15th April 2025 (11 Topics)

Mains Issues

Context

Telangana became the first Indian state to implement sub-categorization within the Scheduled Castes (SC) reservation system. This initiative aims to distribute the existing 15% SC reservation more equitably among various sub-castes based on their socio-economic status and representation in education and employment.

Background

- Historically, the SC reservation system treated all SC communities as a single group.

- However, disparities existed, with some sub-castes benefiting more than others.

- Recognizing this, the Supreme Court, in a landmark judgment (2024), upheld the constitutional validity of sub-classifying SCs for reservation purposes. This decision overruled the 2004 E.V. Chinnaiah verdict, which had previously deemed such sub-classification impermissible. ?

- Following the Supreme Court's decision, Telangana enacted the Scheduled Castes (Rationalisation of Reservations) Act, 2025.

- The Three Groups: Based on recommendations from a commission led by retired High Court judge Justice Shameem Akther, the 59 SC sub-castes in Telangana have been divided into three groups:?

- Group I: Comprises 15 sub-castes identified as the most disadvantaged, constituting approximately 0.5% of the state's population. They have been allocated 1% reservation.?

- Group II: Includes 18 sub-castes that have received marginal benefits historically. This group has been granted 9% reservation.?

- Group III: Consists of 26 sub-castes that have been relatively better placed in terms of opportunities. They have been assigned 5% reservation.

What is Sub-classification?

- Sub-classification involves breaking down a broader category, such as backward classes (BCs) or SCs, into distinct sub-categories like more BCs or SCs.

- Article 14 of the Constitution permits sub-classification within reserved categories as it recognises Scheduled Castes, Scheduled Tribes and Other Backward Classes as a “backward class of citizens.”

Significance and Broader Implications

- This move addresses long-standing concerns about equitable distribution of reservation benefits among SC sub-castes.

- It sets a precedent for other states to consider similar measures, especially in light of the Supreme Court's affirmation of the constitutional validity of such sub-classifications.

- Politically, it also reflects efforts to consolidate support among marginalized communities by ensuring that affirmative action policies reach the most disadvantaged groups effectively.?

Mains Issues

Context

A recent study (Delhi School of Economics), reveals that India's wealthiest individuals significantly underreport their income relative to their wealth. This underreporting leads to a regressive tax structure and underestimation of income inequality.?

Key Findings:

- Inverse Relationship between Wealth and Reported Income: The study found that as family wealth increases by 1%, the reported income-to-wealth ratio decreases by more than 0.6%. ?

- Disparity in Income Reporting:

- Bottom 10% of families report incomes exceeding 188% of their wealth.

- Top 5% report incomes just 4% of their wealth.

- Top 0.1% report incomes less than 2% of their wealth.

- Forbes-listed families report incomes less than 0.6% of their wealth. ?

- Underreporting of Capital Income: Over 90% of capital returns for the wealthiest families do not appear in reported incomes, indicating significant tax avoidance.

- Tax Liability Discrepancies:

- Wealthiest 0.1% have tax liabilities amounting to approximately 0.7% of their wealth.

- Super-wealthy individuals pay taxes that are less than 0.2% of their wealth, which is lower than the tax liability for middle-wealth groups. ?

- Underreporting of Rental and Agricultural Income: Rental incomes are frequently underreported, and some individuals misclassify taxable income as tax-free agricultural income to evade taxes. ?

- Influence of Public Scrutiny: Individuals exposed to higher levels of media and public scrutiny are more likely to report higher incomes, suggesting that visibility and accountability influence income disclosure practices.

Implications:

- This study highlights the need for policy reforms to address income underreporting and ensure a more equitable tax system.

- Enhancing transparency and accountability, especially among the ultra-wealthy, is crucial for reducing income inequality and increasing tax revenues.?

|

Tax Evasion

|

Mains Issues

Context

A recent study analyses the problem of stubble burning from the lens of ‘governmentality’ and market failure.

Why is stubble burning a recurring issue?

- Every year during October and November, parts of North India—especially the Indo-Gangetic Plain—experience a sharp spike in air pollution.

- This is due to a combination of factors like:

- reduced wind movement

- cooler temperatures

- persistent emissions from vehicles and industries

- However, one additional seasonal factor significantly worsens the air quality: “stubble burning”.

- After harvesting the paddy crop, many farmers in Punjab, Haryana, and parts of Uttar Pradesh burn the leftover straw (or “stubble”) in their fields.

- Impact

- Pollution: Stubble burning emits toxic pollutants in the atmosphere containing harmful gases like Carbon Monoxide (CO), methane (CH4), carcinogenic polycyclic aromatic hydrocarbons, volatile organic compounds (VOC).

- Soil fertility: Soil becomes less fertile and its nutrients are destroyed when the husk is burned on the ground

- Heat penetration: Stubble burning generates heat that penetrates into the soil, causing an increase in erosion, loss of useful microbes and moisture.

- Why farmers still opt for it:

- Stubble burning quickly clears the land in time for sowing wheat, the next crop in the Rabi season.

- Burning stubble is fast, cheap, and efficient for farmers with limited time and money—but it's also disastrous for the environment and public health.

What does the new study say?

- A recent study looks at the problem from a different angle. Instead of just blaming individual farmers, they examine how government policies and market structures actually push farmers towards stubble burning.

- They use the concept of "governmentality", developed by French philosopher Michel Foucault, which refers to how governments shape citizen behavior through indirect influence, rather than through direct control.

- In this case, farmers are encouraged—through policy incentives like the Minimum Support Price (MSP)—to grow only rice and wheat.

How the system works against the farmer

- MSP and monoculture: While MSP offers guaranteed prices for these crops, it also discourages crop diversification. Over time, this leads to mono-cropping (growing the same crop repeatedly), which makes managing crop residue more difficult.

- No affordable alternatives: While stubble burning is penalized, farmers are not provided viable, low-cost options like machinery or market incentives to recycle the waste.

- Market dependence and exploitation: Farmers often sell their crops through commission agents (arhatias) who control prices and access to credit. This creates a cycle of dependency and debt.

- Double standards: Farmers feel the government is quick to blame them for pollution but turns a blind eye to industrial sources of pollution. They see this as a bias favoring urban over rural interests.

- Financial stress: With input costs rising and MSP rates remaining stagnant (e.g., wheat MSP rose just 5% in a decade), farmers are under pressure to cut costs—and stubble burning is the cheapest way to clear fields.

What can be done?

- Create a stubble market: There is potential to turn stubble into something useful—like fuel pellets, packaging material, or fodder. Developing this market would make stubble economically valuable rather than a waste product.

|

Important Artificial Machines

|

- Strengthen the value chain: The government should help build the supply chain for stubble-based products. This includes supporting technologies, storage, processing units, and transportation.

- Incentivize alternatives: Subsidies or support schemes should make stubble-removal equipment like happy seeders and super straw management systems more accessible to small and marginal farmers.

- Market reforms: Farmers need a fair and transparent market system. Improving MSP mechanisms, reducing dependency on middlemen, and providing better price discovery could improve their financial health and decision-making.

Mains Issues

Context

India is actively revising its climate finance approach in response to evolving global dynamics, particularly following the United States' withdrawal from the Paris Agreement in January 2025.

|

US’s Emission Levels (UNEP Report 2024)

|

US Withdrawal & Impact

- The United States' exit from the Paris Agreement has created a substantial void in global climate finance.

- Notably, the US had pledged significant contributions to the USD 300 billion annual climate finance goal and was a key participant in the Loss and Damage Fund, designed to support countries severely affected by climate change.

- The absence of US support places additional pressure on other developed nations, especially the European Union, to fulfill financial commitments.

India's Climate Finance Landscape

- India's climate initiatives have predominantly been financed through domestic resources. As of February 2024, India received approximately USD 1.16 billion from international climate funds, including:

- Green Climate Fund (GCF): USD 803.9 million

- Global Environment Facility (GEF): USD 346.52 million

- Adaptation Fund: USD 16.86 million

- Despite these contributions, the funding remains insufficient relative to India's climate action requirements.

- Domestic Financial Commitments: India has made substantial domestic investments in climate adaptation and mitigation:

- Adaptation Expenditure: In 2021-22, India allocated 5.6% of its GDP to climate adaptation efforts, amounting to approximately Rs 13.35 lakh crore.

- Future Requirements: The Economic Survey 2024-25 estimates that India will need around Rs 56.68 lakh crore (approximately USD 700 billion) by 2030 for climate adaptation measures.

Strategic Financial Instruments

To bolster climate finance, India is leveraging various instruments:

- Sovereign Green Bonds: The Reserve Bank of India issued Rs 1,697.40 crore in 10-year Sovereign Green Bonds in the first half of 2024-25 to fund green infrastructure projects.

- Blended Finance Models: India is exploring concessional financing to attract private investments, thereby amplifying the impact of public funds.

- Climate Finance Taxonomy: The government is developing a taxonomy to standardize and enhance the transparency of climate-related financial flows.

|

Loss and damage

Other important Global Climate Funds

|

Prelims Articles

Context

Rongali Bihu, also known as Bohag Bihu, is being celebrated from April 14 to April 20, 2025 in Assam. It marks the Assamese New Year and the beginning of the agricultural season, making it one of the most culturally significant festivals in the state.

About Rongali Bihu (Bohag Bihu)

- “Rongali” comes from “Rong” meaning joy or happiness, reflecting the vibrant and festive spirit of the celebration.

- Rongali Bihu (Bohag Bihu) marks the onset of spring and the start of the sowing season for farmers.

- It is a festival of gratitude and hope, where farmers seek blessings for a good harvest.

|

Pan-India Resonance

|

- It is part of the triannual Bihu cycle:

- Rongali Bihu (Bohag Bihu) – April (spring/new year)

- Kati Bihu – October (sowing season)

- Magh Bihu – January (end of harvest)

- It is celebrated with community feasts, folk songs (Bihu geet), and the famous Bihu dance, especially by the youth.

- Traditional attire and musical instruments like the dhol, pepa, and gagana are central to the festivities.

- Households are cleaned and decorated to welcome the New Year with prosperity and good luck.

Prelims Articles

Context

The Archaeological Survey of India (ASI) has initiated a comprehensive onshore and offshore archaeological expedition at Dwarka and Beyt Dwarka in Gujarat to scientifically date and document submerged heritage linked to India's ancient cultural history.

About Dwarka

- The submerged city of Dwarka is of great relevance to Hindus, and is believed to have been founded by Lord Krishna.

- After killing his uncle Kamsa, Krishna migrated from Mathura to Dwarka with his Yadava clan, and founded his kingdom here by reclaiming 12 yojanaland from the sea.

- Dwarka is considered Krishna’s karmabhoomi (land of action).

- As per the epic Mahabharata, this fortified city of Krishna spanned nearly 84 km and was situated at the confluence of the Gomti River and the Arabian Sea.

- Dwarka is believed to be the first capital of Gujarat, and has been referred to as "Mokshapuri," "Dwarkamati," and "Dwarkavati".

- Present-day Dwarka is a coastal town located at the mouth of the Gulf of Kutch, facing the Arabian Sea.

- The town is a part of the Krishna pilgrimage circuit, which includes Vrindavan, Mathura, Govardhan, Kurukshetra and Puri, and is home to the 13th-century Dwarkadheesh temple dedicated to Lord Krishna.

|

Fact Box: Underwater Archaeology Wing (UAW)

|

Prelims Articles

Context

At the recently concluded World Diabetes Congress in Bangkok, the International Diabetes Federation officially recognised Type 5 diabetes as a new condition.

?About Malnutrition-Related Diabetes (Type 5 Diabetes):

- Type 5 diabetes is a malnutrition-related diabetes, typically affecting lean and malnourished teenagers and young adults in low- and middle-income countries.

- Today, there are an estimated 20-25 million people worldwide, mainly in Asia and Africa, who are afflicted by this disease.

- It is characterized by a significant deficiency in insulin secretion, distinguishing it from Type 1 (autoimmune destruction of beta cells) and Type 2 (insulin resistance) diabetes.

- Insulin therapy, effective in Type 1 diabetes, can be harmful in Type 5 due to the risk of hypoglycemia.?

- First identified in Jamaica in 1955 as J-type diabetes, the condition was recognized by the World Health Organization (WHO) in 1985 but was later removed from classification in 1999 due to insufficient evidence.

- Recent studies have provided substantial evidence leading to its reclassification as Type 5 diabetes.?

How Does Type 5 Differ from Other Types? |

|||

|

|

Cause |

Typical Patient Profile |

Insulin Response |

|

Type 1 |

Autoimmune destruction of insulin-producing cells |

Children and adolescents |

Requires insulin therapy |

|

Type 2 |

Insulin resistance, often linked to obesity |

Adults, often overweight |

May require insulin or oral medications |

|

Type 5 |

Malnutrition leading to impaired insulin secretion |

Young, undernourished individuals |

Poor response to insulin therapy; risk of hypoglycemia |

Prelims Articles

Context

India sent military aircraft to Myanmar to deliver earthquake relief materials under Operation Brahma. While flying over Myanmar, some Indian Air Force (IAF) aircraft faced GPS spoofing — a type of cyberattack that sends false GPS signals to confuse aircraft about their actual location.

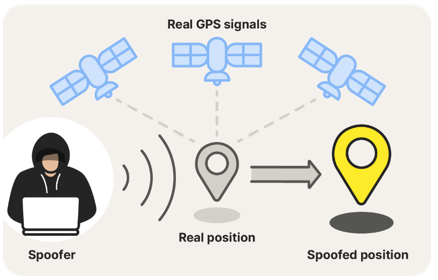

What is GPS Spoofing?

- GPS spoofing refers to an attempt or a cybersecurity threat to alter the initial location of a GPS-enabled device.

- GPS spoofing sends false data to a receiver to divert traffic, goods, or people with falsified information.

- How is it done?GPS spoofing involves a radio transmitter near a target that interferes with the actual GPS signals being transmitted.

- GPS signals are often weak and transmitted through satellites.

- A stronger radio transmitter can be used to override the weaker signal and send illegitimate coordinates and information to the receiver.

- GPS spoofing can then send people off course or say that someone is somewhere that they are not.

- Types of Spoofing: Spoofers overpower relatively weak GNSS signals with radio signals carrying false positioning information. There are two ways of spoofing:

- Rebroadcasting GNSS signals recorded at another place or time (so-called meaconing)

- Generating and transmitting modified satellite signals

|

GPS System

|

Editorials

Context

A preventable maternal death during a home birth in Kerala — a state with one of the lowest maternal mortality rates (MMR) in India — has reignited concerns about the dangers of health misinformation and the emerging trend of rejecting institutional deliveries.

Erosion of Trust in Formal Health Systems

- Romanticisation of “Natural” Childbirth: Misinformation portraying institutional deliveries as unnatural or unsafe is leading to avoidable maternal deaths.

- Health System Disengagement: Lack of antenatal check-ups, risk assessments, and counselling reflects a complete disengagement from the formal health network.

- Public Health Implication: These incidents signal not isolated cases, but systemic challenges to Kerala’s hard-won health achievements.

Health Misinformation as a Public Health Threat

- Beyond Childbirth: From anti-vaccine rhetoric to unscientific cancer “therapies”, misinformation delays diagnosis and undermines evidence-based medicine.

- WHO’s Warning: The World Health Organization identifies misinformation as a top global health threat, with broad implications for morbidity and mortality.

- Digital Amplification: Social media accelerates the spread of falsehoods, often outpacing efforts by health systems to counter them.

Policy and Societal Response Needed

- Legal and Educational Measures: Regulations to curb deliberate disinformation, and health education campaigns rooted in trust and respect, are essential.

- Cross-Sector Collaboration: Engagement from religious leaders, educators, civil society, and digital platforms is needed to reinforce scientific values.

- Safeguarding Kerala’s Gains: Kerala’s success was built on community trust, literacy, and institutional commitment — these pillars must be reinforced to prevent backsliding.

Practice Question

Discuss the emerging challenge of health misinformation in India with reference to recent incidents in Kerala. How does misinformation undermine public health achievements, and what multi-pronged strategies are needed to counter it?

Editorials

Context

The Supreme Court, in State of Tamil Nadu vs Governor of Tamil Nadu, invoked Article 142 to set time limits for gubernatorial assent to Bills, raising concerns about judicial overreach and the federal structure.

Separation of Powers:

- Judicial Overreach: The ruling bypasses Articles 200, 201, and 74 by directing timelines for assent and mandating advisory opinions.

- Rewriting the Constitution: Courts cannot insert provisions (like time limits) which require formal constitutional amendment under Article 368.

- Scope of Article 142: Article 142 enables doing “complete justice,” but cannot be used to override express constitutional provisions.

Federalism and States’ Rights:

- Lack of State Representation: The judgment impacts all states but was passed without issuing notice to them.

- Centralisation of Power: Judicial directive allowing mandamus against the President dilutes state autonomy in legislative processes.

- Distortion of Article 143: Advising the President is the Cabinet’s prerogative, not the judiciary’s.

Judicial Process and Accountability:

- Violation of Article 145(3): Constitutional issues must be heard by a Constitution Bench (minimum five judges), not a two-judge bench.

- Legislative Retaliation Risk: Possibility of parliamentary action to regulate judicial functioning under Article 145(1).

- Erosion of Constitutional Morality: Expanding “constitutional morality” without textual basis raises legitimacy concerns.

Practice Question

Examine the constitutional validity and implications of the Supreme Court’s recent verdict in State of Tamil Nadu vs Governor of Tamil Nadu. In light of this, critically analyse the limits of judicial power under Articles 142 and 145, and the doctrine of separation of powers in India.

Editorials

Context

India’s Index of Industrial Production (IIP) growth fell to a six-month low of 2.9% in February 2025, down from 5.2% in January and 5.6% in February 2024, raising concerns over industrial slowdown and its impact on the 6.5% GDP growth target.

Sectoral Performance Overview

- Manufacturing Sector Slowdown: Manufacturing, with a 77% IIP weightage, grew only 9% in February, down from 4.9% last year, reflecting weak sectoral momentum.

- Mining Sector Contraction: Mining output declined sharply to 6%, compared to 8.1% growth in February 2024, indicating falling core sector productivity.

- Power Sector Marginal Rise: Electricity generation rose slightly to 6% from 3.4% in January, but remained lower than 7.6% a year earlier.

Consumption and Demand Trends

- Consumer Durables Weakening: Output growth fell to 8%, significantly below 12.6% last February, showing weakening demand for high-value goods.

- Consumer Non-Durables Contraction: Output shrank by 1%, third consecutive month of decline, following 3.2% contraction in January, indicating poor essential goods demand.

- Falling Inflation Not Translating to Demand Boost: Despite retail inflation falling to 61% and food inflation to 3.75%, consumption demand remained subdued.

Investment and Macro-Financial Trends

- Capital Goods Growth: Capital goods output rose to 2% from 1.7% last year, signalling continued investment momentum supported by public spending.

- Banking System Liquidity Squeeze: Liquidity shortfall of Rs 1.7 trillion due to foreign capital outflows prompted RBI to inject Rs 2.18 trillion via rupee-dollar swaps.

- Positive Manufacturing Sub-Sectors: 14 out of 23 industry groups showed growth, led by motor vehicles (8.9%), non-metallic mineral products (8%), and basic metals (5.8%).

Practice Question

India’s industrial slowdown amid low inflation and capital investment growth reveals structural imbalances in the post-pandemic recovery. Examine the nature of these imbalances and suggest policy interventions to restore broad-based industrial growth.