9th September 2025 (14 Topics)

Context:

The Union Government is moving towards GST 2.0 with an emphasis on simplification, long-term revenue growth, reduced compliance burden, and increased taxpayer participation.

Background of GST:

- Goods and Services Tax (GST) was launched on July 1, 2017, as India’s largest indirect tax reform.

- It subsumed multiple central and state-level taxes (excise, VAT, service tax, etc.) into a unified tax framework.

Current Issues with GST (GST 1.0):

- High compliance costs for businesses, especially MSMEs.

- Complexity due to multiple tax slabs (5%, 12%, 18%, 28%).

- Frequent procedural changes leading to uncertainty.

- Revenue challenges for states, often requiring compensation cess.

GST 2.0 – Proposed Features:

- Simplification: Reduction of tax slabs and streamlined processes.

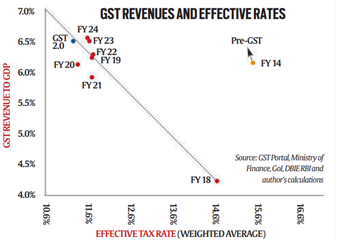

- Lower effective tax rate: Estimated to decline from pre-GST 15.3% to about 11.4%.

- Compliance easing: Simplified return filing for small taxpayers, technology-driven monitoring, and dispute resolution via the GST Appellate Tribunal.

- Broader base, higher collection:Formalisation of the economy and wider taxpayer participation to sustain revenue growth.

- Digital integration: Use of GSTN (Goods and Services Tax Network) and e-invoicing for transparency.

Long-Term Goals:

- Achieve stable revenue buoyancy through broader participation rather than high tax rates.

- Align India’s tax system with global best practices.

- Ensure fiscal federalism by addressing state revenue concerns.

Economic Implications:

- Encourages voluntary compliance and lowers litigation.

- Enhances “ease of doing business.”

- Helps in formalising India’s largely informal economy.

More Articles