increasing issues like online gambling and frauds that push personnel towards extreme actions.

- Contributing Factors to Stress and Suicides: A study conducted by CISF identified the following common causes of stress leading to suicides:

- Nuclear Families: Lack of emotional support due to smaller family structures.

- Marital Problems: Marital disagreements and infidelity.

- Technology and Communication: The faster spread of negative information through smartphones.

- High Expectations: Pressure from family to meet financial and emotional needs.

- Health Issues: Personnel facing serious illnesses, including cancer, skin diseases, and HIV.

- Isolation: Loneliness and the inability to share feelings or vent out distress.

Proactive Measures Taken by CISF

The CISF has implemented several measures to address the mental health of its personnel:

- Commanding Officers’ Engagement: Officers regularly visit posts to communicate with personnel and hold daily “briefing–debriefing” sessions to identify and address signs of distress early.

- Online Grievance Portal: A new portal was introduced for personnel to express grievances, allowing senior officers (up to the Director General level) to resolve them quickly. This initiative ensures that issues are addressed promptly, contributing to the overall well-being of personnel.

- 24x7 Mental Health Support: CISF established round-the-clock tele-counselling services, alongside one-to-one personal counselling. By September 2024, over 4,200 personnel had accessed this mental health support.

- AIIMS Collaboration for Mental Health Study: CISF partnered with AIIMS, New Delhi, to conduct a comprehensive mental health study. The findings led to actionable recommendations being implemented at the unit level to improve personnel welfare.

- Improved HR Policies for Work-Life Balance: CISF recognized that issues like posting matters (which affect personal life) were major grievances. A new HR policy was introduced in December 2024 to offer choice-based postings. This policy aims to provide a better work-life balance, especially for married couples, women personnel, and those nearing retirement.

Fact Box:Suicide Rate in India

Initiatives for Suicide Prevention in India

Legal Aspects Related to Suicide in India

|

PYQQ. Explain why suicide among young women is increasing in Indian society. (UPSC 2023) |

Mains Issues

Context

India's economic landscape is facing new challenges, particularly in the form of rising household debt and growing retail loan defaults. The latest Financial Stability Report (FSR) from the Reserve Bank of India (RBI), released in December 2024, sheds light on these developments, signaling both risks and opportunities for the economy.

Key Findings from the RBI Report

- Rising Household Debt: Household debt in India has risen to 43% of GDP in 2024, up from 35% in 2020. This growth is primarily driven by consumption loans (like personal loans), while loans for asset creation are shrinking.

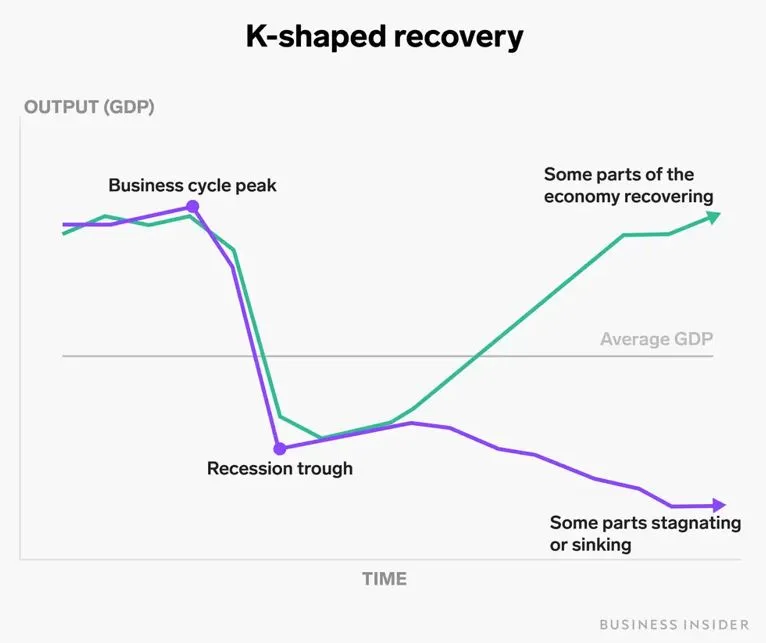

- Economists describe this as a K-shaped recovery, where wealthier individuals borrow for assets, while lower-income segments face increasing debt for daily expenses.

- Retail Loan Stress: There is growing stress in retail loans, especially unsecured loans, which are seeing higher defaults and write-offs. Microfinance loans have also seen rising delinquency rates.

- While overall bank NPAs (non-performing assets) are low at 6%, the RBI’s stress tests suggest this could rise to 3% by 2025-26.

- Economic Growth and Slowdown: The economy is experiencing a cyclical slowdown, with GDP growth forecasted at 6% in 2024-25 and 9% in 2025-26. This is tied to weak income levels and uneven consumption, reflecting broader household financial stress.

- Global and Domestic Risks: Global uncertainties (e.g., geopolitical tensions, trade disruptions) pose risks to India’s economy. However, the RBI remains confident about the strength of India’s financial system, with healthy banking sector fundamentals.

- Equity Market and Inflation: While the Indian stock market performed well in 2024, concerns about high valuations and slowing corporate earnings signal potential risks of a market correction.

- Food inflation and a weak rupee against the US dollar are additional risks that could affect consumer prices and overall economic stability.

Reserve Bank of India’s (RBI) Financial Stability Report (FSR)

What is K-shaped recovery?

|

Mains Issues

Context

The Union Ministry of Environment, Forest, and Climate Change introduced amendments to the rules governing the selection of experts for the Genetic Engineering Appraisal Committee (GEAC), which is responsible for regulating genetically modified (GM) seeds in India. This move follows a Supreme Court directive aimed at addressing conflicts of interest in the decision-making process regarding GM crops.

Key Changes in the New Rules:

- Conflict of Interest Disclosure: The new rules require that expert members disclose any potential conflicts of interest that may arise due to their professional affiliations, associations, or interests. This includes both direct and indirect associations with matters discussed during GEAC meetings.

- Experts must take necessary actions to ensure that these interests do not affect the committee's decisions.

- Recusal Requirement: If an expert has any direct or indirect connection to a matter being discussed, they are obliged to disclose it before the meeting. Unless the committee specifically requests their participation, the expert is expected to recuse themselves from the meeting.

- Professional Affiliations Disclosure: All selected members are required to complete a form detailing their professional affiliations, covering a period of 10 years prior to joining the committee. This measure is aimed at ensuring transparency and accountability in the selection process.

- Supreme Court Directive: The amendments align with a July 2023 Supreme Court order, which required the Centre to formulate a national policy on GM crops. In the same verdict, the Court issued a split judgment on the validity of the 2022 decision by the Centre to grant conditional approval for the environmental release of GM mustard As a result, the final decision on the GM mustard crop was left for a future bench to resolve.

Significance of the Changes:

- Enhanced Transparency: The amendments aim to increase transparency and trust in the decision-making process of the GEAC by ensuring that experts with potential conflicts of interest are not involved in relevant discussions and decisions.

- Regulatory Integrity: By requiring experts to disclose their professional affiliations and associations, the new rules seek to prevent any undue influence from corporate interests, ensuring that decisions on GM crops are made in the public interest.

- Compliance with Supreme Court Ruling: These changes align with the Supreme Court's directions to address concerns of conflict of interest and to ensure a fair and impartial review process for GM crop approvals.

Fact Box:What are GM Crops?

|

Prelims Articles

The Employees Provident Fund Organisation (EPFO) is set to launch its new software system, EPFO 3.0, by June 2025.

About

- The new system aims to provide bank-like services and a more user-friendly website.

- The system will also introduce ATM cards for EPFO subscribers, improving accessibility and ease of use.

- It is designed to enhance the experience of Employees' Provident Fund (EPF) members.

- It focuses on improving accessibility, streamlining processes and offering new features to offer employees better control over their retirement savings.

Fact Box:Employees' Provident Fund Organisation (EPFO)

|

Prelims Articles

Context

The Union Education Ministry’s data reveals that many schools in India still lack important infrastructure and facilities, affecting education quality.

Key-findings:

- Access to Technology: Only 57.2% of schools have functional computers. 53.9% have access to the internet, indicating that many schools still lack digital tools for modern education.

- Basic Amenities vs Specialized Facilities: Over 90% of schools have basic amenities like electricity and gender-specific toilets.

- However, facilities like functional desktops, internet, and accessibility features (such as ramps for disabled students) are limited:

- Only 52.35% of schools have ramps for accessibility, highlighting gaps in infrastructure for differently-abled students.

- Student Enrollment: The total student enrollment decreased by 37 lakh, from 25.17 crore in 2022-23 to 24.8 crore in 2023-24.

- The Gross Enrolment Ratio (GER), which shows the percentage of students enrolled at each education level, highlights disparities:

- Preparatory level (early education): 5% GER, showing good enrollment.

- Foundational level (primary education):5% GER, showing a large drop in enrollment.

- Middle and secondary education: 89.5% and 66.5% GER, respectively, indicating fewer students enrolled at these stages.

- Dropout Rates: The dropout rates have risen sharply:

- 2% dropout rate in middle school.

- 9% dropout rate in secondary school.

- This indicates that a significant number of students are leaving school before completing their education.

- The Gross Enrolment Ratio (GER), which shows the percentage of students enrolled at each education level, highlights disparities:

- Challenges Despite NEP, 2020: The National Education Policy (NEP) 2020 aims to improve access, equity, and quality of education, but infrastructure gaps like the lack of digital tools and accessibility features remain major challenges.

- The education ministry officials highlight that optimizing resources and addressing these infrastructure gaps is crucial to meet the education targets for 2030.

Fact Box:Government Educational Initiatives

|

Prelims Articles

Context

The Securities & Exchange Board of India (SEBI) has unearthed a front-running scam in the Indian securities market and in an interim order, debarred 22 entities.

What is Front-Running?

- Front-running is an illegal practice in financial markets where an individual or entity trades a security based on advanced knowledge of a forthcoming large trade that is likely to affect the price of the security.

- The person who engages in front-running uses this privileged information, typically obtained through their position in a financial institution, to make a profit before the original trade is executed.

- The concept of front-running is primarily seen in situations involving large institutional trades, such as mutual funds, pension funds, or hedge funds, where the size of the trade can significantly influence the market price of a stock, especially if the stock is less liquid.

- Front-running is illegal because it is based on insider information—information that is not available to the general public. This unfair advantage allows the person who knows about the trade to exploit it for personal gain before the market reacts to the institutional trade.

- The Securities and Exchange Board of India (Sebi) uses various algorithms, data analytics, and supervision technology to track instances of front-running and insider trading.

Prelims Articles

Context

The Government of India announced the formation of an expert panel tasked with revising the country's Wholesale Price Index (WPI), in light of the structural changes in the economy that have occurred between the current base year of 2011-12 and the proposed new base year of 2022-23. Additionally, the panel will focus on developing the Producers' Price Index (PPI), a key price gauge that has been approved by the Technical Advisory Panel on Statistics of Prices and Cost of Living.

Key Objectives of the Expert Panel

- The panel will be led by Ramesh Chand, Member of NITI Aayog.

- Revising the WPI: The WPI, which reflects the price changes at the wholesale level, will be updated to better reflect the economic changes over the past decade. This revision will ensure the index remains relevant in tracking price trends in India’s evolving economy.

- Developing the PPI: A new Producers' Price Index (PPI) will be formulated to measure the average change in the prices that domestic producers receive for their goods and services. The panel will also evaluate the methodology and composition for compiling this index.

Fact Box:Wholesale Price Index (WPI)

Limitations of WPI:

|

Prelims Articles

Context

In a significant breakthrough in cancer therapy, researchers from the Indian Institute of Technology-Guwahati (IIT-G) and the Bose Institute, Kolkata have developed a revolutionary injectable hydrogel designed to deliver anti-cancer drugs directly to tumour sites, offering a safer and more effective alternative to traditional chemotherapy and surgery.

Key Features of the Hydrogel

- The hydrogel acts as a stable reservoir for anti-cancer drugs, releasing the medication in a controlled manner while minimizing damage to healthy cells.

- This localized drug delivery system addresses significant limitations of conventional cancer treatments, such as chemotherapy and surgical interventions, which often harm healthy tissues or may not be feasible for certain tumours.

- Hydrogels are water-based, three-dimensional polymer networks that can absorb and retain fluids. Their unique structure mimics living tissues, making them ideal for biomedical applications.

- The hydrogel developed by the researchers is composed of ultra-short peptides, which are biocompatible and biodegradable.

- These peptides ensure that the hydrogel remains localized at the injection site, avoiding systemic circulation.

- Mechanism of Action: What sets this hydrogel apart is its ability to respond to elevated levels of glutathione (GSH), a molecule typically abundant in tumour cells. When the hydrogel encounters these high GSH levels, it triggers a controlled release of the anti-cancer drug directly into the tumour. This mechanism significantly reduces side effects associated with chemotherapy, which can impact healthy tissues throughout the body.

- Benefits Over Traditional Treatments

- Precision Delivery: The hydrogel ensures that the drug is released directly into the tumour, avoiding healthy cells.

- Minimized Side Effects: By targeting only the tumour cells, the hydrogel reduces the systemic side effects commonly seen with chemotherapy, such as nausea, fatigue, and immune suppression.

- Enhanced Drug Uptake: Studies showed that the hydrogel improves drug uptake by cancer cells, inducing cell cycle arrest and promoting programmed cell death (apoptosis), which helps in attacking tumours from multiple fronts.

Prelims Articles

Context

January is Cervical Cancer Awareness Month. It is a perfect opportunity for WHO and partners to raise awareness about cervical cancer and HPV vaccination.

What is Cervical Cancer?

- Cervical cancer is a type of cancer that occurs in the cells of the cervix- the lower part of the uterus that connects to the vagina.

- Caused by: The primary cause is the Human Papillomavirus (HPV), a dangerous virus. The majority of cases of cervical cancer (99%) are associated with HPV infection.

- Other risk factors: Multiple sexual partners, starting the journey into sexual activity at a young age heightens vulnerability, infections like chlamydia, gonorrhea, syphilis, and HIV/AIDScan increase the risk, and smoking can also elevated risk of cervical cancer.

- Symptoms:Although most infections with HPV resolve spontaneously and cause no symptoms, persistent infection can cause cervical cancer in women.

- Prevention: Effective primary (HPV vaccination) and secondary prevention approaches(screening for, and treating precancerous lesions) will prevent most cervical cancer cases.

- Cervical Cancer Types

- Squamous cell carcinoma: This forms in the lining of your cervix. It’s found in up to 90% of cases.

- Adenocarcinoma: This forms in the cells that produce mucus.

- Mixed carcinoma: This has features of the two other types.

HPV

India-made vaccineCervavac (quadrivalent): This is India's first indigenous HPV vaccine, launched in January 2023, It has been developed and manufactured by Pune-based Serum Institute of India (SII). It targets the same four HPV types as Gardasil. |

Editorials

Context

The issue of Bangladesh’s demand for the extradition of its Prime Minister Sheikh Hasina has resurfaced, threatening to impact India-Bangladesh relations. A diplomatic note from Dhaka has called for Hasina’s extradition to face charges, including corruption and alleged human rights violations. This demand, coupled with India’s handling of Hasina’s political pronouncements, highlights the delicate balance required in managing bilateral ties, especially given the complex historical context.

Diplomatic Standoff over Extradition:

- Bangladesh’s Extradition Request: Bangladesh formally demanded the extradition of Prime Minister Sheikh Hasina from India, citing corruption charges and accusations of crimes against humanity related to a police crackdown.

- India's Non-Escalatory Response: India's External Affairs Ministry refrained from outright rejecting the request, signaling a diplomatic approach to avoid escalating tensions between the two nations.

- Extradition Treaty in Focus: India and Bangladesh’s extradition treaty of 2013, amended in 2016, outlines procedures for such requests, but the current situation requires careful diplomatic negotiation to avoid straining relations.

The Historical Context and Strategic Considerations:

- Sheikh Hasina’s Historical Bond with India: India has long maintained a special relationship with Sheikh Hasina, due to her family's pivotal role in Bangladesh’s independence and the support India provided during her exile.

- India's Historical Precedent: India’s past decisions, such as offering refuge to the Dalai Lama, indicate a pattern of protecting political figures from neighboring countries, even under pressure, reinforcing its stance on Hasina’s protection.

- Domestic Implications for Bangladesh: The extradition demand appears more politically motivated, aimed at appeasing domestic political factions in Bangladesh, rather than a genuine legal pursuit.

The Need for Diplomatic Management:

- Potential Strain on Bilateral Relations: India must balance the extradition issue with the broader diplomatic and strategic ties it shares with Bangladesh, including trade, infrastructure, and energy cooperation.

- Hasina’s Political Activities in India: While India shelters Sheikh Hasina, her political activities from Indian soil could exacerbate tensions, and India must carefully assess the impact of her statements on bilateral relations.

- Diplomatic Path Forward: Both India and Bangladesh must focus on resolving this issue diplomatically, keeping it separate from the larger, more cooperative aspects of their bilateral relationship to prevent long-term damage.

Practice Question:

Q. Critically examine the implications of Bangladesh’s demand for the extradition of Prime Minister Sheikh Hasina on India-Bangladesh relations. How should India navigate this issue, considering the historical, legal, and diplomatic aspects involved?

Editorials

Context

Cash transfer schemes have gained significant popularity in India as a quick solution to multiple social and economic issues. The increasing use of these schemes in electoral politics has raised questions about their effectiveness in addressing complex challenges like poverty, women empowerment, agrarian distress, and unemployment. While cash transfers offer easy implementation and immediate benefits, there are concerns about their long-term impact on the economy and the broader social fabric.

The Rise of Cash Transfers as Political Tools:

- Widespread Use in Elections: Cash transfer schemes have been increasingly used by political parties to secure votes, especially in states like Maharashtra, Jharkhand, Telangana, and Odisha, where schemes targeted at women and farmers were launched before elections.

- Short-Term Political Success: These schemes have led to electoral victories for incumbent governments, confirming their political effectiveness in the short term. This success has further cemented the belief in cash transfers as a one-size-fits-all solution.

- Use for Various Social Issues: Cash transfers are being touted as solutions to problems ranging from poverty alleviation to unemployment, with governments expanding these programs, such as PM-KISAN for farmers, in the run-up to major elections.

Benefits and Drawbacks of Cash Transfers:

- Ease of Implementation: The universal access to financial services has made cash transfers easy to implement, and they provide direct and tangible benefits to voters, which politicians can use to connect with their constituencies.

- Unconditional and Fungible Nature: Cash transfers are popular among beneficiaries due to their flexibility, as they are fungible and do not come with conditions, bypassing bureaucratic hurdles and local middlemen.

- Uncertain Impact on Targeted Issues: Despite their success in political terms, evidence on the effectiveness of cash transfers in achieving intended goals, like women empowerment or farmer welfare, remains inconclusive, as seen in studies from Latin America and India.

The Need for a Balanced Approach:

- Limited Long-Term Impact: While cash transfers can serve as short-term relief, they do not address the structural problems requiring policy interventions, like inadequate investments in health, education, and agriculture.

- Fiscal Strain and Competitive Populism: The growing reliance on cash transfers has placed a heavy fiscal burden on governments, diverting resources away from essential services, and fostering competitive populism among political parties.

- A Complementary Tool, Not a Solution: Cash transfers should be seen as complementary to broader reforms, not as substitutes for robust investments in essential services. Without a nuanced understanding, the overreliance on cash transfers may harm long-term development goals.

Practice Question:

Q. Critically analyze the use of cash transfers in India as a tool for political gain. Do you think they effectively address the complex social issues they are designed for, or do they merely serve as short-term solutions with long-term consequences?

Editorials

Context

The passing of former Prime Minister Manmohan Singh provides an opportunity to assess the lasting impact of the 1991 economic reforms and the policies during his tenure as Finance Minister and Prime Minister, which led to remarkable growth and transformation in India's economy. The period from 2004-14 under Singh’s leadership saw significant macroeconomic achievements, but the decade after 2014 witnessed considerable setbacks due to policy-induced shocks.

Economic Growth and Investment:

- Macroeconomic Policy Success: The period from 2004-14 saw an unprecedented rise in India’s investment-to-GDP ratio, reaching 38%, with the GDP growing at an average rate of 7.8% annually. This was primarily due to appropriate fiscal and monetary policies.

- Sectoral Growth: Growth spanned across all sectors, with significant employment generation in the non-farm sector. Non-farm jobs grew at 7.5 million annually, creating new opportunities in construction, manufacturing, and services.

- Poverty Reduction: Between 2004-11, 138 million people were lifted out of poverty, marking a significant decline in the absolute number of poor, a milestone never achieved since India’s independence.

Policy-Induced Shocks Post-2014:

- Impact of Demonetisation and GST: The demonetisation policy and poorly designed GST implementation created shocks in the unorganised sector, leading to closures of MSMEs and a slowdown in job creation.

- Unemployment Crisis: Unemployment rates increased sharply from 2.2% in 2011-12 to a 45-year high of 6.1% by 2017-18. Youth unemployment and graduate joblessness also reached alarming levels, with nearly 33% of graduates unable to secure employment.

- Reversal of Structural Change: The economic shift from agriculture to non-farm sectors reversed post-2015, with migration back to agriculture in 2020-24, signaling a retrogressive shift in the labor market, worsened by the decline in manufacturing jobs.

Distress, Inequality, and Economic Decline:

- Declining Manufacturing Sector: Despite efforts like ‘Make in India’, the share of manufacturing in GDP fell, and employment in manufacturing stagnated. The number of manufacturing workers barely increased from 2019 to 2022.

- Stagnant Wage Growth: Real wage growth stagnated post-2014, with the share of regular salaried workers declining, and the number of unpaid family workers sharply increasing due to economic distress.

- Rising Inequality and Constrained Demand: Economic inequality widened, and a constrained aggregate demand caused by poor job creation has delayed the realization of India’s demographic dividend, risking the nation’s long-term development prospects.

Practice Question:

Q. Critically evaluate the economic reforms initiated by Manmohan Singh in 1991 and their lasting impact on India’s growth trajectory. How have subsequent policy-induced shocks, particularly after 2014, reversed the gains achieved during his tenure?