23rd May 2024 (15 Topics)

Context

Foreign direct investment (FDI) in India has seen a significant downturn, prompting concerns about the country's economic health, as per RBI's "State of Economy".

Key-findings

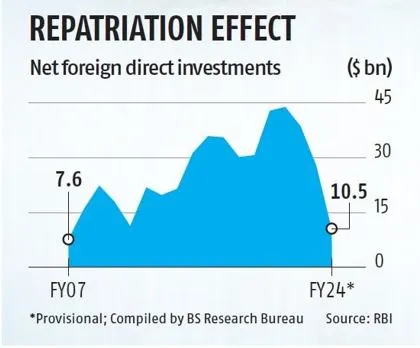

- Overview of FDI Trends: Data from the Reserve Bank of India (RBI) reveals a sharp decline in FDI, with actual investments dropping to USD 26.6 billion in FY 2023-24, the lowest since 2006-07.

- Rising Repatriation and Disinvestment: Foreign companies have increasingly withdrawn investments from India, with repatriated or disinvested funds reaching USD 44.4 billion in FY 2023-24, the highest since 2011-12.

- Trends Over Time: The trend of declining FDI inflows and rising outflows has persisted for several years, indicating a sustained challenge for India's investment climate.

- Sectoral Distribution of FDI: Over 60% of FDI equity flows were directed towards specific sectors, including manufacturing, energy, and services.

- Contributors to FDI Inflows: Singapore, Mauritius, the US, and other countries have been major contributors to FDI inflows into India, as reported by the RBI.

- India's Global Standing: Despite challenges, India remains among the top 10 economies expected to experience high FDI momentum in 2024.

- Global Investment Patterns: A shift in global investment patterns, driven by factors like the COVID-19 pandemic, has seen FDI flows move from developed to developing economies.

- Prospects for Indian Companies: Indian companies have announced a significant number of greenfield FDI projects abroad, indicating their growing presence in the global market.

Role of FDI in promoting economic growth:

- Capital Inflow:FDI provides a source of external capital, which can be used for investment in various sectors of the host country's economy. This capital infusion can stimulate economic development.

- Technology Transfer:Multinational corporations that make FDI often bring advanced technologies, skills, and best practices to the host country. This technology transfer can lead to increased productivity and innovation in domestic industries.

- Job Creation:FDI projects often lead to the creation of jobs in the host country. This contributes to reduced unemployment and improved living standards.

- Increased Productivity:FDI can enhance the efficiency and productivity of domestic firms through knowledge sharing and collaboration with foreign investors.

- Infrastructure Development:In some cases, FDI projects require the development or improvement of infrastructure, which can have spillover effects on the broader economy.

- Export Promotion:FDI can facilitate access to global markets, as foreign investors often use their host country operations as export bases. This can boost a country's exports and improve its trade balance.

- Stimulated Local Businesses:Local businesses may benefit from FDI by becoming part of the supply chain or through other collaborative efforts with foreign companies.

- Government Revenues:FDI can lead to increased tax revenues for the host country, which can be allocated to public services and infrastructure development.

- Balanced Development:FDI can contribute to more balanced and diversified economic development by promoting investments in various sectors, including manufacturing, services, and technology.

PYQQ: Justify the need for FDI for the development of the Indian economy. Why is there a gap between MOUs signed and actual FDIs? Suggest remedial steps to be taken for increasing actual FDIs in India. (2016) |