11th April 2025 (12 Topics)

Mains Issues

Context

India’s customs department issued a circular withdrawing a trans-shipment arrangement that had been in place since June 2020. The move comes amid increasing diplomatic tensions, particularly following controversial remarks by Bangladesh's interim government chief Muhammad Yunus, who referenced the isolation of India’s Northeast while seeking Chinese investments.

What is the Trans-Shipment Facility?

- Trans-shipment refers to the movement of goods through a third country’s port or airport before reaching their final destination.

- Under the 2020 arrangement, Bangladesh was allowed to:

- Transport goods via Indian land customs stations.

- Export them to third countries using Indian seaports and airports (e.g., Kolkata, Haldia, or Delhi airport).

- The facility had allowed Bangladeshi export cargo to pass through Indian ports and airports en route to third countries like those in Europe, West Asia, etc.

Current state of India-Bangladesh Relations

- The India-Bangladesh relationship, once marked by high levels of cooperation and strategic convergence under Sheikh Hasina’s Awami League government, is currently undergoing a period of uncertainty and tension following major political changes in Bangladesh.

- Trade and Economic Partnership:

- Bangladesh is India’s biggest trade partner in South Asia and India is the second biggest trade partner of Bangladesh in Asia. In the fiscal year 2023-24, Bangladesh exported goods worth USD 97 billion to India, and the total bilateral trade for that year amounted to USD 14.01 billion.

- India is Bangladesh’s 2nd largest trading partner in Asia. It is one of the top 15 sources of FDI into Bangladesh.

- Trade facilitation measures:

- SAFTA duty-free access for Bangladeshi goods.

- Border haats and Integrated Check Posts (ICPs).

- Investment in logistics, power, and transport

- Connectivity and Infrastructure

- Rail connectivity:

- Operational lines: Agartala–Akhaura, Haldibari–Chilahati, Gede–Darshana, etc.

- Passenger trains: Maitri Express, Bandhan Express, Mitali Express.

- Port access: Under a 2023 agreement, India can use Chittagong and Mongla ports for Northeast cargo transit.

- Inland waterways are covered under the Protocol on Inland Water Transit and Trade (PIWTT), enhancing cargo movement.

- Rail connectivity:

- Energy Cooperation: India-Bangladesh Friendship Pipeline (IBFPL), operational since 202

- Multilateral and Regional Cooperation:

- Both countries are part of SAARC, BIMSTEC, BBIN, IORA, and SASEC.

- Both the countries conduct joint exercises called Exercise Sampriti (for the army) and Exercise Bongo Sagar (for the navy).

- The India-Bangladesh relationship is currently fragile, marked by a strategic pause, mutual distrust, and increasing influence of third powers like Pakistan and China.

- The direction of ties will depend heavily on Dhaka’s foreign policy choices, India’s diplomatic engagement, and the resolution of internal political instability in Bangladesh.

Key Challenges

- Border Security: The 4,096.7 km border is prone to illegal migration, smuggling, and cross-border crime.

- Management of transboundary river water: The two countries share 54 common rivers which directly impact the livelihoods of people in both countries.

- While both countries have signed major treaties related to river water sharing, such as the Ganga Waters Treaty and the Kushiyara River Treaty, negotiations are ongoing for other major rivers such as the

- China’s Growing Presence: Bangladesh’s ties with China in infrastructure and defense are expanding. Recent outreach to Pakistan adds to India’s strategic concerns.

- Cross-border Migration: Sensitive issue in Indian states like Assam and West Bengal.

- Minority Rights and NRC-CAA: India is concerned about the safety of Hindus in Bangladesh. Bangladesh fears potential influx of Bengali-speaking Muslims due to India’s NRC and CAA.

- Trade Imbalance: Bangladesh complains of non-tariff barriers and slow progress on broader market access.

PYQPrelims Q. With reference to river Teesta, consider the following statements: (2017)

Which of the statements given above is/are correct?

Solution: (b) Mains

|

Mains Issues

Context

Tahawwur Hussain Rana, a key conspirator in the 26/11 Mumbai terror attacks that left 166 people dead, has been extradited from the United States to India. He will now face trial in a special National Investigation Agency (NIA) court.

What is Extradition?

- Extradition is the formal process where one country hands over a person to another country so they can be tried or punished for a crime committed there.

- This is usually done through bilateral treaties (agreements between two countries) or multilateral agreements. Without such a treaty, extradition is extremely rare.

- The Ministry of External Affairs (MEA) is the Central Authority in Extradition matters, including processing of extradition requests.

How Do Extradition Treaties Work?

- India has extradition treaties with 48 countries, and non-binding arrangements with 12 more.

- Old treaties listed specific crimes (like murder, terrorism, etc.).

- However, the newer treaties follow the “dual criminality” principle, meaning the act must be a crime in both countries. Treaties also include exceptions, such as:

- Political offences

- Cases not filed in good faith

- Concerns about unfair treatment or rights violations

- India makes a formal request to the country where the person is staying.

- The foreign court reviews the request, based on the treaty, charges, and evidence. If approved, the person can appeal the decision.

- Once all legal routes are exhausted, India can bring the person back.

Why Are Extraditions So Complicated?

- Even with treaties, countries can reject requests using exceptions.

- Legal, political, and diplomatic factors all play a role. Some cases are resolved quickly; others take years.

- Example:

- Tahawwur Rana (accused in 26/11 attacks) — India requested extradition over 10 years ago, approved only in 2023.

- David Headley — another 26/11 accused, cannot be extradited due to a plea deal in the U.S.

Mains Issues

Context

The Digital Personal Data Protection Act, 2023, meant to protect personal data, has led to concerns that it weakens the RTI Act, especially provisions that allow public access to personal data of officials if it is in public interest.

What are the concerns pertaining to the Act?

Key Technical Concerns:

|

- Section 44(3) of the DPDP Act amends Section 8(1)(j) of the RTI Act.

- Earlier, personal information of public officials could be disclosed under RTI if:

- It related to public activity, or

- There was a larger public interest.

- Now, both these conditions have been removed. The new clause simply states:

“Information which relates to personal information” – making it broadly exempt from RTI.

This change is seen as a blanket ban on personal data disclosure, even if it relates to government corruption, public works, or misuse of funds.

- The amendment shields public officials and reduces accountability. It may hinder investigative journalism and citizen-led scrutiny.

- The Data Act looks like a conflict between two fundamental rights, that is, the right to information, part of Article 19 (1) and Article 21 of the Constitution of India, protection of life and personal liberty.

What does the government say?

- Union IT Minister Ashwini Vaishnaw defends the Act, saying:

- It balances privacy and transparency.

- Any personal data that must be made public under existing laws (e.g., MGNREGA details) will still be available.

- The Act respects the Supreme Court’s Puttaswamy judgment (2017) which made privacy a part of Right to Life (Article 21).

- He cited Section 3(c)(ii)(B) of the DPDP Act, which exempts data from the law if it is already required to be publicly disclosed by other laws.

Fact Box: RTI Act

|

Mains Issues

Context

The Reserve Bank of India (RBI) has cut the repo rate by 25 basis points (bps), from 6.25% to 6%, in its latest policy review. The monetary policy stance has been shifted from neutral to accommodative, meaning the RBI may cut rates further if needed to support growth.

What is the Repo Rate?

- Repo stands for “Re Purchase Option”.

- It is the rate at which the central bank (Reserve Bank of India)lends to other banks by buying the securities with an agreement that the bank will buy back on a certain date.

- Repo lending is a short-term lending option to meet the liquidity requirements of commercial banks.

- It is a part of the Liquidity Adjustment Facility (LAF)of the RBI.

- Impacts of repo rate:

|

Increased repo rate |

Decreased repo rate |

|

|

Why has the RBI cut the repo rate?

- Falling Inflation: Jan-Feb 2025 inflation averaged 9%, lower than expected. RBI’s CPI projection for Q4 FY25 is 4.8%, and for FY26 it is 4%. Lower inflation gives RBI space to reduce rates to spur demand.

- Slowing Growth: RBI revised GDP growth forecast for FY26 to 6.5%, down from 6.7%. Global economic uncertainty (including US tariff increases) is creating downside risks to growth.

- External Factors: Global trade tensions and geopolitical anxieties have increased.

Fact Box:RBI’s Monetary Policy

Important rates

|

Mains Issues

Context

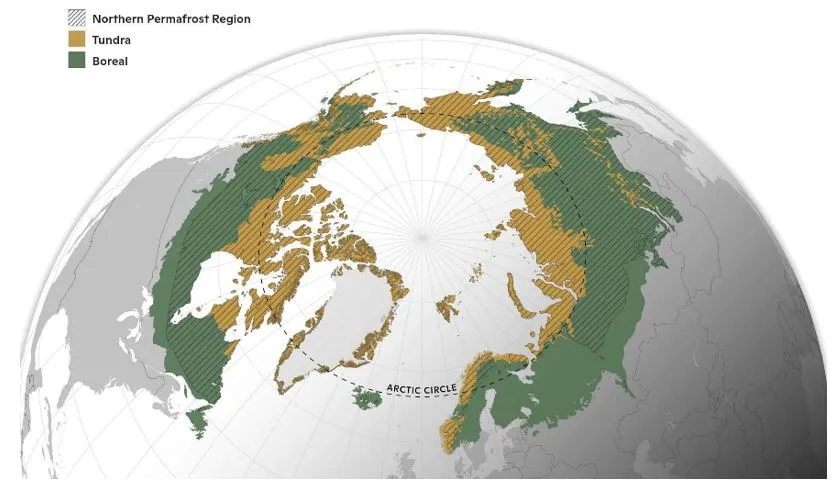

In early 2025, multiple regions across the world — from Texas and California in the United States to Ofunato in Japan — witnessed devastating wildfires. These fires were not only destructive in scale but also released massive amounts of carbon dioxide into the atmosphere. Now, a new study has confirmed that over 30 percent of the Arctic Boreal Zone (ABZ) — previously a major carbon sink — has begun releasing more carbon than it absorbs, turning it into a net carbon source.

Key Findings of the Study

- Between 2001 and 2020, the Arctic region absorbed carbon dioxide during summer months. But this absorption was cancelled out by rising emissions during the colder seasons.

- As a result, one-third of the ABZ has shifted from being a carbon sink to a carbon source.

- Alaska alone accounts for 44 percent of the net emissions, while Siberia and northern Europe contribute 13 and 25 percent, respectively.

- The carbon released during longer non-summer periods (due to thawing and fires) is now exceeding the amount absorbed during the brief growing season.

The study also cites two key historical fire events — Russia’s Eastern Siberia fire in 2003 and Canada’s Timmins fire in 2012 — as critical moments when emissions overwhelmed the region’s carbon sequestration capacity.

What is the Arctic Boreal Zone (ABZ)?

- Arctic Boreal Zone (ABZ) spans the northern latitudes across Alaska, Canada, Siberia, and Scandinavia.

- It includes tundra, coniferous (taiga) forests, permafrost, and wetlands.

- It is the largest terrestrial carbon sink on Earth, having stored massive amounts of organic carbon for centuries in frozen soils and plant biomass.

- Significance:

- The ABZ stores carbon in permafrost, which is permanently frozen ground composed of decomposed organic matter.

- It absorbs atmospheric carbon dioxide during brief summer periods, when plant growth is active.

- Its frozen state ensures slow decomposition, preventing large-scale carbon release.

Why Has It Become a Carbon Source?

- Thawing of Permafrost: As global temperatures rise, permafrost is melting, exposing organic material to decomposition. This decomposition releases carbon dioxide and methane, both greenhouse gases.

- Increased Wildfires: More frequent and intense wildfires destroy vegetation and peat layers, reducing the region’s carbon-absorbing ability and releasing previously stored carbon.

- Changing Vegetation and Soil Moisture: Arctic warming is altering plant types, with fire-prone or less carbon-efficient vegetation replacing older species.

- Longer Warm Seasons and Shorter Winters: The ABZ is experiencing longer non-summer seasons with higher temperatures, leading to year-round carbon release. These emissions now exceed the summer gains, pushing the biome into a net emission status.

Relevance to India

- Indian Forest Fires: According to the India State of Forest Report 2024, over 5,300 fires were recorded in Uttarakhand alone. Forest fires in India already contribute around 69 million tonnes of CO? annually.

- Rising Land Temperatures: Indian regions like the northwest and central India are warming by 2–0.4°C per decade.

- Climatic Risk: India’s agriculture, water systems, and monsoons are highly sensitive to global climate feedbacks, making Arctic emissions a critical external factor.

Prelims Articles

Context

Mahatma Phule Jayanti 2025 is observed on April 11 to pay tribute to one of India's most influential social reformers, Mahatma Jyotirao Phule.

About Jyotirao Govindrao Phule:

- Jyotirao Govindrao Phule (11 April 1827 – 28 November 1890) was an Indian social activist, thinker, anti-caste social reformer and writer from Maharashtra.

- His work extended to many fields, including

- eradication of untouchability and the caste system

- educating women and exploited caste people

- He and his wife, Savitribai Phule (1831 –1897), were pioneers of women’s education in India.

- Phule started his first school for girls in 1848in Pune at Tatyasaheb Bhide’s residence or Bhidewada.

- He, along with his followers, formed the Satyashodhak Samaj (Society of Truth Seekers) to attain equal rights for people from exploited castes.

- People from all religions and castes could become a part of this association which worked for the upliftment of the oppressed classes.

- Phule is regarded as an important figure in the social reform movement in Maharashtra.

- He was bestowed with honorific ‘Mahatma’ title by Maharashtrian social activist Vithalrao Krishnaji Vandekar in 1888.

- He undertook a systematic deconstruction of existing beliefs and history, only to reconstruct an equality promoting version.

- Jyotirao vehemently condemned the Vedas, the ancient holy scriptures of the Hindus.

- He traced the history of Brahmanism through several other ancient texts and held the Brahmins responsible for framing the exploitative and inhuman laws in order to maintain their social superiority by suppressing the “shudras” and “atishudras” in the society.

- His famous works:

- Tritiya Ratna (1855)

- Gulamgiri (1873)

- Shetkarayacha Aasud, or Cultivator’s Whipcord (1881)

- Satyashodhak Samajokt Mangalashtakasah Sarva Puja-vidhi (1887)

About Satya Shodhak Samaj:

|

Prelims Articles

Context

The RBI has proposed to allow securitisation of stressed assets through a market-based mechanism, not just through Asset Reconstruction Companies (ARCs) as is currently done.

Asset Reconstruction Companies (ARCs)

- In India, the SARFAESI Act, 2002 enabled setting up Asset Reconstruction Companies (ARCs), which buy stressed assets from banks and try to recover them.

- Limitations of ARC-driven model:

- Limited number of players

- Low recovery rates in many cases

- Market concentration (few large ARCs dominate)

- The RBI now plans to open securitisation of stressed assets to a broader market-based mechanism, rather than restricting it to ARCs.

- This change is expected to:

- Increase participation from mutual funds, private investors, and financial institutions,

- Create a secondary market for distressed debt, improving pricing and efficiency,

- It aligns with global best practices (like US and UK models).

What Are Stressed Assets?

|

Prelims Articles

Context

The Maharashtra government has sanctioned the development of approximately 256 acres of decommissioned salt pan land in Mulund, Kanjurmarg, and Bhandup for the Dharavi Redevelopment Project (DRP) to relocate inhabitants who are not eligible for rehabilitation within Dharavi.

What Are Salt Pan Lands?

- Salt pans are flat, low-lying lands where seawater is evaporated to extract salt.

- In Mumbai, many such lands were under the control of the Salt Commissioner (a Central Government authority).

- With Mumbai’s salt-making activity declining, large tracts have been decommissioned for non-agricultural use.

- Salt pans are ecologically sensitive due to their hydrological role—they absorb excess rainwater, help prevent flooding, and may support biodiversity.

- Some critics worry about disrupting local micro-ecosystems and flood patterns.

- Government's Stand: The land parcels selected in Mulund, Kanjurmarg, and Bhandup:

- Are outside the CRZ (Coastal Regulation Zone),

- Are not wetlands or bird habitats,

- Were decommissioned nearly a decade ago.

- Don’t fall under Coastal Regulation Zone (CRZ) limits.

What is a Coastal Regulation Zone (CRZ)?

|

Prelims Articles

Context

India has finalised a landmark deal to procure 26 Rafale M fighter jets from France in a government-to-government agreement estimated at over Rs 63,000 crore. The Rafale M is the naval variant of the Rafale aircraft, designed for carrier-based operations.

What is Rafale M?

- The Rafale M (Marine) is a twin-engine, multi-role fighter jet, adapted specifically for operations from aircraft carriers.

- The 'M' in Rafale-M stands for Marine, as this version is specially designed to operate from aircraft carriers.

- Unlike regular fighter jets, these naval aircraft have specific modifications that allow them to take off and land on ships at sea.

- It is fitted with reinforced landing gears, folding wings, and a tailhook system, making it compatible with short runway and arrested landings on carriers.

- Built by Dassault Aviation, it has proven operational performance with the French Navy and is regarded as one of the most advanced naval fighters globally.

- The Rafale M will replace and supplement the ageing fleet of MiG-29K

- The Navy currently operates the MiG-29K fighter jets for its two aircraft carriers - INS Vikrant and INS Vikramaditya.

Fact Box:

|

Editorials

Context

Debate has intensified over the impending delimitation exercise post-2026, mandated by Articles 82 and 170, based on the first Census after 2001 (expected 2021 Census). Southern States express apprehensions about reduced political weight due to slower population growth. The issue has reignited concerns about federal balance, representational equity, and democratic legitimacy.

CONSTITUTIONAL BASIS & TRENDS

- Constitutional Mandate: Delimitation is mandated after every Census under Articles 82 and 170; however, the 42nd Amendment (1976) froze the process till 2026 to incentivize population control.

- Past Adjustments & Seat Variations: Historical trends show non-uniform seat adjustments—e.g., 543 seats post-1971 Census—without any standard formula for per capita representation.

- Population vs Geography: Though population remains the principal criterion, geographic, administrative, and political boundaries have also influenced past delimitation outcomes.

FEDERALISM, REPRESENTATION & FUNCTIONAL ISSUES

- Federal Disparity: A strict population-based seat allocation may disadvantage States with successful population control policies, especially in the South.

- Misinterpretation of Representation: The representative weight of an MP does not change proportionally with voter count; constituency size has little impact on legislative function.

- Functional Role & Local Governance: Law-making and parliamentary duties are not population-dependent; greater focus is needed on strengthening Panchayati Raj and urban local bodies for effective governance.

WAY FORWARD & ALTERNATIVES

- Moderating Population Impact: Introducing a TFR-based deflator could help balance seat allocation, ensuring that States with lower fertility rates are not penalised.

- Alternative Formula Proposal: A 2024-based estimate shows 1,440 Lok Sabha seats if calculated like 1977, but a TFR-adjusted model reduces it to approx. 680, avoiding over-representation of high-growth States.

- Democratic Structural Rebalancing: Like the Finance Commission adapts devolution criteria, Parliament can explore constitutional amendments to ensure equitable representation aligned with current demographic realities.

Practice Question

Q. “Delimitation based solely on population figures risks undermining the federal character and representative balance of Indian democracy.” Critically examine this statement in light of the impending 2026 delimitation exercise. Suggest alternatives to population-based representation.

Editorials

Context

India is progressing toward a national social security scheme for gig and app-based workers, with proposals such as Ayushman Bharat coverage and a transaction-based pension policy pending Cabinet approval. While this marks a milestone in recognising non-traditional workers, it also exposes the fragmented, reactive, and piecemeal nature of India's broader social security architecture.

EXISTING SYSTEMIC SHORTFALLS

- Unratified Global Commitments: Despite being a founding ILO member, India has not ratified Convention No. 102 (1952), which outlines minimum social security standards, indicating a lag in aligning with global norms.

- Gaps in the Labour Code: The Code on Social Security, 2020, though well-intentioned, suffers from vague definitions, weakened protections, and poor implementation, falling short of creating a robust, inclusive safety net.

- Dysfunctional Welfare Boards: Audit data reveals poor fund utilization—e.g., ?70,744 crore in unspent cess across States, and ?221.8 crore in delayed remittances in Tamil Nadu—undermining the welfare objective of existing Boards.

LIMITATIONS OF SEGMENTED APPROACHES

- Arbitrary Worker Categorisation: Targeted schemes for niche groups (like Karnataka's beedi workers or gig workers) risk creating artificial boundaries between informal sectors, leaving many unprotected by eligibility thresholds.

- False Formalisation Expectations: Over-reliance on formalising gig work won’t inherently resolve informal sector issues; the gig economy itself lacks stable employer-employee relationships to anchor comprehensive benefits.

- Vulnerability to Technological Shifts: Piecemeal welfare frameworks are ill-equipped to adapt to future labour disruptions, such as AI-driven work displacement or platform-based jobs beyond gig work.

TOWARDS UNIVERSAL SOCIAL PROTECTION

- Strengthen the Existing Framework: The Social Security Code must be treated as a foundational floor, not the ceiling, from which States can build more inclusive and accessible systems.

- Integrated and Future-Proof Design: India should aim for universal social protection systems that transcend employment type and offer continuity across workforce transitions.

- Central-State Synergy: With the Code centralising oversight but allowing State-level innovation, this dual structure should be leveraged for decentralized, yet comprehensive, coverage.

Practice Question

Q. India’s approach to social security remains fragmented and exclusionary, particularly for informal and gig workers. Critically assess the limitations of the current framework and suggest a roadmap for a universal, inclusive social protection system in India.

Editorials

Context

The Reserve Bank of India (RBI) has cut the repo rate by 25 basis points, from 6.25% to 6%, marking the second consecutive rate cut. The Monetary Policy Committee (MPC) has shifted its stance from neutral to accommodative, signalling a focus on reviving growth amid global uncertainties, including the ongoing US-led trade war.

ECONOMIC RATIONALE BEHIND RATE CUT

- Global Headwinds and Trade War: With US tariffs disrupting global trade, the RBI has lowered India’s FY26 GDP growth forecast to 6.5% from 6.7%, indicating external challenges and deceleration risks.

- Inflation Under Control: The inflation forecast for 2025-26 is reduced to 4% (from 4.2%), with H1 expected at 75% and H2 at 4.1%, giving the RBI space for monetary easing without stoking price pressures.

- Export Exposure Lower than Peers: Although India’s exports contribute 21% to GDP, lower than Thailand (65%) and Vietnam (87%), the indirect effects of global slowdown and capital outflows are still concerning.

DOMESTIC IMPLICATIONS OF THE RATE CUT

- Boost to Consumption and Credit: Lower repo rates can reduce EMIs on housing and auto loans, potentially reviving consumer demand and facilitating credit growth.

- Weak Private Investment Outlook: Despite earlier signs of recovery, private sector investment remains tepid, as global instability and weak domestic consumption dent investor confidence.

- Impact on Savers: Falling deposit rates may erode real returns for fixed-income savers, possibly altering household investment preferences towards riskier assets.

LIMITATIONS & WAY FORWARD

- Limited Transmission by Banks: Monetary policy effectiveness is constrained by inefficient rate transmission to borrowers, weakening the intended stimulus impact.

- Need for Fiscal and Structural Support: Rate cuts cannot substitute structural reforms; coordinated fiscal measures and policy clarity are crucial to revitalising investment and demand.

- Vigilance Against Macroeconomic Risks: The RBI must monitor currency volatility and inflation, as prolonged easing can increase external sector vulnerability and price instability.

Practice Question

Q. Discuss the implications of the RBI’s accommodative monetary policy stance in the current global and domestic economic context. What limitations does monetary policy face in reviving economic growth in India?