24th September 2025 (14 Topics)

Mains Issues

Context:

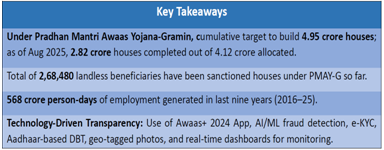

The Union Cabinet has extended the Pradhan Mantri Awaas Yojana–Gramin (PMAY-G) till FY 2028–29 with an additional target of constructing 2 crore houses, raising the cumulative target to 4.95 crore.

PMAY-G: A Transformative Rural Housing Scheme

Introduction

- Housing is a fundamental human requirement and a crucial element of poverty alleviation.

- Launched on 1st April 2016, PMAY-G aims to provide "Housing for All" in rural areas through pucca houses with basic amenities.

Key Features of PMAY-G

- Minimum unit size: 25 sq. m, with hygienic cooking space.

- Design flexibility: Localized, disaster-resilient designs.

- Quality construction: Use of trained masons and local materials.

Scheme Targets and Achievements

- Initial target (2016–24):95 crore houses.

- Extension (2024–29): Additional 2 crore houses, cumulative 4.95 crore.

- Progress (Aug 2025): Out of 4.12 crore allocated, 3.85 crore sanctioned, 2.82 crore completed.

- Employment: 568 crore person-days generated (2016–25).

Beneficiary Selection & Financial Assistance

- Identification: Based on SECC 2011 data, Gram Sabha verification, and Awaas+ surveys.

- Prioritization: Landless, SC/ST (60% earmarked), and PwDs (5% suggested).

- Financial aid: ?1.20 lakh in plain areas; ?1.30 lakh in hilly states.

- Funding pattern: 60:40 (Centre:State) in plains; 90:10 in hilly states; 100% Central for UTs.

Convergence with Other Schemes

- MGNREGS: 90/95 person-days of employment per house.

- SBM-G: ?12,000 for toilet construction.

- Other linkages: LPG (PMUY), electricity (Saubhagya), piped water (Jal Jeevan Mission).

Digital and Technological Innovations

- AwaasSoft MIS & App: For beneficiary data, fund releases, and real-time monitoring.

- Awaas+ 2024 App: e-KYC, geo-tagging, face authentication, self-survey facility.

- ABPS: Aadhaar-based Direct Benefit Transfer.

- AI/ML Models: Fraud detection and beneficiary verification.

Challenges in Implementation

- Delay in land allotment for landless beneficiaries.

- Regional disparities in house completion rates.

- Issues of fund release and coordination with states.

- Ensuring quality and durability of construction across varied geographies.

Way Forward

- Strengthening land allotment: Priority monitoring for landless households.

- Capacity building: Expansion of rural mason training for skilled manpower.

- Inclusive approach: Enhanced coverage of vulnerable groups (tribals, PwDs, single women).

- Sustainability focus: Greater integration with renewable energy and green building materials.

- Robust grievance redressal: Strengthen CPGRAMS and social audit frameworks.

|

AwaasSoft Management Information System (MIS)

Awaas+ 2024 App

|

Mains Issues

Context:

A recent debate in The Hindu revisited the historical evidence and maps relating to the India–China border, offering contrasting perspectives on the boundary alignments and their legitimacy.

Introduction

- The India–China border dispute remains one of the most complex territorial conflicts in Asia, involving divergent historical claims, colonial-era treaties, and geopolitical interests.

- Historical maps and agreements, including Manchu-era maps and the Simla Convention (1914), are central to the interpretation of boundary legitimacy.

Historical Evidence of Boundaries

- Manchu Maps (1644–1911)

- Kang-hsi’s Map (1721): Showed Tibet’s southern boundary confined to the Himalayas; excluded Tawang and tribal belts (today’s Arunachal Pradesh).

- Ch’ien-lung’s Map (1761): Defined Eastern Turkestan without extending south of the Kunlun Mountains; thus, Aksai Chin was not part of Chinese conception.

- Simla Conference (1913–14)

- Republic of China (RoC) delegate admitted Tibet had no claim over territories south of the Himalayan divide.

- India incorporated these tribal areas into Assam, leading to the 1914 alignment (McMahon Line).

- 1899 Alignment (Aksai Chin)

- Proposal based on the watershed principle between Kashmir and Xinjiang, representing a pragmatic boundary framework.

Shifting Chinese Claims

- 1943 & 1947 Maps: Republic of China (RoC) introduced expansive claims, discarding earlier Manchu maps.

- 1954: Chou En-lai acknowledged maps were “mostly old” and not definitive, suggesting lack of deliberate boundary alteration at the time.

- 1960 Talks: Chou attempted to weaken India’s claims through reinterpretation of evidence, while avoiding reliance on Chinese-origin evidence.

Negotiation Dynamics

- Chou En-lai proposed moving beyond maps and documents to agreed principles for settlement, raising suspicion of a strategic trap.

- No concrete evidence of a formal territorial swap proposal exists (Aksai Chin for Arunachal Pradesh).

- Both sides discussed a package deal covering the entire boundary, trade, and geopolitical issues.

Comprehensive Analysis

- Strengths of India’s Position:

- Historical maps (1721 & 1761) show Tibet/China did not control trans-Himalayan or trans-Kunlun regions.

- Simla Convention validates India’s claim over Arunachal Pradesh.

- Watershed principle supports the 1899 alignment in Aksai Chin.

- Weaknesses/Challenges:

- China’s rejection of colonial-era treaties like the Simla Convention.

- Strategic importance of Aksai Chin for China’s Xinjiang–Tibet highway.

- Political instability during 1940s and 1950s weakened India’s diplomatic assertion.

Way Forward

- Bilateral Dialogue: Structured negotiations acknowledging historical evidence (1899 & 1914 alignments).

- Confidence-Building: Military disengagement, border management protocols, and improved communication mechanisms.

- Principled Settlement: A solution that avoids “victory–defeat” rhetoric, ensuring equity and dignity for both nations.

- Geopolitical Balance: Incorporate trade and security dimensions into the settlement to create interdependence.

Mains Issues

Context:

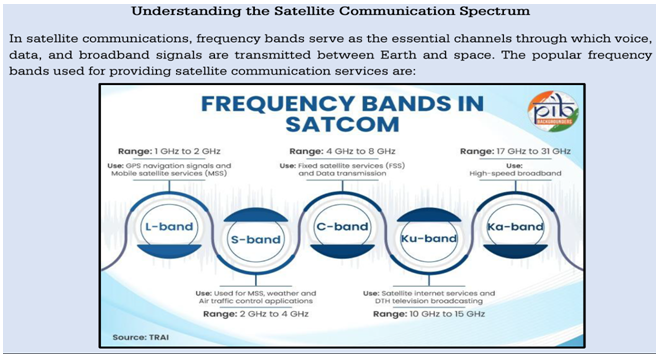

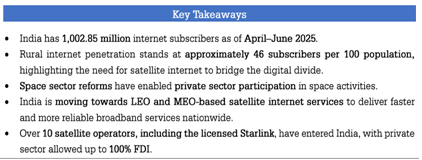

India is expanding its satellite communication ecosystem with recent GSAT launches, reforms in licensing of GMPCS services, and promotion of private participation through IN-SPACe.

Satellite Communication as a Driver of Digital India

Introduction

- Satellite communication (Satcom) plays a crucial role in ensuring connectivity across remote, rural, and border areas where terrestrial networks are inadequate.

- With the rise of digital infrastructure requirements, Satcom is emerging as a vital pillar of Digital India and BharatNet projects.

India’s Satellite Communication Ecosystem

- Government Agencies

- ISRO: Development and launch of GSAT series for communication services.

- Department of Telecommunications (DoT): Licensing and regulatory framework.

- IN-SPACe: Facilitates private sector participation.

- Key Satellites

- GSAT-11, GSAT-19, GSAT-29, GSAT-N2: Provide broadband, DTH, VSAT, and high-throughput satellite (HTS) services.

Recent Developments

- GMPCS Licensing: Approval for global mobile personal communication by satellite (GMPCS) operators to provide broadband and voice services.

- Private Participation: IN-SPACe enabling start-ups and companies to utilize ISRO infrastructure.

- Policy Push: TRAI recommendations on licensing reforms (2023) to streamline spectrum allocation.

- Integration with BharatNet: Use of Satcom for last-mile connectivity in uncovered villages..

Applications of Satcom in India

- Telecommunication: Broadband, voice, DTH, and backhaul connectivity.

- Education & Health: Digital classrooms, telemedicine in rural areas.

- Governance & Security: Disaster management, armed forces communication, border connectivity.

- Commercial Uses: Aviation, shipping, IoT, and enterprise solutions.

|

Government Initiatives for Inclusive Digital Connectivity 1. Digital Bharat Nidhi (DBN)

2. Comprehensive Telecom Development Plan (CTDP)

3. National Broadband Mission (NBM) 2.0

|

Challenges in Satellite Communication

- High Cost: Launch and bandwidth leasing costs remain expensive.

- Spectrum Allocation Issues: Regulatory delays and policy bottlenecks.

- Technological Dependence: Reliance on foreign satellites for certain high-throughput services.

- Competition with 5G/terrestrial networks: Integration challenges between Satcom and ground-based telecom.

Way Forward

- Policy Reforms: Expedite Satcom policy for spectrum pricing and licensing clarity.

- Indigenous Capability: Expand GSAT and HTS fleet to reduce foreign reliance.

- Public-Private Partnerships: Encourage start-ups via IN-SPACe and production-linked incentives (PLI).

- Integration with 5G/6G: Develop hybrid Satcom-terrestrial architecture for nationwide coverage.

- International Collaboration: Leverage partnerships with global players for technology transfer and innovation.

Prelims Articles

Context:

The Trump administration has introduced a $100,000 annual fee on new H-1B visa applications, significantly impacting Indian IT firms and global Big Tech companies.

Introduction

- The H-1B visa programme, launched in 1990 under the U.S. Immigration Act, allows U.S. employers to hire skilled foreign workers in specialty occupations.

- Indian IT firms are the largest beneficiaries, with Indian professionals accounting for over 70% of total H-1B visas issued annually.

- The newly imposed fee represents a structural change in U.S. immigration policy with wide-ranging implications for India, U.S. tech firms, and the global innovation ecosystem.

Background of H-1B Programme

- Purpose: To fill skill gaps in the U.S. workforce in areas like IT, engineering, and research.

- Criticism: Allegations of wage suppression, worker displacement, and overdependence on Indian outsourcing firms.

- Current Context: H-1B workers now form 65% of U.S. IT workforce, up from 32% in 2003, raising domestic concerns of unemployment among U.S. graduates.

Key Provisions of the New Policy

- Fee Structure: $100,000 per new H-1B application.

- Applicability: Only on new visa petitions, not renewals.

- Objective: To reduce dependence on foreign workers, discourage wage arbitrage, and prioritise domestic employment.

Implications for Stakeholders

- Indian IT Firms

- Indian companies (TCS, Infosys, Wipro) face higher operating costs.

- Likely shift towards offshore delivery models or higher pricing.

- Estimated impact: Job losses in India and reduced competitiveness in the U.S. market.

- S. Tech Companies

- Increased costs for hiring H-1B workers may limit startups and SMEs, while large firms (Google, Microsoft, Amazon) may absorb costs more easily.

- Talent concentration risk in big corporations.

- Innovation & Education Ecosystem

- International students (contributing $40 billion annually to U.S. economy) may prefer Canada, UK, or Australia.

- Risk of “innovation exodus”, with U.S. losing its edge in global talent attraction.

- Global Labour Dynamics

- Could accelerate offshoring of jobs to India and other countries.

- May paradoxically reduce opportunities for U.S. workers.

Prelims Articles

Context:

Several countries including France, UK, Canada, and Australia have formally recognised Palestine as a state, intensifying diplomatic and geopolitical discourse regarding the Israel–Palestine conflict.

Diplomatic Recognition and Its Implications

Recognition of Palestine — Background

- Global Diplomatic Moves: Countries such as France, UK, Canada, Australia, Portugal, Andorra, Belgium, Luxembourg, Malta, and Monaco have recognised the Palestinian state.

- Israeli Position: Israel opposes such recognition, arguing that the path to Palestinian statehood must involve direct negotiations and not unilateral actions.

Impact on the War

- Diplomatic Leverage: Recognition increases Palestine’s diplomatic stature but does not directly end hostilities.

- Israeli Response: Israel continues military operations in Gaza and insists that recognition alone does not alter its security concerns.

- International Dynamics: European states recognising Palestine may restrict arms exports to Israel; however, significant powers like the USA remain supportive of Israel.

Palestinian State — Legal and Political Dimensions

- Four Core Requirements for Statehood (Montevideo Convention, 1933):

- Defined territory

- Permanent population

- Government

- Capacity to enter into relations with other states

- Recognition by states bolsters Palestine’s case, but it does not automatically translate into full sovereignty.

- Palestine exercises limited control, with Israel’s military presence and control over borders, airspace, and movement.

Impact on Israel

- Strategic Disadvantage: Recognition of Palestine undercuts Israel’s unilateral claims to territory.

- Political Fallout: Israeli leadership views such recognitions as interference, strengthening hardline positions internally.

- Operational Impact: No immediate halt in Israel’s military actions in Gaza, but international pressure increases.

Broader Implications

- Recognition strengthens Palestine’s standing in international forums, including the United Nations.

- Contributes to long-term diplomatic leverage for Palestinians.

- Does not, however, guarantee peace without negotiated settlement.

Prelims Articles

Context:

The United States has imposed 50% tariffs on India’s cut and polished diamonds and 50–57% tariffs on studded and non-studded jewellery, severely impacting India’s gems and jewellery exports.

India’s Export Dependence:

- S. is the largest market for Indian diamonds and jewellery.

- Exports (2024–25): Diamonds worth ?46,000 crore and studded gold jewellery worth ?23,000 crore.

Employment Impact:

- Industry employs 2 lakh skilled workers.

- Tariffs expected to affect 7 lakh jobs.

MSME Vulnerability:

- 85% exporters are MSMEs, unable to absorb sudden loss of U.S. market.

- States worst affected:Gujarat, Rajasthan, Maharashtra.

Reliefs Sought by Industry:

- Extend export obligation period from 90 ? 270 days.

- Allow reverse job work in SEZs and permit SEZs to sell domestically with duty foregone.

- Monetary incentives: interest subvention (as during COVID), subsidised exports, liquidity packages.

- Worker support: loan restructuring, healthcare coverage.

- Marketing support: funds for exploring new markets.

Urgency & Bailout:

- Disrupts a five-decade-old trade relationship.

- Industry estimates relief package at ?500 crore.

- S. accounts for 30% of India’s gems and jewellery exports, mostly supplied by MSMEs.

Prelims Articles

Context:

India’s growing prominence in global tea production, consumption, and exports was highlighted at the India International Tea Convention, 2025.

India’s Position in the Global Tea Market

- Global Tea Production and India’s Role

- Global Scenario (2024):

- Total production:074 billion kg.

- Total consumption:97 billion kg.

- Global Scenario (2024):

- India’s Share:

- Production:303 billion kg (~18.4% of global output).

- Consumption: 1.22 billion kg (~17.5% of global consumption).

- Global ranking:

- 2nd largest producer and consumer.

- 3rd largest exporter.

Export Dynamics

- Global Export Comparison:

- Kenya: Largest exporter; exports almost all production.

- China: 2nd largest exporter; consumes most domestically.

- Sri Lanka: Exported 245 million kg worth $1.4 billion.

- India: Exported 255 million kg worth ~$800 million.

- Implications for India:

- Focus on quality improvement to increase revenue.

- Diversify markets to South America and Africa for better global reach.

Domestic Consumption Trends

- Current Per Capita Consumption:

- India: 840 gm/year.

- Turkey: 3 kg/year (highest globally).

- Potential Growth:

- Increasing domestic per capita consumption to 1 kg/year could absorb India’s entire production, indicating significant domestic market potential.

- Rising willingness to pay for quality tea presents an opportunity for premiumization.

|

Tea Board of India Establishment and Legal Status:

Vision and Mission:

Composition of the Board:

Functions and Role:

Key Schemes / Initiatives:

|

Prelims Articles

Context:

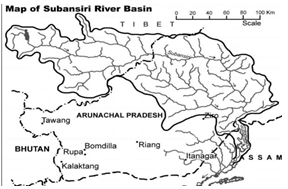

The Union Environment Ministry’s expert panel has recommended environmental clearance for the 2,200 MW Oju hydroelectric project near the China border in Arunachal Pradesh.

Project Overview:

- Location:Subansiri basin, Arunachal Pradesh, close to China border.

- Proposed Capacity: 2,200 MW (largest in terms of approved capacity in the basin).

- Distance & Site: 5 km downstream of Redi village, Upper Subansiri district.

- Developer:Subansiri Hydro Power Corporation Pvt Ltd (central public sector enterprise).

Technical and Environmental Aspects:

- Dam Height & Area: Requires diversion of 750 hectares of forest land; submergence of 43 hectares.

- Villages Affected: Nine families will be displaced; rehabilitation planned in Redi village.

- Hydrology & Flood Risk: Detailed assessment required for glacial lake floods, dam-break scenarios, and other environmental risks.

Strategic and Regional Significance:

- Part of North-East infrastructure push for hydropower development.

- Positioned in cascade of hydro projects in the Subansiri basin.

- Close to international border, adding strategic energy security significance.

|

Subansiri River

Course & Geography

Tributaries

|

Prelims Articles

Context:

India is set to submit its updated Nationally Determined Contributions (NDCs) at COP30 in Brazil, likely with enhanced energy efficiency targets.

India’s Climate Commitments and Global NDC Landscape

India’s NDCs: Background and Evolution

- Previous Commitments (NDC 2.0, 2022)

- Reduce emissions intensity of GDP by 45% of 2005 levels by 2030.

- Source 50% of electric power capacity from non-fossil fuel sources.

- Create a carbon sink of at least 2 billion tonnes by 2030.

- Key Definitions

- Emissions Intensity of GDP: Carbon emissions per unit of GDP; does not equate to net emissions reduction.

- Progress So Far

- Emissions intensity reduced by 33% between 2005 and 2019.

- Installed 50% of power capacity from non-fossil fuel sources as of June 2025.

Updated NDCs (NDC 3.0)

- Objectives

- Likely to reflect emissions reduction trajectory until 2035.

- Demonstrates India’s ongoing climate ambition in energy efficiency and renewable adoption.

- Operational Initiatives

- India Carbon Market to be operationalised by 2026.

- 13 major sectors to have mandatory emission-intensity targets.

- Emission Reduction Certificates (ERCs) will enable trading of excess reductions.

- India Carbon Market to be operationalised by 2026.

Global Context and Comparisons

- Significance of COP30

- Brazil, as COP30 President, focuses on assessing shortfalls in achieving stated NDCs.

- Current NDCs globally, even if fully implemented, insufficient to limit warming to 1.5°C–2°C; projected warming ~3°C by century-end.

- Key Country Targets

- European Union: Net-zero by 2050; proposed 90% reduction by 2040 (relative to 1990). Expected 2035 target: 66.25%-72.5%.

- Australia: Updated NDC targets 62%-70% reduction by 2035 relative to 2005.

- Implication

- Global ambition to reduce emissions remains modest; India’s NDC update contributes to reinforcing collective climate action.

Prelims Articles

Context:

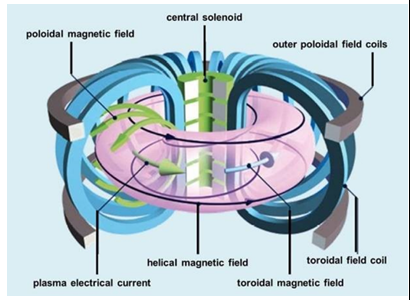

Indian researchers at IPR Gandhinagar have outlined a roadmap for developing India’s first fusion electricity generator, SST-Bharat, targeting commercial fusion energy by 2060.

Fusion Power: From Research to Commercial Prospects

Background and Objective

- Current Research Status:

- Indian Institute of Plasma Research (IPR), Gandhinagar, is spearheading fusion research.

- Current facility:Steady-state Superconducting – 1tokamak – produces plasma for ~650 milliseconds, designed for up to 16 minutes.

- Roadmap Goals:

- SST-Bharat: Fusion-fission hybrid reactor, 130 MW total, 100 MW from fission, target power output 5× input.

- Full-scale demonstration reactor by 2060: Output-to-input ratio (Q) = 20, generating 250 MW.

- Estimated construction cost: ?25,000 crore.

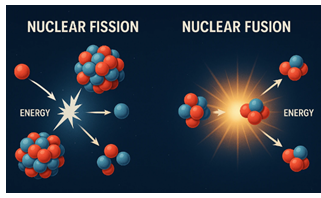

|

Fusion vs Fission Fission:

Fusion:

Requirements for Controlled Fusion:

|

Global Context

- ITER (France) collaboration: Aims for Q=10.

- UK STEP: Prototype by 2040.

- USA private firms: Grid-connected fusion in 2030s.

- China’s EAST tokamak: Record plasma durations.

- India’s target of 2060 is cautious but aligns domestic programs with global trends.

|

Key Technical Aspects Tokamak:

Plasma Confinement:

Digital Innovations:

|

Prelims Articles

Context:

Prime Minister Shri Narendra Modi today paid heartfelt tribute to RashtrakaviRamdhari Singh Dinkar on the occasion of his Jayanti, recalling his timeless contributions to Indian literature and national consciousness.

Early Life & Education

- Born:23 September 1908, Simaria, Begusarai, Bihar.

- Studied philosophy, politics, and history at Patna University.

- Multilingual proficiency:Sanskrit, Urdu, Bengali, English.

Contributions to Literature

- Known as Rashtrakavi (National Poet) of India.

- Major works:

- Rashmirathi – epic poem on Karna from Mahabharata.

- SanskritikeChaarAdhyaye – analysis of India’s cultural evolution.

- Parshuram kiPratiksha – socio-political critique in poetic form.

- Style:Veer Rasa (heroic poetry), blending patriotism, social justice, and cultural pride.

- Influences:Tagore (poetic style), Gandhi (political ideals), Marx (revolutionary ideas).

Role in Freedom Struggle

- His fiery nationalist verses inspired masses during the Indian independence movement.

- Poetry became a tool of resistance, igniting patriotic zeal against colonial rule.

Political & Academic Engagement

- Rajya Sabha Member: 1952–1964.

- Vice-Chancellor: Bhagalpur University (1960s).

- Strengthened the link between literature, politics, and academia.

Honours& Recognition

- Padma Bhushan (1959) for literature.

- Featured in 1999 postal stamp series celebrating Hindi writers (50 years of Hindi as official language).

- Golden Jubilee Celebrations (2015): PM Narendra Modi commemorated SanskritikeChaarAdhyaye and Parshuram kiPratiksha.

Editorials

Context:

China’s governance model is increasingly influencing global political-economic discourse, challenging Western democratic norms.

Emergence of the China Model

- Decline of Western Consensus:Post-Cold War liberal democracy faced erosion due to financial crises, economic inequality, and governance challenges, creating space for alternative models.

- China’s Development Approach:China’s model blends state control with market economics, prioritising rapid economic growth over liberal freedoms, which appeals to developing nations.

- Global Adoption Trends:Several countries are considering China’s model for development, emphasising strong state intervention, infrastructure expansion, and controlled liberalisation.

Core Features and Criticisms

- Surveillance and Control:China’s governance involves robust surveillance mechanisms and restriction of freedoms under the justification of national development and security.

- Economic Statecraft:China leverages state-led development, large-scale infrastructure projects, and targeted foreign investments to strengthen its influence globally.

- Critiques of Human Rights:The China model is criticised for undermining human rights and individual freedoms, raising concerns about democratic erosion and authoritarian entrenchment.

Global Implications

- New Global Consensus:China’s model is influencing emerging economies seeking alternatives to liberal democracy, blending economic growth with controlled political governance.

- Challenge to Western Models:The model questions the universality of liberal democracy, shifting the ideological balance in international governance debates.

- Strategic Impact on India:India must balance democratic governance with efficient state intervention to address developmental challenges without compromising constitutional freedoms.

Practice Question:

"Examine the global appeal of the ‘China Model’ of governance. Discuss its implications for democratic systems and how India should respond to emerging alternative governance models in the 21st century." (250 words)

Editorials

Context:

Donald Trump’s legal strategies and reliance on lawyers have once again come into focus as ongoing legal cases highlight how he has historically used the law as a tool for deal-making, risk mitigation, and political gain.

Legal Networks and Wealth

- Scale of Legal Profession: The U.S. has over 1.3 million lawyers, with 2,50,000 criminal defence lawyers, 35,000 state prosecutors, and about 90 federal prosecutors, forming a vast professional ecosystem.

- Revolving Door Advantage: Many top lawyers enrich themselves by moving between government and corporate law, leveraging networks and expertise for financial gain.

- Trump’s Legal Praetorian Guard: Wealthy attorneys, often revolving door veterans, have consistently shielded Trump from accountability, cementing his centrality in their power networks.

Trump’s Use of Law

- Litigation as Strategy: Since the 1990s, Trump and his companies have been involved in more than 4,000 lawsuits, treating litigation as a core business strategy.

- Courts as Arenas of Deals: For Trump, courts are not spaces for justice but for making adversarial settlements, often resolved “out of court” with financial advantage.

- Lawyers as Weapons: Trump views lawyers as tools to protect wealth, evade taxes, defend controversial acts, and undermine democratic institutions.

Subversion of Law

- Cherry-Picking Legal Principles: Trump exploits both the letter and spirit of the law selectively, bending them to serve personal and political objectives.

- Congressional Subservience: By influencing the U.S. Congress, notably through MAGA-aligned leadership, Trump has extended his dominance beyond the courts.

- Plea Bargains and Loopholes: With 90% of U.S. criminal cases resolved through plea bargains, Trump has used this machinery to delay, minimise, or escape punishment.

Practice Question

“Donald Trump’s legal strategies reflect a deliberate subversion of the U.S. judicial system by converting the law into a tool of political and financial bargaining. Critically examine how this phenomenon reveals the interplay between law, politics, and democratic institutions.” (250 words)

Editorials

Context:

The 56th GST Council meeting approved historic reforms under GST 2.0, simplifying the indirect tax structure and reducing compliance burdens.

Structural Reforms in GST

- Rate Rationalisation: The previous four-slab structure (5%, 12%, 18%, 28%) has been collapsed into three key slabs: 5% for essentials, 18% as the standard rate, and 40% for luxury and sin goods.

- Consumer Benefits: The Finance Minister confirmed that 99% of goods and services will now fall under zero, 5%, or 18%, ensuring significant savings for households and moderating inflationary pressures.

- Procedural Simplification: Provisions such as faster refunds, stock adjustments without full relabelling, and clearer classification norms have been introduced to ease compliance.

Impact on Industry and MSMEs

- Relief for Key Sectors: FMCG, textiles, cement, appliances, small vehicles, and farm equipment sectors benefit from reduced inverted duty structures and lower input costs.

- MSME Empowerment: Reduced litigation, lighter compliance requirements, and lower tax incidence will improve margins and free up working capital for smaller enterprises.

- Industry Commitment: CII member-companies and even public sector insurers have pledged to pass on tax savings to consumers, ensuring benefits reach the end-user.

Economic and Administrative Implications

- Boost to Growth: Analysts project that GST 2.0 may add over one percentage point to GDP growth through demand acceleration, despite short-term revenue losses.

- Implementation Challenges: Effective rollout requires readiness of GSTN, State tax departments, and regulatory bodies, along with special support for MSMEs lacking sophisticated systems.

- Need for Monitoring: Continuous feedback loops on classification, packaging, and transition issues are vital to ensure reforms translate into real benefits on the ground.

Practice Question

“GST 2.0 has been hailed as a defining reform in India’s indirect tax regime. Critically analyse its potential to balance simplification, revenue buoyancy, and consumer welfare.” (250 words)