10th July 2024 (9 Topics)

Mains Issues

Context

Prime Minister Modi’s first bilateral visit to Russia after being sworn in, showcases the importance of India-Russia ties for India, especially in energy and defence. India and Russia have maintained a relationship for over seventy years. However, as India has expanded its global ties in a multi-polar world, its partnership with Russia has seen stagnation in some areas and decline in others.

- Defence remains the strongest aspect of their strategic alliance, with significant cooperation also in nuclear and space sectors.

Significance of Russia for India

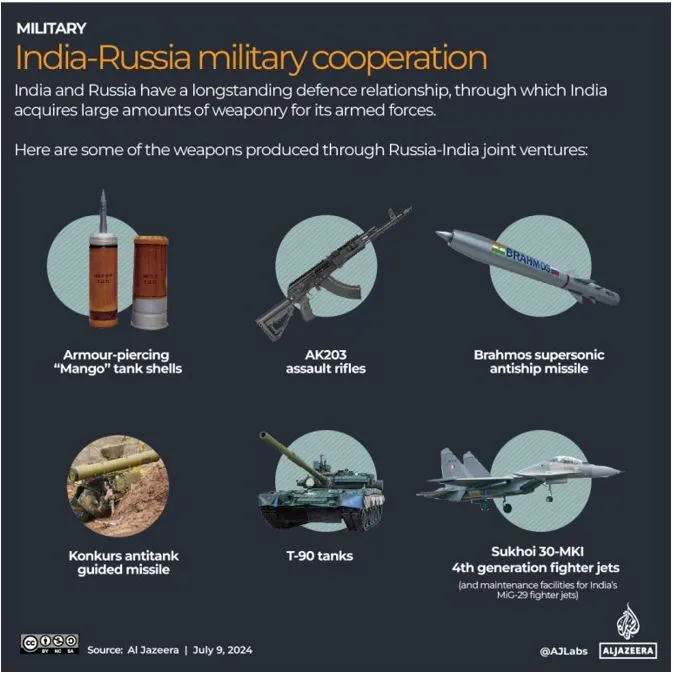

- Critical Defence Interests: India heavily relies on Russian and Soviet-origin defence equipment, constituting 60-70% of its arsenal. Cooperation includes joint R&D, co-development, and production of various military systems like S-400 missiles, MiG-29s, and tanks.

- India’s armed forces still rely heavily on armoured divisions and 97 percent of its 3,740 tanks are Russian-made.

- The Brahmos supersonic antiship missile, for instance, was jointly designed by Indian and Russian engineers for the Indian armed forces and first tested in 2001.

- Russian joint ventures with India also include making

- 35,000 Kalashnikov AK203 assault rifles for the Indian army

- licensed production of advanced T-90 tanks and Sukhoi Su-30-MKI fourth-generation fighter jets

- maintenance facilities for India’s MiG-29 fighter jets

- collaboration on making the Konkurs antitank guided missile

- War and Oil Trade Boost: India buys Russian oil at discounted rates, significantly impacting bilateral trade.

- Despite the threat of even more US sanctions, Russia has become the 1 supplier of oil for India, which in turn is the top buyer of seaborne Russian oil. In June, India bought a stunning 2.13 million barrels of oil per day from Russia.

- This trade helps mitigate inflation from rising crude prices, though it creates diplomatic challenges with Western allies due to Russia's actions in Ukraine.

Factors irritating United States in India-Russia Relations

- India continues to strengthen its trade and diplomatic relationship with the world's most-sanctioned country.

- India has taken a neutral stance regarding Ukraine.

- The Chennai-Vladivostok maritime route and the International North-South Transport Corridor (INSTC), are aimed at long-term integration of the Indian and Russian economies. The INSTC also brings Iran - another American adversary - into the mix.

- India has even defied the US to strike a 10-year deal to develop Iran's Chabahar port.

- India significantly boosted India-Russia cooperation in military affairs. For example, India bought the Russian S-400 missile defense systems.

- India and Russia are considering cooperation on numerous strategic areas such as joint production of weapons, reciprocal access to military facilities, joint deployment of troops, warships and fighter jets.

Indo-US vs Indo-Russia Defence Deals

|

Aspect |

Indo-US Defence Deals |

Indo-Russian Defence Deals |

|

Historical Background |

Started gaining momentum post-Cold War. |

Strong and longstanding since the Cold War era. |

|

Nature of Cooperation |

Emphasizes technology transfer and joint development. |

Primarily involves supply of Russian equipment and technology. |

|

Key Equipment |

Includes advanced aircraft (e.g., P-8I, Apache), naval systems (e.g., drones, ships), Stryker Armoured Infantry Combat Vehicles

|

Includes fighter jets (e.g., Su-30MKI, MiG-29), missiles (e.g., BrahMos), tanks (e.g., T-90). |

|

Strategic Implications |

Seen as bolstering India's capabilities vis-à-vis China. |

Ensures reliable supply of critical defence equipment. |

PYQ

Q: What is the significance of Indo-US defence deals over Indo-Russian defence deals? Discuss with reference to stability in the Indo-Pacific region. (2020)

Mains Issues

Context

In February 2023, the Ministry of Corporate Affairs formed the Committee on Digital Competition Law (CDCL) to explore the need for specific legislation on competition in digital markets. The CDCL recommended supplementing the current Competition Act, 2002 (which focuses on penalizing anti-competitive behavior after it occurs) with a proactive, preventative framework known as an "ex-ante" regulation.

Need of the Bill

- The draft bill aims to address the concerns against anti-competitive practices by Big Tech in digital markets. Over the years, Indian internet companies, as well others globally, have been fighting the alleged monopoly imposed by major US players like Google and Apple.

- Among the significant problems noticed in digital markets were preferential pricing, deep discounting, anti-steering, bundling and tying, accumulation of big data and its usage, network effects, exclusive tie-ups, search and rank preferencing, restricting third-party applications, advertising policies, etc.

- The ex-ante provisions in the draft bill aim to prevent anti-competitive behaviour before it harms the market.

Key-highlights of the Draft Digital Competition Bill:

- The draft Bill, inspired by the EU's Digital Markets Act, targets dominant digital enterprises rather than all digital businesses.

- It identifies specific "core digital services" and sets criteria (such as financial strength and user base) to determine dominance.

- The Bill proposes that for certain “core digital services” like search engines, and social media sites, the Competition Commission of India (CCI) should designate companies as “Systematically Significant Digital Enterprise (SSDE). SSDEs are obligated to operate fairly, transparently, and non-discriminatively.

- Prohibited practices include self-preferencing, restricting third-party applications, anti-steering measures, and leveraging user data unfairly.

- This framework empowers the Competition Commission of India (CCI) to monitor potential misconducts by major enterprises.

- What is an ex-ante framework?

- Unlike the current "ex-post" framework under the Competition Act, an ex-ante framework aims to prevent anti-competitive practices by digital enterprises before they occur.

- This approach is unusual globally, with the European Union being the only jurisdiction currently implementing a comprehensive ex-ante framework under the Digital Markets Act.

- Concerns: Concerns arise about the effectiveness of the ex-ante model, its potential negative impact on startup investments and scalability, and its implications for MSMEs.

Fact Box:

|

Mains Issues

Context

A recent study has highlighted significant soil moisture anomalies (Negative Soil Moisture Anomaly (SMA)) across India in 2023, impacting agricultural productivity and water resource management.

Key-findings:

- Extent of Soil Moisture Anomalies

- Approximately 32.8% of India's total land area experienced negative Soil Moisture Anomalies (SMA), indicating vulnerability to drought stress, covering about 1.08 million square kilometers.

- Conversely, 47.7% of the country's geographical area saw positive SMA, leading to wetter soil conditions than usual and increasing the risks of flooding and water logging.

- Seasonal Variations

- Monsoon Period (June-September):

- Punjab benefited from positive soil moisture levels, supporting robust crop growth and potentially preventing flooding.

- Odisha, with near-average soil moisture, could improve agriculture output by adopting water management techniques from Punjab.

- Bihar and Jharkhand faced below-average soil moisture, necessitating improved irrigation and water conservation methods.

- Pre-Monsoon Period (March-May):

- Punjab maintained above-average soil moisture levels, whereas Odisha experienced slight deficits, suggesting a need for shared water management practices.

- Andhra Pradesh and Kerala showed favorable conditions, while Bihar exhibited below-average soil moisture, emphasizing water conservation.

- The Andaman and Nicobar Islands faced dry conditions, highlighting the urgency for enhanced water management practices.

- Winter Period (December-February):

- Punjab recorded positive soil moisture anomalies, benefiting winter crops and reducing the need for excess irrigation.

- Odisha faced negative SMA, indicating drier conditions compared to historical averages, suggesting potential benefits from adopting Punjab's irrigation techniques.

- State-Wise Implications

- Punjab: Benefits from positive soil moisture anomalies, supporting robust agriculture.

- Odisha: Faces challenges with negative SMA during specific periods, suggesting the adoption of efficient irrigation practices from other states.

- Bihar, Jharkhand: Require improved water conservation and irrigation techniques to address drought impacts.

- Maharashtra, Madhya Pradesh: Showed variability in soil moisture levels, necessitating stable water management policies.

- Andhra Pradesh, Kerala: Require customized water management plans due to varying soil moisture conditions.

- Monsoon Period (June-September):

Policy Recommendations

- There is need to develop tailored water management policies based on regional soil moisture conditions.

- The state must implement drought management plans in deficit areas and flood management strategies in surplus moisture areas.

- Farmers should invest in advanced soil moisture monitoring systems using remote sensing and ground-based sensors for real-time data.

Fact Box: What is Negative Soil Moisture Anomaly (SMA)?

|

Prelims Articles

Context

The Reserve Bank of India's (RBI) Financial Inclusion (FI) Index rose to 64.2 in March 2024 (compared to 60.1 in March 2023), showing growth across all parameters.

About the Index

- The RBI's FI Index measures the level of financial inclusion in India, scoring between 0 (complete exclusion) and 100 (full inclusion).

- Parameters: The FI Index comprises:

- Access (35%): Measures the ease of accessing financial services.

- Usage (45%): Evaluates the extent to which financial services are utilized by the population.

- Quality (20%): Assesses the standard and reliability of financial services provided.

- Implications: The increase in the FI Index suggests improvements in access, usage, and service quality of financial services across India. This growth reflects efforts to enhance financial inclusion, enabling more people to benefit from banking services.

Government Schemes for Financial Inclusion

|

PYQQ: With reference to India, consider the following: (2010)

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

Solution: (d) |

Prelims Articles

With the city expanding and with unplanned urbanisation, documentation of ecologically rich spaces in the People’s Biodiversity Register (PBR) is a step towards conservation and benefit sharing of traditional knowledge

What is a People’s Biodiversity Register (PBR)?

- The People’s Biodiversity Register (PBR) is a mandated repository of information on flora, fauna, local livelihoods, and traditional knowledge about medicinal herbs and plants.

- It is governed by the Biological Diversity Act, 2002.

- The PBR serves as a comprehensive database that documents locally available bio-resources, including the landscape and demographics of specific areas.

- It aims to protect intellectual property rights associated with traditional knowledge.

- It is crucial for conservation efforts amidst urban expansion and unplanned urbanization.

- Implementation: The National Biodiversity Authority (NBA) oversees PBR activities at the national level, while state biodiversity boards and local Biodiversity Management Committees (BMCs) coordinate at state and local levels respectively.

- Role in Conservation and Benefit Sharing:

- The PBR facilitates conservation efforts by identifying ecologically rich spaces and documenting traditional knowledge.

- It ensures benefit sharing from the commercial use of biological resources and associated traditional knowledge.

Prelims Articles

Context

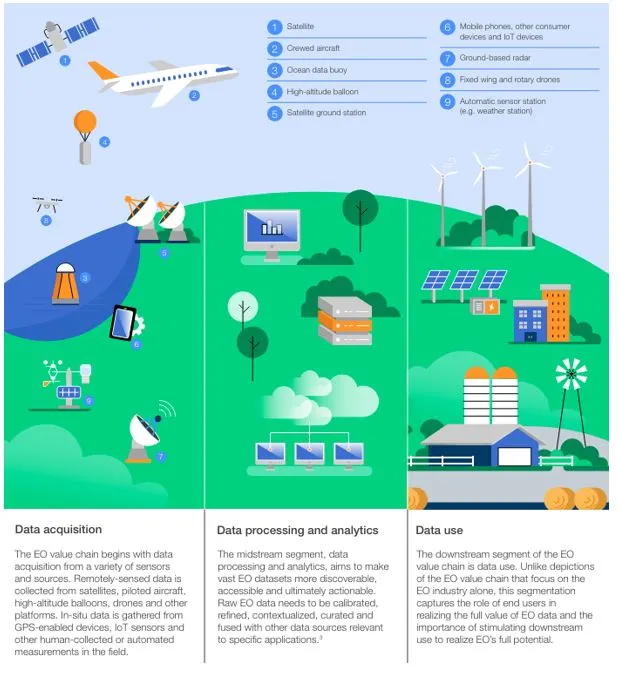

An estimated $3.8 trillion could be generated by Earth observation (EO) data by 2030, according to a new World Economic Forum (WEF).

What is Earth Observation Data?

- Earth observation (EO) data refers to information gathered about Earth's physical, chemical, and biological systems using various sensor technologies.

- These include satellites, aircraft, underwater devices, and even people equipped with specialized equipment.

- Applications in Environmental Protection:

- Monitoring Natural Ecosystems: EO data monitors variables like soil moisture, atmospheric conditions, and temperature changes on land and sea. It tracks changes in land cover and detects the presence of chemicals and radiation levels.

- Protecting Ecosystems: EO plays a crucial role in safeguarding ecosystems like mangroves and coral reefs.

- Mangroves, vital for marine life and carbon storage, are monitored to prevent loss from human activities and natural disasters.

- Disaster Prevention and Response: EO data aids in early warning systems for wildfires and helps identify illegal deforestation. It detects gas leaks from pipelines and other sources, reducing greenhouse gas emissions.

- Optimizing Resource Use: EO optimizes shipping routes to save fuel and minimize emissions. It monitors crop health, allowing for efficient use of fertilizers and water.

- Environmental Impact Reduction: By applying EO technologies, global greenhouse gas emissions could potentially be reduced by 3.6% annually, equivalent to 2 gigatonnes.

Editorials

Context

Despite 1.3 billion people with disabilities globally (60 million in India), they face significant employment challenges. However, disability-inclusive organizations demonstrate superior financial performance and workforce stability.

Benefits of Disability Inclusion in the Workplace:

- Financial Performance: Companies employing people with disabilities realize 1.6 times more revenue, 2.6 times more net income, and 2 times more economic profit.

- Workforce Stability: People with disabilities tend to seek new jobs less frequently, forming a more stable workforce.

- Legal Compliance: The Rights of Persons with Disabilities Act mandates private establishments to publish equal-opportunity policies detailing facilities and amenities for persons with disabilities.

Challenges in Implementing Disability-Inclusive Practices:

- Lack of Implementation: Many organizations have policies in place but fail to actively implement them, lacking necessary facilities for people with disabilities.

- Employer Hesitation: Employers are often reluctant to hire people with disabilities, fearing the need to designate team members for assistance with basic tasks.

- Technology Barriers: Rapid advancements in digital technology have inadvertently created new challenges for people with disabilities in the modern workforce.

Strategies for Creating Disability-Friendly Workplaces:

- User-Centered Design: Involve people with disabilities in the design process of digital interfaces to reflect their requirements adequately.

- Assistive Technologies: Enable the use of assistive technologies like screen-readers to unlock digital content for persons with visual impairment.

- Accessibility Standards: Ensure all digital platforms conform to accessibility standards set by the World Wide Web Consortium (W3C) to enable effective use of assistive technologies.

UPSC Mains Questions:

Q. Analyze the economic and social benefits of integrating people with disabilities into the workforce. How can organizations overcome the challenges in implementing disability-inclusive practices?

Editorials

Context

The Initiative on Critical and Emerging Technologies (iCET) between India and the US faces structural challenges in its execution, particularly regarding technology transfer and autonomy of US defense companies.

Challenges in Technology Transfer:

- IPR and Export Control Hurdles: US defense companies are reluctant to share military technologies due to strict export control laws and intellectual property rights concerns.

- Partial Technology Transfer: General Electric's F-414INS6 engine deal with India involves transferring about 80% technology, but excludes critical know-how related to forging metallurgy discs for turbines.

- Limited UAV Technology Sharing: Technology transfer from General Atomics for MQ-9 UAVs is limited to around 10-15%, primarily focused on establishing a domestic maintenance facility.

Limitations of US Defense Industry Cooperation:

- Commercial Interests vs. Strategic Goals: US government does not act on behalf of defense companies owning IPRs, as these companies are primarily driven by commercial interests.

- Historical Precedent: Failure of the 2012 Defense Technology and Trade Initiative (DTTI) due to technology transfer issues highlights persistent challenges.

- Restrictions on 'Jugaad': Complex 'enabling' protocols and strict end-use monitoring programs like 'Golden Sentry' restrict India's ability to apply 'jugaad' (innovative adaptations) to US-origin platforms.

Strategic Implications and Future Prospects:

- Shifting Defense Partnerships: iCET is part of US strategy to reduce India's dependency on Russian arms, as outlined in a recent Senate Foreign Relations Committee report.

- Multi-organizational Approach: The initiative involves multiple organizations like INDUS-X, Joint IMPACT, and ADDD to facilitate cooperation.

- Balancing Act: Success of iCET depends on overcoming bureaucratic hurdles and aligning US commercial interests with broader strategic goals in the India-US partnership.

UPSC Mains Questions:

Q. How does the restriction on applying 'jugaad' to US-origin platforms impact India's defense capabilities? Discuss the implications for India's strategic autonomy in military technology.

Editorials

Context

The upcoming 2024-25 Budget presents an opportunity for the new government to outline its medium-term growth and employment perspective, aiming for a minimum 7% growth in the short term and 7-7.5% in the medium term, while reducing the fiscal deficit.

Investment and Savings Prospects:

- Real Investment Rate: Sustaining a 7% growth rate requires a real investment rate of 35%. Current rates are 33.3% for 2022-23 and 33.5% for 2023-24. An increase to 35% in Gross Fixed Capital Formation (GFCF) is needed.

- Household Financial Savings: Household financial savings fell to 5.2% of Gross National Disposable Income in 2022-23. Boosting this rate is essential for increasing investible surplus for the private sector.

- Demand-Side Contributions: Net exports have been a weak contributor to GDP growth, with negative or low contributions in recent years. Government investment demand must support growth until export demand and private investment gain momentum.

Budgetary Options:

- Revenue Position: The Centre's revenue position is expected to improve due to higher tax and non-tax revenues. Gross tax revenues (GTR) for 2023-24 were higher than revised estimates, with expectations of continued growth.

- Expenditure Allocation: Assuming adherence to a 5.1% fiscal deficit to GDP ratio, total expenditure can be ?49 lakh crore. This needs allocation between revenue and capital expenditures, with potential increases in subsidies, health expenditures, and MGNREGA allocations.

- Tax and Policy Measures: Tax rationalization and expansion of the Production Linked Incentive (PLI) scheme, especially for employment generation, may be considered.

Commitment to FRBM Targets:

- Fiscal Stability: Achieving fiscal stability includes reducing the fiscal deficit to GDP ratio to 5.1% in 2024-25, with a goal of reaching 3% in the next three to four years.

- Nominal GDP Growth: Ensuring nominal GDP growth of 11%-11.5% will help reduce the debt GDP ratio and interest payment to revenue receipts ratio.

- Virtuous Cycle: Reducing fiscal deficit and maintaining GDP growth will create a virtuous cycle of fiscal consolidation, enhancing economic stability.

UPSC Mains Questions:

Q. Discuss the implications of falling household financial savings on India's economic growth. Suggest measures that the government can take to boost household savings.