|

Overview

|

Context

According to a recent study, the number of workers engaged in the gig economy is expected to grow to 2.35 crore by 2029-30.

About

- Report title:India's Booming Gig and Platform Economy

- Released by:NITI Aayog has released the report.

- Objective:To present comprehensive perspectives and recommendations on the gig–platform economy in India.

- Key highlights of the study:

- The Indian gig workforce is expected to expand to 23.5 million workers by 2029-30, a near 200 per cent jump from 7.7 million now.

- Gig workers will form 4.1 per cent of the total workforce in India by FY30, from 1.5 per cent now.

Analysis

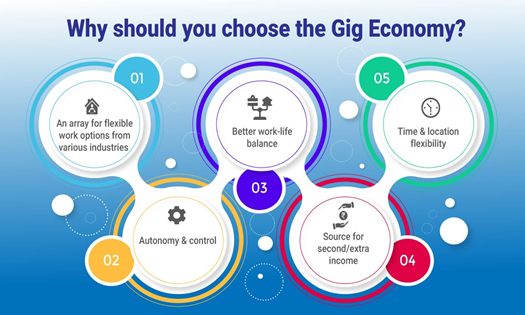

What is gig economy?

- As per the World Economic Forum (WEF), gig economy is defined by its focus on workforce participation and income generation via “gigs”, single projects or tasks for which a worker is hired.

- Classification: Gig workers can be broadly classified into:

- Platform workers: Those whose work is based on online software apps or digital platforms such as food aggregator platforms Zomato, Swiggy, Ola, and others.

- Non-platform-based workers: generally casual wage and own-account workers in conventional sectors, engaged part-time or full-time.

What is India’s potential for growth of gig economy?

- An estimated 56% of new employment in India is being generated by the gig economy companies across both the blue-collar and white-collar workforce.

- While the gig economy is prevalent among blue-collar jobs in India, the demand for gig workers in white-collar jobs such as project-specific consultants, salespeople, web designers, content writers and software developers are also emerging.

- The gig economy can serve up to 90 million jobs in the non-farm sectors in India with a potential to add 1.25% to the GDP over the "long term".

- As India moves towards its stated goal of becoming a USD 5 trillion economy by 2025, the gig economy will be a major building block in bridging the income and unemployment gap.

|

RAISE Framework for Operationalizing the Code on Social Security (CoSS), 2020 As Central and State governments draw up rules and regulations under CoSS 2020, they could adopt the five-pronged RAISE approach to ensure realisation of full access to social security for all gig and platform workers:

|

What are the Major Issues Raised by the Report?

- Accessibility: Even though the gig economy, with the wide variety of employment options it offers, it is accessible to all those who are willing to engage in such employment, access to internet services and digital technology can be a restrictive factor.

- This has made the gig economy largely an urban phenomenon.

- Job and Income Insecurity: Gig Workers do not get benefit from labour regulations pertaining to wages, hours, working conditions, and the right to collective bargaining.

- Occupational Safety and Health Risks:

- Workers engaged in employment with the digital platforms, particularly, women workers in the app-based taxi and delivery sectors face various occupational safety and health risks.

- Skills Mismatch:

- Varying degrees of vertical and horizontal skills mismatch can be observed on online web-based platforms.

- According to International Labour Organization (ILO) surveys, workers with higher educational achievements are not necessarily finding work commensurate with their skills.

- Challenges faced due to Terms of Contract:

- Working conditions on digital platforms are largely regulated by the terms of service agreements. They tend to characterize the contractual relationship between the platform owner and worker as other than one of employment.

Benefits in the sector

- Flexibility of working: In the digital age, the worker need not sit at a fixed location—the job can be done from anywhere, so employers can select the best talent available for a project without being bound by geography.

- Enormous potential for job creation in India: The start-up ecosystem in India has been developing rapidly. For start-ups, hiring full-time employees leads to high fixed costs and therefore, contractual freelancers are hired for non-core activities.

- Start-ups are also looking at hiring skilled technology freelancers (on a per project basis) in areas such as engineering, product, data science and ML to bolster their tech platforms.

- Better income opportunities to those previously engaged in similar non-platform jobs:

MNCs are adopting flexi-hiring options, especially for niche projects, to reduce operational expenses after the pandemic.

- This trend is significantly contributing to the gig culture in India.

Rising challenges

- lack of job security

- Irregularity of wages and uncertain employment status for workers

- The contractual relationship between the platform owner and worker is characterised as other than one of employment

- No workplace protections and entitlements.

NITI Aayog’s recommendation

- Social security measures to gig workers and their families, including sick leave, insurance, and pension.

- Platformisation: Introducing a ‘Platform India initiative’, on the lines of the ‘Start-up India initiative’ built on the pillars of accelerating platformisation by simplification and handholding, funding support and incentives, skill development, and social financial inclusion.

- Self-employed individuals may also be linked to platforms so that they can sell their produce to wider markets in towns and cities.

- Focus on social security: Measures should be taken to provide social security, including paid leave, occupational disease and work accident insurance, and support during irregularity of work and pension plans for the gig workforce in the country.

- Improving women participation in gig-economy: Fiscal incentives such as tax-breaks or start-up grants may be provided for businesses that provide livelihood opportunities where women constitute a substantial portion (say, 30 per cent) of their workers.

Conclusion

The rapidly burgeoning gig workforce is ushering in a new economic revolution globally. India – with its demographic dividend of half-a-billion labour force and the world’s youngest population, rapid urbanisation, widespread adoption of smartphones and associated technology – is the new frontier of this revolution.

|

PRACTICE QUESTION Q1.Gig economy is becoming the new normal. Discuss the key drivers of the gig economy. Q2. Gig economy can be a major building block in inclusively achieving the $5 trillion economy goal, bridging the income and unemployment gap. Critically Analyse. |