23rd May 2024 (15 Topics)

Context

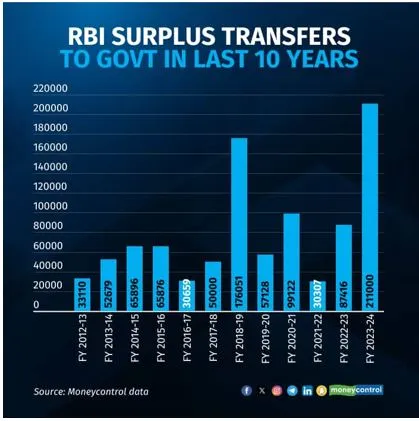

The Reserve Bank of India (RBI) has approved the transfer of Rs 2.11 lakh crores (highest ever yearly surplus transfer to the government) as surplus to the government for the financial year 2023-24.

Major Factors responsible for sharp jump:

- The sharp jump in the surplus amount could be attributed to higher income from the forex holding of the central bank, among other factors.

- The higher-than-expected surplus would support the the centre's liquidity surplus, and, thereafter, expenditure.

About RBI’s surplus transfer

- The RBI gives its surplus money to the government, the owner of the institution every year after setting aside some for emergencies.

|

Generation of Surplus by RBI |

RBI's Expenditure |

|

|

Government's Use of Surplus:

- The government usually puts the surplus money into the Consolidated Fund of India.

- This fund is used for paying salaries, pensions, interest payments, and government programs.

- It helps the government reduce planned borrowings and keep interest rates low.

- Also provides opportunities for private companies to raise money from markets.

- Can help lower the fiscal deficit if revenue targets are met.

- Alternatively, the government can use the funds for public spending or specific projects to boost economic activity in certain sectors.

Fact Box: Calculation Method

|